March 27, 2024

To Our Fellow Stockholders:

Our purpose is to create financially independent families. We remain committed to serving middle-income households throughout the United States and Canada and have created a culture that aligns the needs of our stockholders, clients, the independent sales force and our employees. During 2023, our Board of Directors continued to guide and oversee management in the creation of long-term stockholder value through effective and sustainable business strategies, performance-aligned compensation programs, a commitment to corporate ethics, valuing human capital and strong governance practices. We strongly encourage you to review the entire accompanying Proxy Statement, which provides an overview of the priorities of our Board and senior management.

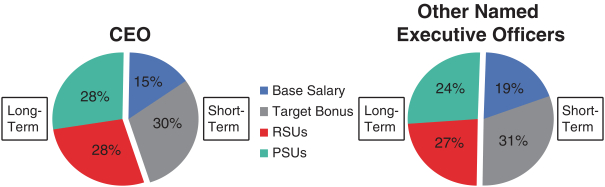

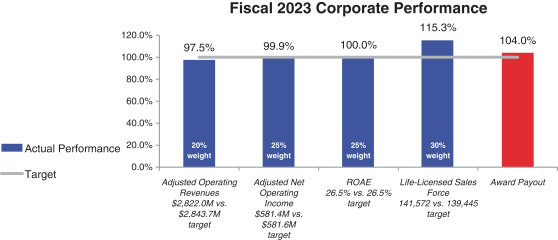

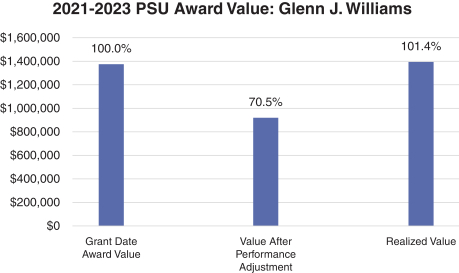

Continued Alignment of Compensation and Performance

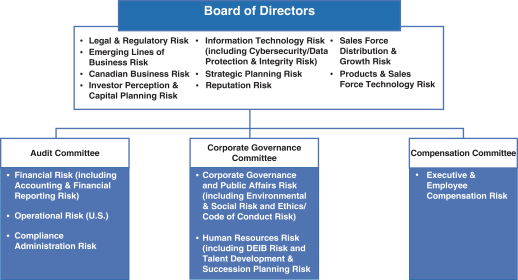

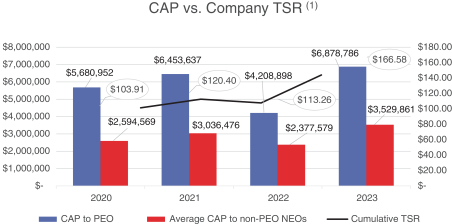

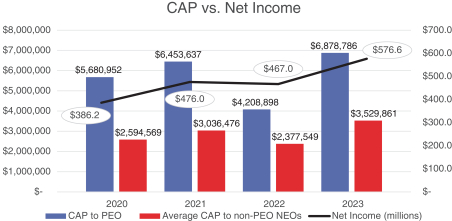

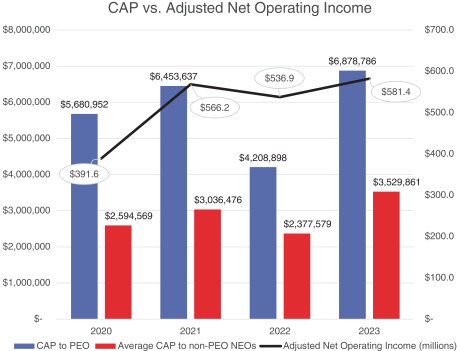

Our compensation philosophy includes a strong commitment to provide compensation programs that link executive pay to Company performance. The Compensation Committee of our Board reviews our executive compensation program with independent experts as part of its ongoing effort to appropriately align compensation with performance. As part of this effort, the Compensation Committee is focused on ensuring that our key executives are incentivized to execute on the strategic priorities of our Company. Please read a message from the Compensation Committee beginning on page 45 of the accompanying Proxy Statement.

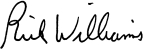

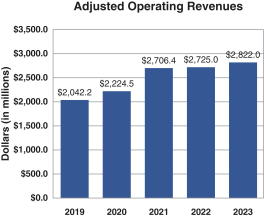

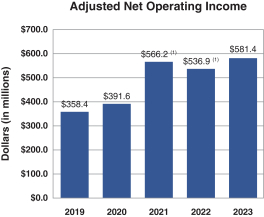

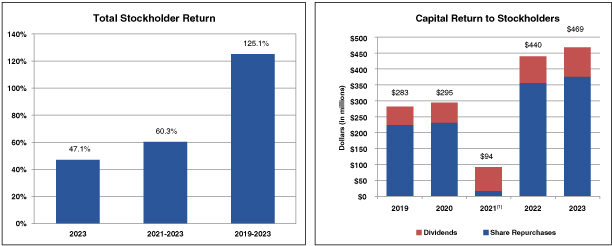

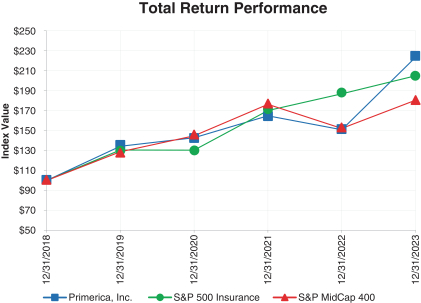

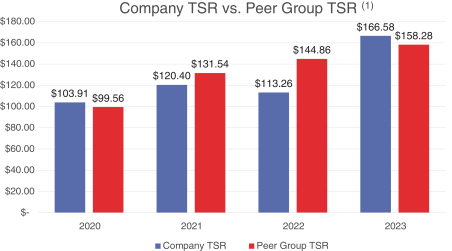

Despite market challenges in 2023 due to the continued economic downturn and high inflation, the Company performed well. Further, our total stockholder return (which includes the payment and reinvestment of dividends) for fiscal 2023 and the five-year period from fiscal 2019 through fiscal 2023 was 47.1% and 125.1%, respectively. Please read a message from Glenn J. Williams, our Chief Executive Officer, in our 2023 Annual Report to Stockholders that accompanies the Proxy Statement.

Social Impact

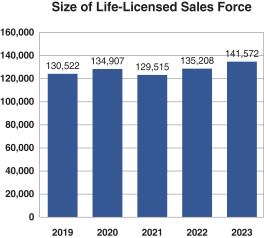

For more than 45 years, our core business has centered on enabling access to financial information, products and services for traditionally underserved markets throughout the United States and Canada. By leveraging the independent sales force and our employees, we help middle-income families make informed financial decisions and provide them with a strategy and means to gain financial independence. The diversity of the independent sales force reflects the communities in which sales representatives live and work, and their recruitment of new sales