March 30, 2022

To Our Fellow Stockholders:

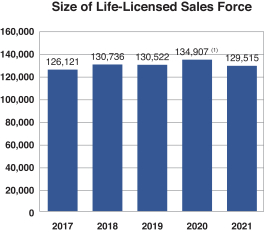

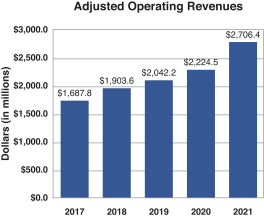

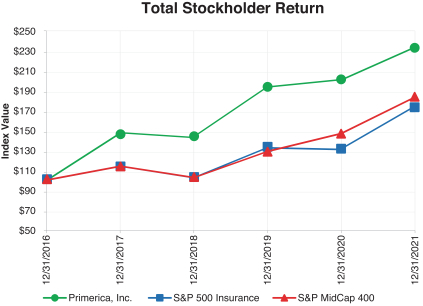

Our purpose is to create financially independent families. We remain committed to serving middle-income households throughout the United States and Canada and have created a culture that aligns the needs of our stockholders, clients, the independent sales force and our employees. During 2021, our Board of Directors continued to guide and oversee management in the creation of long-term stockholder value through effective and sustainable business strategies, performance-aligned compensation programs, a commitment to corporate ethics, valuing human capital and strong governance practices. This letter provides an overview of the priorities of our Board and senior management, and we strongly encourage you to review the entire accompanying Proxy Statement.

Corporate Strategy

We recognize that our Board’s engagement with management in setting the strategic direction of our Company is essential to our ability to create long-term value for our stockholders. Our Board continues to be actively engaged in discussions about Primerica’s strategy and its execution. Through presentations and discussion at regular Board meetings and written senior management updates between meetings, our Board oversees Company strategy as well as events that bear upon those planned initiatives. In July 2021, our Board oversaw the Company’s acquisition of 80% of e-TeleQuote Insurance, Inc. and its subsidiaries, a Florida-based senior health insurance distributor of Medicare-related insurance products in all 50 states and Puerto Rico. This acquisition supports our strategic pillar to broaden and strengthen our protection product portfolio, and we expect it to enhance our ability to serve the financial needs of middle-income families and to enhance stockholder value over the long-term.

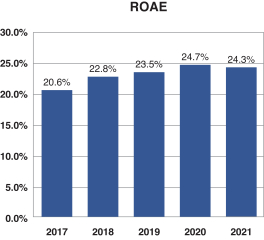

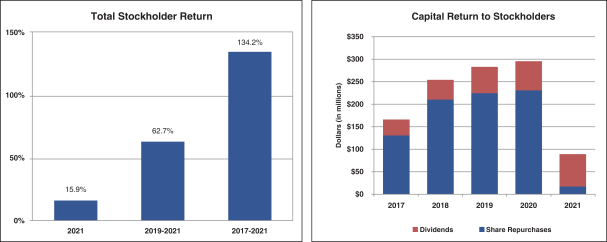

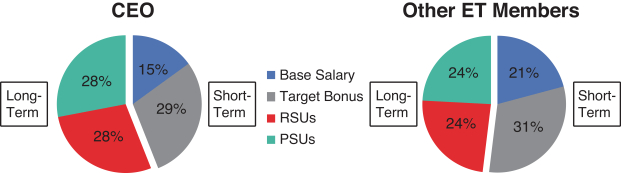

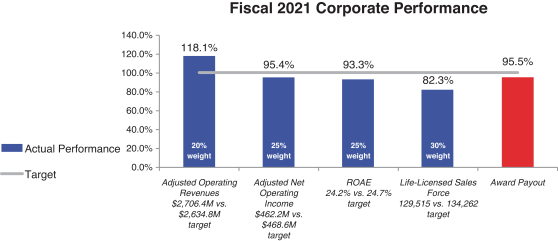

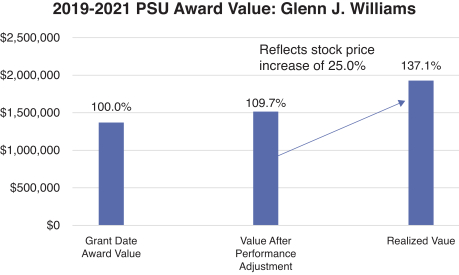

Continued Alignment of Compensation and Performance

Our compensation philosophy includes a strong commitment to provide compensation programs that link executive pay to Company performance. The Compensation Committee of our Board reviews our executive compensation program with independent experts as part of its ongoing effort to appropriately align compensation with performance. As part of this effort, the Compensation Committee is focused on ensuring that our key executives are incentivized to execute on the strategic priorities of our Company. Please read a message from the Compensation Committee beginning on page 43 of the accompanying Proxy Statement.