As filed with the Securities and Exchange Commission on December 22, 2009

Registration No. 333-162918

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Primerica, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 6331 | 27-1204330 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Primerica, Inc.

3120 Breckinridge Blvd.

Duluth, Georgia 30099

(770) 381-1000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Peter W. Schneider, Esq.

Executive Vice President, General Counsel and Secretary

Primerica, Inc.

3120 Breckinridge Blvd.

Duluth, Georgia 30099

(770) 381-1000

(770) 564-6216 (facsimile)

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

COPIES TO:

| Gregory A. Fernicola, Esq. Jeffrey A. Brill, Esq. Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 (212) 735-2000 (facsimile) |

Steven E. Fox, Esq. Alan C. Leet, Esq. Rogers & Hardin LLP 229 Peachtree St. N.E. Atlanta, Georgia 30303 (404) 522-4700 (404) 525-2224 (facsimile) |

Jeffrey D. Karpf, Esq. Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 (212) 225-2000 (212) 225-3999 (facsimile) |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one)

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale thereof is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 22, 2009

PRELIMINARY PROSPECTUS

Shares

Primerica, Inc.

Common Stock

$ per share

This is an initial public offering of shares of our common stock. A wholly owned subsidiary of Citigroup Inc. is our sole stockholder and is selling shares of our common stock. We will not receive any of the proceeds from the sale of shares of our common stock being offered hereby. We currently expect the initial public offering price to be between $ and $ per share of common stock.

The selling stockholder has granted the underwriters an option to purchase up to additional shares of common stock to cover over-allotments.

Prior to this offering, there was no public market for our common stock. We intend to apply to have our common stock listed on the New York Stock Exchange, or NYSE, under the symbol “ ”.

Investing in our common stock involves risks. Please see the section of this prospectus entitled “Risk Factors” beginning on page 13.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||

| Public offering price |

$ | $ | ||||

| Underwriting discount |

$ | $ | ||||

| Proceeds to the selling stockholder (before expenses) |

$ | $ | ||||

The underwriters expect to deliver the shares to purchasers on or about , 2010 through the book-entry facilities of The Depository Trust Company.

Citigroup Global Markets Inc. is acting as the sole book-running manager for this offering.

Citi

, 2010

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. None of Primerica, the selling stockholder or the underwriters is making an offer to sell these securities in any jurisdiction where the offer or sale thereof is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

| Page | ||

| 1 | ||

| 13 | ||

| 39 | ||

| 41 | ||

| 41 | ||

| 42 | ||

| 43 | ||

| 44 | ||

| 47 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

53 | |

| 101 | ||

| 136 | ||

| 157 | ||

| 158 | ||

| 172 | ||

| 181 | ||

| 183 | ||

| 186 | ||

| 188 | ||

| 192 | ||

| 192 | ||

| 192 | ||

| F-1 |

The states in which our insurance subsidiaries are domiciled have laws which require regulatory approval for the acquisition of “control” of insurance companies. Under these laws, there exists a presumption of “control” when an acquiring party acquires 10% or more of the voting securities of an insurance company or of a company which itself controls an insurance company. Therefore, any person acquiring 10% or more of our common stock would need the prior approval of the state insurance regulators of these states or a determination from such regulators that “control” has not been acquired.

i

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including the sections entitled “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements” and our combined financial statements, the notes to such financial statements and our selected historical combined financial data and pro forma combined financial statements before making an investment decision regarding our common stock. As used in this prospectus, references to “Primerica,” “we,” “us” and “our” refer to Primerica, Inc., a Delaware corporation, and its consolidated subsidiaries, after giving effect to the transfer to us by Citi of the subsidiaries that comprise our business, and references to “Citi” refer to Citigroup Inc. and its subsidiaries other than Primerica.

Our Company

We are a leading distributor of financial products to middle income households in North America with approximately 100,000 licensed sales representatives. We assist our clients in meeting their needs for term life insurance, which we underwrite, and mutual funds, variable annuities and other financial products, which we distribute primarily on behalf of third parties. We insure more than 4.3 million lives and more than two million clients maintain investment accounts with us. Our distribution model uniquely positions us to reach underserved middle income consumers in a cost-effective manner and has proven itself in both favorable and challenging economic environments. We view this offering as our company’s refounding — an opportunity to enhance the entrepreneurial spirit of our organization and to align the interests of our independent sales force and our employees with our future performance.

Our mission is to serve middle income families by helping them make informed financial decisions and providing them with a strategy and means to gain financial independence. Our distribution model is designed to:

Address our clients’ financial needs: Our sales representatives use our proprietary financial needs analysis tool and an educational approach to demonstrate how our products can assist clients to provide financial protection for their families, save for their retirement and manage their debt. Typically, our clients are the friends, family members and personal acquaintances of our sales representatives. Meetings are generally held in informal, face-to-face settings, usually in the clients’ own homes.

Provide a business opportunity: We provide an entrepreneurial business opportunity for individuals to distribute our financial products. Low entry costs and the ability to begin part-time allow our recruits to supplement their income by starting their own independent businesses without incurring significant start-up costs or leaving their current jobs. Our unique compensation structure, technology, training and back-office processing are designed to enable our sales representatives to successfully grow their independent businesses.

We were the largest provider of individual term life insurance in the United States in 2008 based on the amount of in-force premiums collected, according to LIMRA International, an independent market research organization. In 2008, we issued new term life insurance policies with more than $87 billion of aggregate face value and sold approximately $4.5 billion of investment and savings products.

In connection with this offering, we will enter into coinsurance agreements with affiliates of Citi pursuant to which we will cede the risks and rewards of a significant majority of our term life insurance policies that will be in-force at December 31, 2009. On a pro forma basis, after giving effect to the Transactions described on page 7 of this prospectus, our stockholder’s equity would have been $ million as of September 30, 2009.

1

Our History

We trace our roots to A.L. Williams & Associates, Inc., an insurance agency founded in 1977 to distribute term life insurance as an alternative to cash value life insurance. A.L. Williams popularized the concept of “buy term and invest the difference,” reflecting a view that we continue to share today. A.L. Williams grew rapidly from its inception and within a few years became one of the top sellers of individual life insurance in the United States. We have since added several other product lines, including mutual funds, variable annuities, segregated funds and other financial products. Citi acquired our principal operating entities in the late 1980s and remains our parent company today.

Our Clients

Our clients are generally middle income consumers, defined by us to include households with $30,000 to $100,000 of annual income, representing approximately 50% of U.S. households. We believe that we understand the financial needs of this middle income segment well:

| • | they have inadequate or no life insurance coverage; |

| • | they need help saving for retirement and other personal goals; |

| • | they need to reduce their consumer debt; and |

| • | they prefer to meet face-to-face when considering financial products. |

We believe that our educational approach and distribution model best position us to address these needs profitably, which traditional financial services firms have found difficult to accomplish.

Our Distribution Model

The high fixed costs associated with in-house sales personnel and salaried career agents and the smaller-sized sales transactions typical of middle income consumers have forced many other financial services companies to focus on more affluent consumers. Product sales to affluent consumers tend to be larger, generating more sizable commissions for the selling agent, who usually works on a full-time basis. As a result, this segment has become increasingly competitive. Our distribution model — borrowing aspects from franchising, direct sales and traditional insurance agencies — is designed to reach and serve middle income consumers efficiently. Key characteristics of our unique distribution model include:

| • | Independent entrepreneurs: Our sales representatives are independent contractors, building and operating their own businesses. This “business-within-a-business” approach means that our sales representatives are entrepreneurs who take responsibility for selling products, recruiting sales representatives, setting their own schedules and managing and paying the expenses associated with their sales activities, including office rent and administrative overhead. |

| • | Part-time opportunity: Our compensation approach accommodates varying degrees of individual sales representative activity, which allows us to use part-time sales representatives and gives us a variable cost structure for product sales. By offering a flexible part-time opportunity, we are able to attract a significant number of recruits who desire to earn supplemental income and generally concentrate on smaller-sized transactions typical of middle income consumers. Virtually all of our sales representatives begin selling our products on a part-time basis, which enables them to hold jobs while exploring an opportunity with us. |

| • | Incentive to build distribution: When a sale is made, the selling representative receives a commission, as does the representative who recruited him or her, which we refer to as “override compensation.” Override compensation is paid through several levels of the selling representative’s recruitment and supervisory organization. This structure motivates existing sales representatives to grow our sales force by providing them with commission income from the sales completed by their recruits. |

2

| • | Sales force leadership: A sales representative who has built a successful organization can achieve the sales designation of a regional vice president, which we refer to as a “RVP,” and can earn higher commissions and bonuses. RVPs open and operate offices for their sales organizations and devote their full attention to their Primerica businesses. RVPs also support and monitor the part-time sales representatives on whose sales they earn override commissions in compliance with applicable regulatory requirements. RVPs’ efforts to expand their businesses are a primary driver of our success. |

| • | Motivational culture: Through our proven system of sales force recognition events and contests, we seek to create a culture that inspires and rewards our sales representatives for their personal success. We believe this motivational environment is a major reason that many sales representatives join and achieve success in our business. |

These attributes have enabled us to build a large sales force in North America with approximately 100,000 sales representatives licensed to sell life insurance. Approximately 25,000 of our sales representatives are also licensed to sell mutual funds in North America. In 2008, our sales representatives generated approximately 240,000 newly-issued term life insurance policies and acquired approximately 138,000 new mutual fund clients and 39,000 new variable annuity clients.

Our Segments

While we view the size and productivity of our sales force as the primary drivers of our product sales, historically the majority of our revenue has not been directly correlated to our sales volume in any particular period. Rather, our revenue is principally driven by our in-force book of term life insurance policies, our sale, maintenance and administration of investment and savings products and accounts, and our investment income. The following is a summary description of our segments:

| • | Term Life Insurance: We earn premiums on our in-force book of term life insurance policies, which are underwritten by our three life insurance subsidiaries. The term “in-force book” is commonly used in the insurance industry to refer to the aggregate policies issued by an insurance company that have not lapsed or been settled. Revenues from the receipt of premium payments for any given in-force policy are recognized over the multi-year life of the policy. This segment also includes investment income on the portion of our invested asset portfolio used to meet our required statutory reserve and targeted capital. |

| • | Investment and Savings Products: We earn commission and fee revenues from the distribution of mutual funds in the United States and Canada, variable annuities in the United States and segregated funds in Canada and from the associated administrative services we provide. We distribute these products on behalf of third parties, although we underwrite segregated funds in Canada. In the United States, the mutual funds that we distribute are managed by third parties such as Legg Mason, Van Kampen, American Funds and other fund companies. In Canada, we sell Primerica-branded Concert™ mutual funds and the funds of several other third parties. The variable annuities that we distribute are underwritten by MetLife. Revenues associated with these products are comprised of commissions and fees earned at the time of sale, fees based on the asset values of client accounts and recordkeeping and custodial fees charged on a per-account basis. |

| • | Corporate and Other Distributed Products: We also earn fees and commissions from the distribution of various third party products, including loans, long-term care insurance, auto insurance, homeowners insurance and prepaid legal services, and from our mail-order student life insurance and short-term disability benefit insurance, which we underwrite through our New York insurance subsidiary. This segment also includes unallocated corporate income and expenses, realized gains and losses and investment income on our invested asset portfolio that is not allocated to Term Life Insurance. |

3

Our Strengths

Proven excellence in building and supporting a large independent financial services sales force. We believe success in serving middle income consumers requires generating and supporting a large distribution system, which we view as one of our core competencies. We have recruited more than 200,000 new sales representatives and assisted more than 35,000 recruits to obtain life insurance licenses in each of the last five calendar years. Approximately 65,000 sales representatives registered to attend our six regional meetings in 2009, and approximately 50,000 sales representatives registered to attend our most recent national convention in 2007. Our RVPs conduct thousands of meetings per month to introduce our business opportunity to new recruits. Over 500 instructors conduct approximately 5,500 classes annually to help our sales representatives obtain all requisite life insurance licenses and fulfill state-mandated licensing requirements. We have excelled at motivating and coordinating a large and geographically diverse, mostly part-time sales force by connecting with them through multiple channels of communication and providing innovative compensation programs and home office support.

Cost-effective access to middle income consumers. We have a proven ability to reach middle income consumers in a cost-effective manner. Our back-office systems, technology and infrastructure are designed to process a relatively high volume of transactions efficiently. Because our part-time sales representatives are supplementing their income, they are willing to pursue smaller-sized transactions typical of middle income clients. Our unique distribution model avoids the higher costs associated with advertising and media channels.

Exclusive distribution. Our sales representatives sell financial products solely for us; therefore, we do not have to “compete for shelf space” with independent agents for the distribution of our products. We, in turn, do not distribute our principal products through alternative channels. This approach garners loyalty from our sales representatives and eliminates competition for home office resources. Having exclusive distribution helps us to price our products appropriately for our clients’ needs, establish competitive sales force compensation and maintain our profitability.

Scalable operating platform. We have a compensation and administration system designed to encourage our sales representatives to build their sales organizations, which gives us the capacity to expand our sales force and increase the volume of transactions we process and administer with minimal additional investment.

Conservative financial profile and risk management. We manage our risk profile through conservative product design and selection and other risk-mitigating initiatives. Our life insurance products are generally limited to term life and do not include the guaranteed minimum benefits tied to asset values that have recently caused industry disruption. We further reduce and manage our life insurance risk profile by reinsuring a significant majority of the mortality risk in our newly-issued life insurance products. Furthermore, our invested asset portfolio, after giving pro forma effect to the Transactions described on page 8 of this prospectus, will continue to be comprised primarily of highly liquid, investment grade securities and cash equivalents.

Experienced management team and sales force. We are led by a management team that has extensive experience in our business and a thorough understanding of our unique culture and business model. Our senior executives largely have grown up in the business. Primerica’s co-Chief Executive Officers, John Addison and Rick Williams, both joined our company more than 20 years ago and were appointed co-CEOs in late 1999. The 14 members of our senior management team have an average of 23 years of experience at Primerica. Equally important, our more successful sales representatives, who have become influential within our sales organization, also have significant longevity with us. Of our sales representatives, 20,000 have been with us for at least ten years, and 6,500 have been with us for at least 20 years.

4

Our Strategy

Our strategies are designed to leverage our core strengths to serve the vast and underserved middle income segment. These strategies include:

Align the interests of our company and sales force. Becoming a publicly traded company will allow us to use equity awards to align the interests of our employees and sales representatives with the performance of our company. This will be accomplished by the issuance of Primerica equity awards to certain employees and sales force leaders concurrently with this offering, the implementation of a directed share program in which employees and RVPs will have the opportunity to buy shares of our common stock in this offering, the intended conversion of certain outstanding Citi equity awards held by our employees and sales representatives to Primerica equity awards and the creation of Primerica equity award compensation programs for our employees and sales representatives. These incentives will give us new ways to motivate our sales force.

Grow our sales force. Our strategy to grow our sales force includes:

| • | Increasing the number of recruits. Our existing sales representatives replenish and grow our sales force through recruiting activities that generate a high volume of new recruits. Moreover, the introduction of new recruits to our business provides us with an opportunity for product sales, both to the recruits themselves and to their friends, family members and personal acquaintances. When our co-CEOs were appointed in late 1999, they prioritized recruiting growth. The number of recruits more than doubled to over 202,000 in 2002, the highest annual number since the company’s inception up to that time. We have increased this level of recruiting, reaching a record of 235,000 recruits in 2008. We intend to continue to grow recruiting through a number of initiatives launched in recent years, including a reduction in the upfront entry fee charged to new recruits to join our sales force, increased use of our electronic application technology and an expansion of early-stage compensation opportunities for new recruits. |

| • | Increasing the number of licensed sales representatives. In recent years, we have launched a series of initiatives designed to increase the number of recruits who obtain life insurance licenses. Working with industry groups, we have been instrumental in enacting licensing reforms to reduce regulatory barriers for applicants and to address licensing disparities across ethnic groups. In addition, we continue to design and improve educational courses, training tools and incentives that are made available to help recruits prepare for state and provincial licensing examinations. |

| • | Growing the number of RVPs. We have approximately 4,000 RVPs. The number of RVPs is an important factor in our sales force growth; as RVPs build their individual organizations, they become the primary driver of our sales force recruiting and licensing success. We are currently providing new technology to our sales representatives to enable RVPs to reduce the time spent on administrative responsibilities associated with their sales organizations so they can devote more time to sales and recruiting activities. These improvements, coupled with our new equity award program, will encourage more of our sales representatives to make the commitment to become RVPs. |

Increase our use of innovative technology. We expect to continue to invest in technology to make it easier for individuals to join our sales force, complete licensing requirements and build their own businesses. We provide our sales representatives, who are generally most active during nights and weekends outside their own homes and offices, with access to innovative technology, including wireless communication devices and Internet record access, to facilitate “straight-through-processing” of the client information that they collect. We intend to develop new analytical tools to help our sales representatives manage their businesses better and increase efficiency. For example, in cooperation with Morningstar, Inc., a leading provider of independent investment research, we are developing a portfolio management tool to enable our sales representatives to view client investment positions, which is expected to create additional sales opportunities for our investment and savings products.

5

Enhance our product offerings. We will continue to enhance and refine the basic financial products we offer with features, riders and terms that are most appropriate for the market we serve and our distribution system. We typically select products that we believe are highly valued by middle income families, making it easy for sales representatives to feel confident selling them to individuals with whom they have a personal relationship. Prior product developments have included a 35-year term life insurance policy, new mutual fund families, other protection products and our Primerica DebtWatchers™ product. The enhancement of our product offerings increases our sources of revenue.

Risk Factors

There are a number of risks that you should understand before making an investment decision regarding this offering. These risks are discussed more fully in the section entitled “Risk Factors” following this prospectus summary. These risks include, but are not limited to:

| • | Risks related to our distribution structure, such as: |

| • | our potential failure to attract and retain sales representatives; |

| • | misconduct by our sales representatives, including their failure to comply with applicable laws or protect the confidentiality of our clients’ information; |

| • | challenges to the independent contractor status of our sales representatives; and |

| • | determinations that laws relating to business opportunities, franchising or pyramid schemes are applicable to us. |

| • | Risks related to our insurance business, such as: |

| • | our estimates regarding mortality and policy lapse rates may prove to be materially inaccurate; |

| • | mortality rates may be significantly higher than our estimates due to wars, terrorist attacks, natural or man-made disasters, pandemics or other catastrophic events; |

| • | we may experience material losses in our invested asset portfolio; |

| • | ratings downgrades; and |

| • | the failure of our reinsurers to perform their obligations. |

| • | Risks related to our investments and savings products business, such as: |

| • | a deterioration of the overall economic environment and savings and investment levels in North America; |

| • | the failure of our investment and savings products to remain competitive with other investment options or the loss of our relationship with companies that offer mutual fund and variable annuity products; and |

| • | changes in laws and regulations that could require us to alter our business practices. |

| • | Other risks, such as: |

| • | the loss of key personnel; |

| • | the continued decline of our loan business; |

| • | conflicts of interest resulting from our relationship with Citi; and |

| • | sales of a large number of shares of common stock by Citi following this offering could depress our stock price. |

6

The Reorganization, the Citi Reinsurance Transactions and the Concurrent Transactions

The reorganization. We were incorporated in Delaware in October 2009 by Citi to serve as a holding company for the life insurance and financial product distribution businesses that our predecessors have operated for more than 30 years. These businesses, which currently are wholly owned indirect subsidiaries of Citigroup Inc., will be transferred to us prior to the completion of this offering in a reorganization pursuant to which we will issue to Citigroup Insurance Holding Corporation, a wholly owned subsidiary of Citigroup Inc., shares of our common stock, which represent all outstanding shares of our capital stock, and a $ million note due on bearing interest at an annual rate of %, which we refer to in this prospectus as the “Citi note.” Prior to such reorganization, we will have no material assets or liabilities. Immediately following such reorganization, we will be a holding company, and our primary asset will be the capital stock of our operating subsidiaries, and our primary liability will be the Citi note. We will remain a majority-owned subsidiary of Citi immediately following the completion of its sale of approximately % of our outstanding common stock in this offering. Citi intends to divest its remaining interest in us as soon as is practicable, subject to market and other conditions.

Citi reinsurance transactions. Prior to completion of this offering, we will enter into coinsurance agreements with three affiliates of Citi, which we refer to in this prospectus as the “Citi reinsurance transactions.” Under these agreements, we will cede between 80% and 90% of the risks and rewards of our term life insurance policies that will be in-force at December 31, 2009. The Citi reinsurance transactions will reduce the amount of our capital and will result in a substantial reduction in our insurance exposure. We will retain our operating platform and infrastructure and continue to administer all policies subject to these coinsurance agreements.

As a result of the Citi reinsurance transactions, the revenues and earnings of our term life insurance segment are expected to initially decline in proportion to the amount of revenues and earnings associated with our existing in-force book of term life insurance policies ceded to Citi. In periods following this offering, as we add new in-force business that will not be ceded to Citi, revenues and earnings of our life insurance segment would be expected to grow from these initial levels. The rate of revenue and earnings growth in periods following the Citi reinsurance transactions would be expected to decelerate with each successive financial period as the size of our in-force book grows and the incremental sales have a reduced marginal effect on the size of the then existing in-force book. For more information about the financial effect of the Citi reinsurance transactions, please see the sections entitled “Pro Forma Combined Financial Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Concurrent transactions. Prior to completion of this offering, we will complete the following concurrent transactions:

| • | through a series of steps described elsewhere in this prospectus, we will transfer $ billion of cash and invested assets to Citi, of which $ billion relates to statutory benefit reserves assumed by Citi in the Citi reinsurance transactions and $ million consists of statutory capital; |

| • | we will distribute approximately $ billion of cash and invested assets to Citi; |

| • | we will issue equity awards for shares of our common stock to our directors, officers and certain of our employees and sales force leaders; and |

| • | we intend that certain unvested equity awards held by our employees and sales representatives under Citi’s equity compensation plans will be converted into Primerica equity awards. |

7

On a pro forma basis, after giving effect to the reorganization, the Citi reinsurance transactions and these concurrent transactions, which are collectively referred to in this prospectus as the “Transactions,” we expect to have $ billion of stockholder’s equity and $ billion of total assets, as of September 30, 2009. Additionally, we will have $ million of indebtedness owing to Citi that matures in . We believe that these changes to our balance sheet favorably position our company with the growth profile of a newly-formed life insurance holding company with a proven track record and infrastructure developed over more than 30 years.

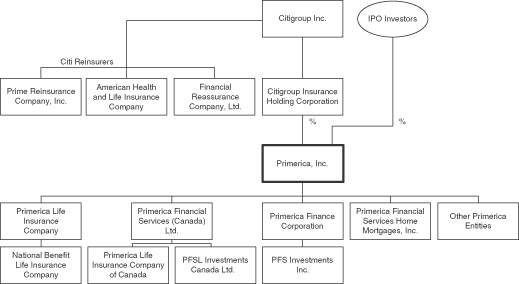

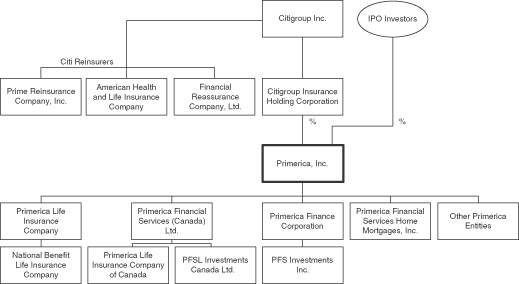

Our corporate organization and ownership structure. The following diagram depicts the corporate organization and ownership structure of our business and certain related entities described in this prospectus immediately following the completion of this offering:

| Note: | All subsidiaries are wholly owned unless otherwise indicated. |

Conflicts of Interest

All of our outstanding common stock will be owned by the selling stockholder, a wholly owned subsidiary of Citigroup Inc., until the completion of this offering. The selling stockholder will continue to own a majority of our outstanding common stock immediately following completion of this offering. Prior to this offering we have had, and after this offering we will continue to have, numerous commercial and contractual arrangements with affiliates of the selling stockholder. In addition, Citigroup Global Markets Inc., the sole book-running manager of this offering, is a wholly owned subsidiary of Citigroup Inc. The selling stockholder will receive all of the net proceeds of this offering. Please see the sections entitled “Risk Factors — Risks Related to Our Relationship with Citi,” “Use of Proceeds” and “Underwriting.”

Our principal executive offices are located at 3120 Breckinridge Blvd., Duluth, Georgia 30099, and our telephone number is (770) 381-1000.

8

The Offering

| Common stock to be sold by Citi in this offering |

shares ( % of shares outstanding) |

| Common stock to be held by Citi after this offering |

shares ( % of shares outstanding) |

| Common stock to be outstanding after this offering |

shares |

| Use of proceeds |

We will not receive any proceeds from the sale of shares of our common stock being offered hereby. |

| Stock exchange symbol |

We intend to apply to have our common stock listed on the NYSE under the symbol “ ”. |

Throughout this prospectus, all references to the number and percentage of shares of common stock outstanding, and percentage ownership information, in each case following this offering, assume the following:

| • | the underwriters’ over-allotment option will not be exercised; |

| • | shares of common stock will be issued upon the intended conversion of certain unvested Citi equity awards, the number of which have been estimated based on the midpoint of the initial public offering price range set forth on the cover page of this prospectus and the average closing price of Citi’s common stock over a recent three trading day period. The actual number of shares will change based on our stock price and Citi’s stock price for the three trading days following the date of the final prospectus; and |

| • | shares of common stock will be issued as equity awards to our directors, officers and certain of our employees and sales force leaders in connection with this offering. |

In addition, we have reserved additional shares for issuance pursuant to an omnibus equity incentive plan that we intend to adopt prior to the completion of this offering.

9

SUMMARY HISTORICAL AND FINANCIAL DATA

The summary historical income statement data for the years ended December 31, 2008, 2007 and 2006 and the summary historical balance sheet data as of December 31, 2008 presented below have been derived from our audited combined financial statements which are included in this prospectus. The summary historical income statement data for the nine months ended September 30, 2009 and 2008 and the summary historical balance sheet data as of September 30, 2009 have been derived from our unaudited condensed combined financial statements, which are included in this prospectus. In the opinion of management, the unaudited condensed combined financial statements provided herein have been prepared on substantially the same basis as the audited combined financial statements and reflect all normal and recurring adjustments necessary for a fair statement of the information for the periods presented.

The unaudited summary pro forma statement of operations data for the nine months ended September 30, 2009 has been derived from our unaudited condensed combined financial statements and our audited combined financial statements, respectively, included in this prospectus and give effect to the Transactions as if they had occurred on January 1, 2008. The unaudited summary pro forma balance sheet data as of September 30, 2009 give effect to such transactions as if they had occurred on September 30, 2009. The unaudited summary pro forma financial data are based upon available information and assumptions that we believe are reasonable. The unaudited summary pro forma financial data are not necessarily indicative of the results of future operations or the actual results that would have been achieved had the transactions occurred on the dates indicated.

All financial data presented in this prospectus have been prepared using U.S. generally accepted accounting principles, or GAAP. The Transactions will result in financial results that are materially different from those reflected in the combined historical financial data that appear in this prospectus. For an understanding of the pro forma financial data that gives pro forma effect to the Transactions, please see the section entitled “Pro Forma Combined Financial Statements.”

You should read the following summary historical and financial data in conjunction with the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Selected Historical Combined Financial Data” and “Pro Forma Combined Financial Statements” and our audited and unaudited combined financial statements and related notes thereto included elsewhere in this prospectus.

10

| Historical |

Pro Forma | ||||||||||||||||||||||

| Nine Months Ended September 30, |

Year Ended December 31, |

Nine Months Ended September 30, 2009 | |||||||||||||||||||||

| 2009 |

2008 |

2008(1) |

2007 |

2006 |

|||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||

| Income statement data |

|||||||||||||||||||||||

| Revenues |

|||||||||||||||||||||||

| Direct premiums |

$ | 1,577,364 | $ | 1,562,359 | $ | 2,092,792 | $ | 2,003,595 | $ | 1,898,419 | $ | ||||||||||||

| Ceded premiums |

(450,736 | ) | (425,239 | ) | (629,074 | ) | (535,833 | ) | (496,061 | ) | |||||||||||||

| Net premiums |

1,126,628 | 1,137,120 | 1,463,718 | 1,467,762 | 1,402,358 | ||||||||||||||||||

| Net investment income |

260,876 | 232,288 | 314,035 | 328,609 | 318,853 | ||||||||||||||||||

| Commissions and fees |

246,685 | 374,449 | 466,484 | 545,584 | 486,145 | ||||||||||||||||||

| Other, net |

39,083 | 41,947 | 56,187 | 41,856 | 37,962 | ||||||||||||||||||

| Realized investment (losses) gains |

(31,473 | ) | (59,741 | ) | (103,480 | ) | 6,527 | 8,746 | |||||||||||||||

| Total revenues |

1,641,799 | 1,726,063 | 2,196,944 | 2,390,338 | 2,254,064 | ||||||||||||||||||

| Benefits and Expenses |

|||||||||||||||||||||||

| Benefits and claims |

451,825 | 455,526 | 938,370 | 557,422 | 544,556 | ||||||||||||||||||

| Amortization of deferred policy acquisition costs |

273,759 | 240,837 | 144,490 | 321,060 | 284,787 | ||||||||||||||||||

| Insurance commissions |

23,425 | 18,188 | 23,932 | 28,003 | 26,171 | ||||||||||||||||||

| Insurance expenses |

115,771 | 121,084 | 141,331 | 137,526 | 126,843 | ||||||||||||||||||

| Sales commissions |

120,755 | 200,926 | 248,020 | 296,521 | 265,662 | ||||||||||||||||||

| Goodwill impairment(2) |

— | — | 194,992 | — | — | ||||||||||||||||||

| Other operating expenses |

95,280 | 119,783 | 152,773 | 136,634 | 127,849 | ||||||||||||||||||

| Total benefits and expenses |

1,080,815 | 1,156,344 | 1,843,908 | 1,477,166 | 1,375,868 | ||||||||||||||||||

| Income (loss) before income taxes |

560,984 | 569,719 | 353,036 | 913,172 | 878,196 | ||||||||||||||||||

| Income taxes (loss) |

192,476 | 195,329 | 185,354 | 319,538 | 276,244 | ||||||||||||||||||

| Net income (loss) |

$ | 368,508 | $ | 374,390 | $ | 167,682 | $ | 593,634 | $ | 601,952 | $ | ||||||||||||

| Segment data |

|||||||||||||||||||||||

| Revenues |

|||||||||||||||||||||||

| Term Life Insurance |

$ | 1,312,246 | $ | 1,290,400 | $ | 1,682,852 | $ | 1,654,895 | $ | 1,584,866 | $ | ||||||||||||

| Investment and Savings Products |

217,186 | 307,779 | 386,508 | 439,945 | 383,397 | ||||||||||||||||||

| Corporate and Other Distributed Products |

112,367 | 127,884 | 127,584 | 295,498 | 285,801 | ||||||||||||||||||

| Segment income (loss) before income taxes |

|||||||||||||||||||||||

| Term Life Insurance |

$ | 509,978 | $ | 519,263 | $ | 521,649 | $ | 693,439 | $ | 675,130 | $ | ||||||||||||

| Investment and Savings Products |

67,306 | 105,285 | 125,163 | 152,386 | 132,208 | ||||||||||||||||||

| Corporate and Other Distributed Products |

(16,300 | ) | (54,829 | ) | (293,776 | ) | 67,347 | 70,858 | |||||||||||||||

11

| Historical | |||||||||||||||

| Nine Months Ended September 30, |

Year Ended December 31, | ||||||||||||||

| 2009 |

2008 |

2008 |

2007 |

2006 | |||||||||||

| (in thousands) | |||||||||||||||

| Operating data |

|||||||||||||||

| Number of new recruits |

173,730 | 185,502 | 235,125 | 220,950 | 204,316 | ||||||||||

| Number of newly insurance-licensed sales representatives |

28,890 | 30,207 | 39,383 | 36,308 | 35,233 | ||||||||||

| Average number of licensed sales representatives(3) |

100,682 | 98,882 | 99,361 | 97,103 | 96,998 | ||||||||||

| Number of term life insurance policies issued |

173,295 | 182,868 | 241,173 | 244,733 | 245,520 | ||||||||||

| Average number of mutual fund licensed sales representatives |

24,244 | 25,401 | 25,269 | 25,483 | 26,983 | ||||||||||

| Client asset values (end of period) |

$ | 29,805,914 | $ | 30,410,914 | $ | 24,406,787 | $ | 37,300,483 | $ | 34,190,353 | |||||

| As of September 30, 2009 | ||||||

| Actual |

Pro Forma | |||||

| (in thousands) | ||||||

| Balance sheet data |

||||||

| Investments |

$ | 6,308,580 | $ | |||

| Cash and cash equivalents |

580,116 | |||||

| Deferred policy acquisition costs, net |

2,797,269 | |||||

| Total assets |

12,971,585 | |||||

| Future policy benefits |

4,161,925 | |||||

| % note payable to Citi |

||||||

| Total liabilities |

8,040,279 | |||||

| Stockholder’s equity |

4,931,306 | |||||

| (1) | Includes a $191.7 million pre-tax charge due to a change in our deferred policy acquisition cost and reserve estimation approach implemented as of December 31, 2008. |

| (2) | Relates to a goodwill impairment charge resulting from impairment testing as of December 31, 2008. |

| (3) | Sales representatives licensed to sell insurance. |

12

Investing in our common stock involves substantial risks. You should consider carefully the following risks and other information in this prospectus, including our combined and pro forma financial statements and related notes, before you decide to purchase our common stock. If any of the following risks actually materializes, our business, financial condition and results of operations could be materially adversely affected. As a result, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Distribution Structure

Our failure to continue to attract large numbers of new recruits and retain sales representatives or to maintain the licensing success of our sales representatives would materially adversely affect our business.

New sales representatives provide us with access to new referrals, enable us to increase sales, expand our client base and provide the next generation of successful sales representatives. As is typical with insurance and distribution businesses, we experience a high rate of turnover among our part-time sales representatives, which requires us to attract, retain and motivate a large number of sales representatives. Recruiting is primarily performed by our current sales representatives, and the effectiveness of our recruiting is generally dependent upon our reputation as a provider of a rewarding and potentially lucrative income opportunity, as well as the general competitive and economic environment. The motivation of recruits to complete their training and licensing requirements and to commit to selling our products is largely dependent upon the effectiveness of our compensation and promotional programs and the competitiveness of such programs compared with other companies, including other part-time business opportunities.

If our new business opportunities and products do not generate sufficient interest to attract new recruits, motivate them to become licensed sales representatives and incentivize them to sell our products and recruit other new sales representatives, our business would be materially adversely affected.

Furthermore, if we or any other direct sales businesses with a similar distribution structure engage in practices resulting in increased negative public attention for our business, the resulting reputational challenges could adversely affect our ability to attract new recruits. Direct sales companies such as ours are frequently the subject of negative commentary on website postings and other non-traditional media. This negative commentary can spread inaccurate or incomplete information about our company or the direct sales industry in general, which can make our recruiting more difficult.

Certain of our key RVPs have large sales organizations that include thousands of downline sales representatives. These key RVPs are responsible for attracting, motivating, supporting and assisting the sales representatives in their sales organizations. The loss of one or more key RVPs, together with a substantial number of their sales representatives, for any reason, including movement to a competitor, or any other event that causes the departure of a large number of sales representatives, could materially adversely affect our financial results and could impair our ability to attract new sales representatives.

There are a number of laws and regulations that could apply to our distribution model, which subject us to the risk that we may have to modify our distribution structure.

In the past, certain direct sale distribution models have been subject to challenge under various laws, including laws relating to business opportunities, franchising, pyramid schemes and unfair or deceptive trade practices. If these laws were to apply to us, we may be required to make changes to our distribution model, which could materially adversely affect our business, financial condition and results of operations.

In general, state business opportunity and franchise laws in the United States prohibit sales of business opportunities or franchises unless the seller provides potential purchasers with a pre-sale disclosure document that has first been filed with a designated state agency and grants purchasers certain legal recourse against sellers of business opportunities and franchises. In Canada, the provinces of Alberta, Ontario, New Brunswick and Prince Edward Island have enacted legislation dealing with franchising, which typically requires mandatory

13

disclosure to prospective franchisees. The Federal Trade Commission, or FTC, defines the term “business opportunity” to mean any continuing commercial relationship in which the business opportunity purchaser offers, sells or distributes goods, commodities or services that are supplied either by the seller or its affiliate; the seller or its affiliate secures for the purchaser retail outlets, accounts or displays for such goods, commodities or services; and the purchaser is required as a condition to obtaining the business opportunity to make a payment to or a commitment to pay the seller or its affiliate. The FTC defines the term “franchise” to mean any continuing commercial relationship in which the franchisee obtains the right to operate a business, or to offer, sell or distribute goods, services or commodities, identified or associated with the franchisor’s trademark; the franchisor exerts or can exert a significant degree of control over, or provide significant assistance to, the franchisee’s method of operation; and the purchaser is required as a condition to obtaining the franchise to make a payment or a commitment to pay the seller or its affiliate.

We have not been and are not currently subject to business opportunity laws because the amounts paid by our new representatives to us (i) are less than the minimum thresholds set by many state statutes and (ii) are not fees paid for the right to participate in a business, but rather are for bona fide expenses such as state-required insurance examinations and pre-licensing training. We have not been, and are not currently, subject to franchise laws for similar reasons. For example, the FTC’s Franchise Rule does not apply to arrangements in which the amounts paid to the seller of the franchise are less than $500 during the first six months of the parties’ relationship, and the amounts paid by our new representatives are less than this amount. State franchise laws either (i) contain similar minimum thresholds that are greater than the amounts paid to us by our new representatives or (ii) only apply to situations in which a person pays a fee for the right to participate in a business. However, there is a risk that a governmental agency or court could disagree with our assessment or that these laws and regulations could change. In addition, the FTC is in the process of promulgating a new “Business Opportunity Rule,” which would not apply to companies like ours as currently drafted, but could be broadened in its final form to encompass our business. Becoming subject to business opportunity or franchise laws or regulations could require us to provide certain disclosures and regulate the manner in which we recruit our sales representatives that may increase the expense of, or adversely impact our success in, recruiting new sales representatives and make it more difficult for us to successfully attract and recruit new sales representatives or require us to change our business model, which could materially adversely affect our business, financial condition and results of operations.

There are various laws and regulations that prohibit fraudulent or deceptive schemes known as “pyramid schemes.” In general, a pyramid scheme is defined as an arrangement in which new participants are required to pay a fee to participate in the organization and then receive compensation primarily for recruiting other persons to participate, either directly or through sales of goods or services that are merely disguised payments for recruiting others. Such schemes are illegal because, without legitimate sales of goods or services to support the organization’s continued existence, new participants are exposed to the loss of the fee paid to participate in the scheme. The application of these laws and regulations to a given set of business practices is inherently fact-based and, therefore, is subject to interpretation by applicable enforcement authorities. We do not believe that we are subject to these laws primarily because we do not pay representatives for recruiting others to participate in our business. Rather, our representatives are paid by commissions based on sales of our products and services to bona fide purchasers. Moreover, our representatives are not required to purchase any of the products marketed by us. However, even though we believe that our distribution practices are currently in compliance with, or exempt from, these laws and regulations, there is a risk that a governmental agency or court could disagree with our assessment or that these laws and regulations could change, which may require us to alter our distribution model or cease our operations in certain jurisdictions or result in other costs or fines, any of which could materially adversely affect our business, financial condition and results of operations.

There are also federal, state and provincial laws of general application, such as the Federal Trade Commission Act, or the FTC Act, and state or provincial unfair and deceptive trade practices laws that could potentially be invoked to challenge aspects of our recruiting of sales representatives and compensation practices. In particular, our recruiting efforts include promotional materials for recruits that describe the potential opportunity available to them if they join our sales force. These materials, as well as our other recruiting efforts

14

and those of our sales representatives, are subject to scrutiny by the FTC and state and provincial enforcement authorities with respect to misleading statements, including misleading earnings claims made to convince potential new recruits to join our sales force. If claims made by us or by our sales representatives are deemed to be misleading, it could result in violations of the FTC Act or comparable state and provincial statutes prohibiting unfair or deceptive trade practices or result in reputational harm, any of which could materially adversely affect our business, financial condition and results of operations.

There may be adverse tax and employment law consequences if the independent contractor status of our sales representatives is successfully challenged.

Our sales representatives are treated by us as independent contractors who operate their own businesses. In the past, we have been successful in defending our company in various contexts before courts and administrative agencies against claims that our sales representatives should be treated like employees. Of note, the Internal Revenue Service, or IRS, issued a National Office Technical Advice Memorandum in 1997 confirming the independent contractor status of our U.S. sales representatives for U.S. federal income tax purposes. Although we believe that we have properly classified our representatives as independent contractors, there is nevertheless a risk that the IRS or another authority will take a different view. Furthermore, the tests governing the determination of whether an individual is considered to be an independent contractor or an employee are typically fact sensitive and vary from jurisdiction to jurisdiction. Laws and regulations that govern the status of independent sales representatives are subject to change or interpretation by various authorities. If a federal, state or provincial authority or court enacts legislation or adopts regulations that change the manner in which employees and independent contractors are classified or makes any adverse determination with respect to some or all of our independent contractors, we could incur significant costs in complying with such laws and regulations, including, in respect of tax withholding, social security payments and recordkeeping, or we may be required to modify our business model, any of which could have a material adverse effect on our business, financial condition and results of operations. In addition, there is the risk that we may be subject to significant monetary liabilities arising from fines or judgments as a result of any such actual or alleged non-compliance with federal, state, or provincial tax or employment laws. Further, if it were determined that our sales representatives should be treated as employees, we could possibly incur additional liabilities with respect to any applicable employee benefit plan.

Our sales representatives’ non-compliance with any applicable laws could subject us to material liabilities.

Extensive federal, state, provincial and local laws regulate our products and our relationships with our clients, imposing certain requirements that our sales representatives must follow. Some of these requirements and procedures vary from jurisdiction to jurisdiction, but many of them, especially those applicable to our securities business, arise from applicable securities laws or from the rules promulgated by the Financial Industry Regulatory Authority, Inc., or FINRA, the Securities and Exchange Commission, or SEC, the FTC and state insurance lending and securities regulatory agencies in the United States. In Canada, the following Canadian regulatory authorities have responsibility for us: Office of the Superintendent of Financial Institutions, or OSFI, Financial Transactions and Reports Analysis Centre of Canada, or FINTRAC, Financial Consumer Agency of Canada, or FCAC, Mutual Fund Dealers Association of Canada, or MFDA, and provincial and territorial insurance regulators and provincial and territorial securities regulators. In addition to imposing requirements that representatives must follow in their dealings with clients, these laws and rules generally require us to maintain a system of supervision to attempt to ensure that our sales representatives comply with these requirements. In order to comply with these laws, we have developed policies, procedures and controls to supervise and monitor our sales representatives. However, despite these compliance and supervisory efforts, the breadth of our operations and the broad regulatory requirements could result in oversight failures and instances of non-compliance or misconduct on the part of our sales representatives.

Examples of such non-compliance or misconduct could include selling products that are not provided or otherwise authorized by us, which is referred to as “selling away,” selling fictitious products, misappropriating client funds or engaging in other fraudulent or otherwise improper activity, recommending products that are not

15

suitable, engaging in activities for which a sales representative is unlicensed or otherwise not authorized to sell, or failing to comply with applicable laws regarding contact with persons on “do not call” or “do not fax” lists, or requirements under anti-spam laws.

Non-compliance or misconduct by our sales representatives could result in violations of law and could subject us to regulatory sanctions, significant monetary liabilities, restrictions on or the loss of the operation of our business, claims against us or reputational harm, any of which could have a material adverse effect on our business, financial condition and results of operations.

In addition, from time to time, we are subject to private litigation as a result of alleged misconduct by our sales representatives. For example, with respect to life insurance, we have been subject to claims that actions by our sales representatives, such as the failure to disclose underwriting-related information regarding the insured on the application or when there has been an alleged misrepresentation about the features or terms of the insurance policy being applied for, have resulted in the denial of a life insurance policy claim. Similarly, with respect to the sale of investment and savings products, we have in some circumstances been subject to claims made in arbitration under FINRA for alleged errors or omissions by representatives in connection with opening a securities account. Such litigation may be costly to defend and settle. Although incidents of misconduct in the past have not caused material harm to our business, financial condition and results of operations, there is no assurance that future incidents will not result in significant claims or result in litigation that could have a material adverse effect on our business, financial condition and results of operations.

Any failure to protect the confidentiality of client information could adversely affect our reputation and have a material adverse effect on our business, financial condition and results of operations.

Pursuant to federal laws, various federal regulatory and law enforcement agencies have established rules protecting the privacy and security of personal information. In addition, most states and some provinces have enacted laws, which vary significantly from jurisdiction to jurisdiction, to safeguard the privacy and security of personal information. Many of our sales representatives have access to and routinely process personal information of clients through a variety of media, including the Internet and software applications. We rely on various internal processes and controls to protect the confidentiality of client information that is accessible to, or in the possession of, our company and our sales representatives. We have a significant number of sales representatives in North America, and it is possible that a sales representative could, intentionally or unintentionally, disclose or misappropriate confidential client information. If we fail to maintain adequate internal controls, including any failure to implement newly-required additional controls, or if our sales representatives fail to comply with our policies and procedures, misappropriation or intentional or unintentional inappropriate disclosure or misuse of client information could occur. Such internal control inadequacies or non-compliance could materially damage our reputation or lead to civil or criminal penalties, which, in turn, could have a material adverse effect on our business, financial condition and results of operations.

Risks Related to Our Insurance Business and Reinsurance

We may face significant losses if our actual experience differs from our expectations regarding mortality or persistency.

We set prices for life insurance policies based upon expected claim payment patterns derived from assumptions we make about the mortality rates, or likelihood of death, in any given year of our policyholders. The long-term profitability of these products depends upon how our actual mortality rates compare to our pricing assumptions. For example, if mortality rates are higher than those assumed in our pricing assumptions, we could be required to make more death benefit payments under our life insurance policies or to make such payments sooner than we had projected, which may decrease the profitability of our term life insurance products and result in an increase in the cost of our subsequent reinsurance transactions.

16

The prices and expected future profitability of our life insurance products are also based, in part, upon assumptions related to persistency, which is the probability that a policy will remain in-force from one period to the next. Actual persistency that is lower than our persistency assumptions could have an adverse effect on profitability, especially in the early years of a policy, primarily because we would be required to accelerate the amortization of expenses we deferred in connection with the acquisition of the policy. Actual persistency that is higher than our persistency assumptions could have an adverse effect on profitability in the later years of a block of policies because the anticipated claims experience is higher in these later years. If actual persistency is significantly different from that assumed in our pricing assumptions, our reserves for future policy benefits may prove to be inadequate. We are precluded from adjusting premiums on our in-force business during the initial term of the policies, and our ability to adjust premiums on in-force business after the initial policy term is limited by our insurance policy forms to the maximum premium rates in the policy.

Our assumptions and estimates regarding persistency and mortality require us to make numerous judgments and, therefore, are inherently uncertain. We cannot determine with precision the actual persistency or ultimate amounts that we will pay for actual claim payments on a block of policies, the timing of those payments, or whether the assets supporting these contingent future payment obligations will increase to the levels we estimate before payment of claims. If we conclude that our reserves, together with future premiums, are insufficient to cover actual or expected claims payments and the scheduled amortization of our deferred policy acquisition cost, or DAC, assets, we would be required to first accelerate our amortization of the DAC assets and then increase our reserves and incur income statement charges for the period in which we make the determination, which could materially adversely affect our business, financial condition and results of operations.

The occurrence of a catastrophic event could materially adversely affect our business, financial condition and results of operations.

Our insurance operations are exposed to the risk of catastrophic events, which could cause a large number of premature deaths of our insureds. Catastrophic events include wars and other military actions, terrorist attacks, natural or man-made disasters and pandemics or other widespread health crises. Catastrophic events are not contemplated in our actuarial mortality models. A catastrophic event could also cause significant volatility in global financial markets and disrupt the economy. Although we have ceded a significant majority of our mortality risk to reinsurers since the mid-1990s, a catastrophic event could cause a material adverse effect on our business, financial condition and results of operations. Claims resulting from a catastrophic event could cause substantial volatility in our financial results for any fiscal quarter or year and could also materially harm the financial condition of our reinsurers, which would increase the probability of default on reinsurance recoveries. Our ability to write new business could also be adversely affected.

In addition, most of the jurisdictions in which our insurance subsidiaries are admitted to transact business require life insurers doing business within the jurisdiction to participate in guaranty associations, which raise funds to pay contractual benefits owed pursuant to insurance policies issued by impaired, insolvent or failed issuers. It is possible that a catastrophic event could require extraordinary assessments on our insurance companies, which may have a material adverse effect on our business, financial condition and results of operations.

Our insurance business is highly regulated, and statutory and regulatory changes may materially adversely affect our business, financial condition and results of operations.

Life insurance statutes and regulations are generally designed to protect the interests of the public and policyholders. Those interests may conflict with your interests as a stockholder. Currently, in the United States, the power to regulate insurance resides almost exclusively with the states. Much of this state regulation follows model statutes or regulations developed or amended by the National Association of Insurance Commissioners, or NAIC, which is comprised of the insurance commissioners of each U.S. jurisdiction. The NAIC re-examines and amends existing model laws and regulations (including holding company regulations) in addition to determining whether new ones are needed.

17

The laws of the various U.S. jurisdictions grant insurance departments broad powers to regulate almost all aspects of our insurance business.

Some recent NAIC and state statutory and regulatory activity has been undertaken in response to increased federal attention focused on inefficiencies in the current U.S. state-based regulatory system. The U.S. Congress continues to examine the current condition of U.S. state-based insurance regulation to determine whether to impose federal regulation and to allow optional federal insurance company incorporation. Bills are occasionally introduced in the U.S. Congress that could affect life insurers. In addition to an optional federal charter, Congress has considered legislation pre-empting state law in certain respects in connection with the regulation of reinsurance and other matters. We cannot predict with certainty whether, or in what form, reforms will be enacted and, if so, whether the enacted reforms will positively or negatively affect our business or whether any effects will be material. Changes in federal statutes, including the Gramm-Leach-Bliley Act, financial services regulation and federal taxation, in addition to changes to state statutes and regulations, may be more restrictive than current requirements or may result in higher costs, and could materially adversely affect the insurance industry and our business, financial condition and results of operations.

Provincial and federal insurance laws regulate many aspects of our Canadian insurance business. Please see the section entitled “Business — Regulation — Insurance Regulation.” Changes to provincial or federal statutes and regulations may be more restrictive than current requirements or may result in higher costs could materially adversely affect the insurance industry and our business, financial condition and results of operations.

If there were to be extraordinary changes to statutory or regulatory requirements, we may be unable to fully comply with or maintain all required insurance licenses and approvals. Regulatory authorities have relatively broad discretion to grant, renew and revoke licenses and approvals. If we do not have all requisite licenses and approvals, or do not comply with applicable statutory and regulatory requirements, the regulatory authorities could preclude or temporarily suspend us from carrying on some or all of our insurance activities or monetarily penalize us, which could materially adversely affect our business, financial condition and results of operations. We cannot predict with certainty the effect any proposed or future legislation or regulatory initiatives may have on the conduct of our business. Please see the section entitled “Business — Regulation — Insurance Regulation.”

A decline in the risk-based capital, or RBC, of our insurance subsidiaries could result in increased scrutiny by insurance regulators and ratings agencies and have a material adverse effect on our business, financial condition and results of operations.

Each of our insurance subsidiaries is subject to RBC standards and other minimum statutory capital and surplus requirements (in Canada, minimum continuing capital and surplus requirements, or MCCSR) imposed under the laws of its respective jurisdiction of domicile. The RBC formula for U.S. life insurance companies generally establishes capital requirements relating to insurance, business, asset and interest rate risks. Our U.S. insurance subsidiaries are required to report their results of RBC calculations annually to the applicable state department of insurance and the NAIC. Our Canadian insurance subsidiary is required to provide its MCCSR calculations to the Canadian regulators. Following this offering, the capitalization of our life insurance subsidiaries will be established and maintained at levels in excess of the effective minimum requirements of the NAIC in the United States and OSFI in Canada. These minimum standards are 100% of the Company Action Level (as defined on page 161) of RBC for our U.S. insurance subsidiaries and 150% of the MCCSR for our Canadian insurance subsidiary. To comply with RBC levels prescribed by the regulators of our insurance subsidiaries, our initial capitalization levels are based on our estimates and assumptions regarding our business. In any particular year, statutory capital and surplus amounts and RBC and MCCSR ratios may increase or decrease depending on a variety of factors, including the amount of statutory income or losses generated by our insurance subsidiaries (which is sensitive to equity and credit market conditions), the amount of additional capital our insurance subsidiaries must hold to support business growth, changes in their reserve requirements, the value of certain fixed income and equity securities in their investment portfolios, the credit ratings of investments held in their portfolios, the value of certain derivative instruments, changes in interest rates, credit market volatility, changes in consumer behavior, as well as changes to the NAIC’s RBC formula or the MCCSR calculation of OSFI. Many of these factors are outside of our control.

18

Our financial strength and credit ratings are significantly influenced by the statutory surplus amounts and RBC and MCCSR ratios of our insurance company subsidiaries. Ratings agencies may change their internal models, effectively increasing or decreasing the amount of statutory capital we must hold in order to maintain our current ratings. In addition, ratings agencies may downgrade the invested assets held in our portfolio, which could result in a reduction of our capital and surplus by means of other-than-temporary impairments. Changes in statutory accounting principles could also adversely impact our ability to meet minimum RBC, MCCSR and statutory capital and surplus requirements. Furthermore, during the initial years of operation after the Citi reinsurance transactions, our statutory capital and surplus may prove to be insufficient and we may incur ongoing statutory losses as a result of the high amounts of upfront commissions that are paid to our sales force in connection with the issuance of term life insurance policies. The statutory capital and surplus strain associated with payment of these commissions will be of greater impact during the initial years of our operations as a public company, as the in-force book of business, net of the Citi reinsurance transactions, grows. There is no assurance that our insurance subsidiaries will not need additional capital or that we will be able to provide it to maintain the targeted RBC and MCCSR levels to support their business operations.

The failure of any of our insurance subsidiaries to meet its applicable RBC and MCCSR requirements or minimum capital and surplus requirements could subject it to further examination or corrective action imposed by insurance regulators, including limitations on its ability to write additional business, supervision by regulators or seizure or liquidation. Any corrective action imposed could have a material adverse effect on our business, financial condition and results of operations. A decline in RBC or MCCSR also limits our ability to take dividends or distributions out of the insurance subsidiary and could be a factor in causing ratings agencies to downgrade the financial strength ratings of all our insurance subsidiaries. Such downgrades would have an adverse effect on our ability to write new insurance business and, therefore, could have a material adverse effect on our business, financial condition and results of operations.

A ratings downgrade by a ratings organization could materially adversely affect our business, financial condition and results of operations.