Exhibit 10.21

11/20/02

INDUSTRIAL

LEASE AGREEMENT

THIS INDUSTRIAL LEASE AGREEMENT (this “Lease”) is executed as of this 21st day of Nov, 2002, by and between DUKE REALTY LIMITED PARTNERSHIP, an Indiana limited partnership (“Landlord”), and PRIMERICA LIFE INSURANCE COMPANY, a Massachusetts corporation (“Tenant”).

WITNESSETH:

ARTICLE I - LEASE OF PREMISES

Section 1.01. Basic Lease Provisions and Definitions.

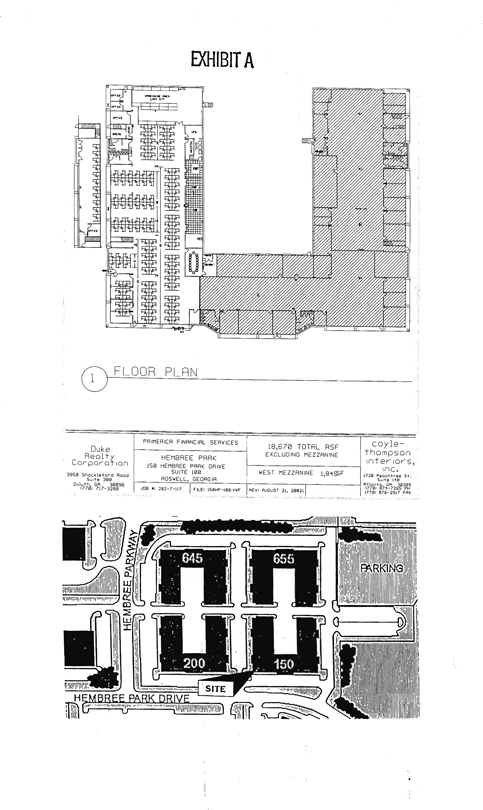

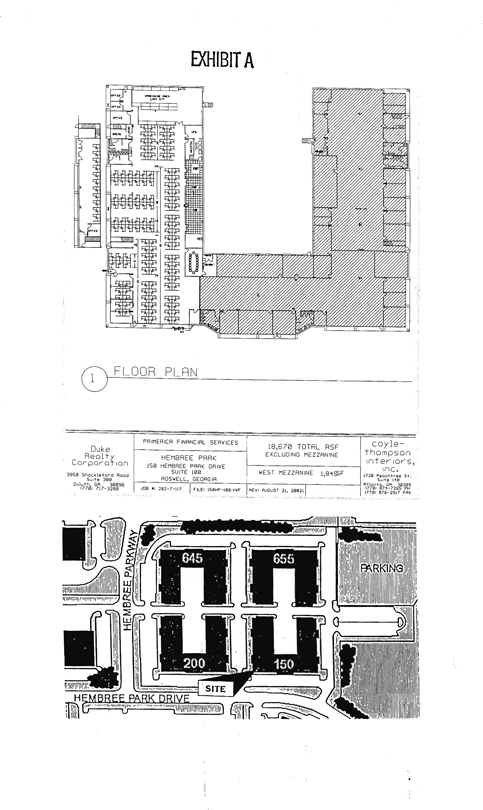

| A. | Leased Premises (shown outlined on Exhibit A attached hereto): Suite 100 of that certain building (the “Building”) located at 150) Hembree Park Drive, Roswell, Georgia 30076, located in Hembree Park (the “Park”); |

| B. | Rentable Area: approximately 18,670 square feet (which includes approximately 17,147 square feet of usable space); |

Landlord shall use commercially reasonable standards, consistently applied, in determining he Rentable Area and the rentable area of the Building. Landlord’s determination of Rentable area shall conclusively be deemed correct for all purposes hereunder.

| C. | Tenant’s Proportionate Share: 42,10%; |

| D. | Minimum Annual Rent: |

| Year 1 |

$120,606.67 (2 months free rent) | |

| Year 2 |

$148,346.20 | |

| Year 3 |

$152,838.80 | |

| Year 4 |

$157,361.55 | |

| Year 5 |

$162,035.06 | |

| Year 6 |

$166,889.48 | |

| Year 7 |

$79,665.72 (5 months and 16 days total) |

| E. | Monthly Rental Installments: |

| Months 1 – 2 |

$ | 0.00 | |

| Months 3 – 14 |

$ | 12,060.67 | |

| Months 15 – 26 |

$ | 12,422.49 | |

| Months 27 – 38 |

$ | 12,799.38 | |

| Months 39 – 50 |

$ | 13,176.28 | |

| Months 51 – 62 |

$ | 13,568.25 | |

| Months 63 – 74 |

$ | 13,975.30 | |

| Months 75 – 78 |

$ | 14,397.42 |

| F. | Base Year: 2003: |

| G. | Lease Term: Six (6) years, five (5) months and sixteen (16) days; |

| H. | Commencement Date: January 15, 2003; |

| I. | Security Deposit: None; |

| J. | Guarantor(s): None; |

| K. | Broker(s): CB Richard Ellis, Inc. representing Tenant; |

| L. | Permitted Use: Disaster recovery center, and office and administrative uses reasonably ancillary thereto; |

| M. | Address for notices: |

| Landlord: | Duke Realty Limited Partnership | |

| 3950 Shackleford Road, Suite 300 | ||

| Duluth, Georgia 30096 | ||

| Attn: Legal Department - Atlanta Market | ||

| Tenant: | Primerica Life Insurance Company | |

| 150 Hembree Park Drive, Suite 100 | ||

| Roswell, Georgia 30076 | ||

| With copies to: | Primerica Life Insurance Company | |

| 2150 Boggs Road, Suite 145 | ||

| Duluth, Georgia 30096 | ||

| Attn: Terry Robertson, VP Facilities Management | ||

| Primerica Life Insurance Company | ||

| 3100 Breckinridge Blvd. | ||

| Bldg. 1200 | ||

| Duluth, Georgia 30099 | ||

| Attn: General Counsel | ||

| Address for rental and other payments: | ||

| Duke Realty Limited Partnership | ||

| 75 Remittance Drive | ||

| Suite 3205 | ||

| Chicago, Illinois 60675-3205 | ||

| Exhibits attached hereto: | ||

| Exhibit A: Site Plan of Leased Premises | ||

| Exhibit B: Tenant Improvements | ||

| Exhibit C: Letter of Understanding | ||

| Exhibit D: Special Stipulations | ||

| Exhibit E: Offer Space | ||

| Exhibit F: Mezzanine Space | ||

Section 1.02. Leased Premises. Landlord hereby leases to Tenant and Tenant leases from Landlord, under the terms and conditions herein, the Leased Premises.

ARTICLE 2 - TERM AND POSSESSION

Section 2.01. Term. The term of this Lease (“Lease Term”) shall be for the period of time as set forth in Section 1.01(G) hereof, and shall commence on the Commencement Date set forth in Section 1.01(H) hereof.

Section 2.02. Construction of Tenant Improvements.

(a) Tenant has personally inspected the Leased Premises and accepts the same “AS IS” without representation or warranty by Landlord of any kind and with the understanding that Landlord shall have no responsibility with respect thereto except to construct in a good and workmanlike manner the improvements described in the scope of work attached hereto as Exhibit B and made a part hereof (the “Tenant Improvements”).

(b) Landlord shall provide Tenant with a proposed schedule for the construction and installation of the Tenant Improvements and shall notify Tenant of any material changes to said schedule. Tenant agrees to coordinate with Landlord regarding the installation of Tenant’s phone and data wiring and any other trade related fixtures that will need to be installed in the Leased Premises prior to substantial completion of the Tenant Improvements. In addition, if and to the extent permitted by applicable laws, rules and ordinances, Tenant shall have the right to enter the Leased Premises for thirty (30) days prior to the scheduled date for substantial completion of the Tenant improvements (as may be notified from time to time) in order to install fixtures (such as racking) and otherwise prepare the Leased Premises for occupancy (which right shall expressly exclude making any structural modifications). During any entry prior to the Commencement Date (i) Tenant shall comply with all terms and conditions of this Lease other than the obligation to pay rent, (ii) Tenant shall not interfere with Landlord’s completion of the Tenant Improvements, (iii) Tenant shall cause its personnel and contractors to comply with the terms and conditions of Landlord’s rules of conduct (which Landlord

-2-

agrees to furnish to Tenant upon request), and (iv) Tenant shall not begin operation of its business. Tenant acknowledges that Tenant shall be responsible for obtaining all applicable permits and inspections relating to any such entry by Tenant.

(c) Landlord shall use commercially reasonable efforts to substantially complete the Tenant Improvements on or before September 1, 2002. Promptly following the Commencement Date, Tenant shall execute Landlord’s Letter of Understanding in substantially the form attached hereto as Exhibits C and made a part hereof, acknowledging, among other things, that Tenant has accepted the Leased Premises.

(d) Landlord agrees to complete the Tenant Improvements no later than September 1, 2002.

Section 2.03. Surrender of the Premises. Upon the expiration or earlier termination of this Lease, Tenant shall immediately surrender the Leased Premises to Landlord in broom-clean condition and in good condition and repair, normal wear and tear excepted. Tenant shall also remove its personal property, trade fixtures, wiring and cabling (including above ceiling), and any of Tenant’s alterations designated by Landlord, promptly repair any damage caused by such removal, and restore the Leased Premises to the condition existing prior to the removal of such items. In addition, at Landlord’s option, Tenant shall be required to remove any unique Tenant Improvements installed as a result of Tenant’s specific use of the Leased Premises; provided, however, that Landlord shall notify Tenant whether it considers any Tenant Improvements “unique” prior to the installation thereof. If Tenant fails to do so, Landlord may restore the Leased Premises to such condition at Tenant’s expense, Landlord may cause all of said property to be removed at Tenant’s expense, and Tenant hereby agrees to pay all the costs and expenses thereby reasonably incurred. All Tenant property which is not removed within ten (10) days following Landlord’s written demand therefor shall be conclusively deemed to have been abandoned by Tenant, and Landlord shall be entitled to dispose of such property at Tenant’s cost without thereby incurring any liability to Tenant. The provisions of this section shall survive the expiration or other termination of this Lease.

Section 2.04. Holding Over. If Tenant retains possession of the Leased Premises after the expiration or earlier termination of this Lease, Tenant shall be a tenant at sufferance at One Hundred Fifty Percent (150%) of the Minimum Annual Rent and Annual Rental Adjustment for the Leased Premises in effect upon the date of such expiration or earlier termination, and otherwise upon the terms, covenants and conditions herein specified, so far as applicable. Acceptance by Landlord of rent after such expiration or earlier termination shall not result in a renewal of this Lease, nor shall such acceptance create a month to month tenancy. This Section 2.04 shall in no way constitute a consent by Landlord to any holding over by Tenant upon the expiration or earlier termination of this Lease, nor limit Landlord’s remedies in such event.

ARTICLE 3 - RENT

Section 3.01. Base Rent. Tenant shall pay to Landlord the Minimum Annual Rent in the Monthly Rental Installments, in advance, without demand and without abatement, deduction or offset, beginning on the Commencement Date and on or before the first day of each and every calendar month thereafter during the Lease Term. The Monthly Rental Installments for partial calendar months shall be prorated.

Section 3.02. Additional Rent.

(a) Any amount required to be paid by Tenant hereunder (in addition to Minimum Annual Rent) and any charges or expenses incurred by Landlord on behalf of Tenant under the terms of this Lease shall be considered “Additional Rent” payable in the same manner and upon the same terms and conditions as the Minimum Annual Rent reserved hereunder except as set forth herein to the contrary. Any failure on the part of Tenant to pay such Additional Rent when and as the same shall become due shall entitle Landlord to the remedies available to it for non-payment of Minimum Annual Rent.

(b) In addition to the Minimum Annual Rent, Tenant shall pay to Landlord for each calendar year during the Lease Term, as Additional Rent, Tenant’s Proportionate Share of all costs and expenses incurred by Landlord during the Lease Term for Operating Expenses (as hereinafter defined) for the Building and the common areas associated therewith.

(c) In addition to the Minimum Annual Rent and Tenant’s share of Operating Expenses, Tenant shall pay to Landlord for each calendar year during the Lease Term, as Additional Rent (i) any increase in insurance premiums and deductibles (payable by Landlord) over the base amount paid in the

-3-

Base Year; and (ii) the amount by which all Real Estate Taxes (as herein defined) for each tax year exceeds all Real Estate Taxes for the Base Year.

(d) For purposes of this Lease, “Operating Expenses” shall mean all of Landlord’s expenses for operation, repair, and maintenance to keep the Building and the common areas associated therewith in good order, condition and repair (including all additional direct costs and expenses of operation and maintenance of the Building which Landlord reasonably determines it would have paid or incurred during such year if the Building had been fully occupied), including, but not limited to, management or administrative fees (which shall not exceed 3.5% of the Minimum Annual Rent due under this Lease); utilities; insurance deductibles: stormwater discharge fees; license, permit, inspection and other fees; fees and assessments imposed by any covenants or owners’ association; security services; and maintenance, repair and replacement of the driveways, parking areas (including snow removal), exterior lighting, landscaped areas, walkways, curbs, drainage strips, sewer lines, exterior walls, foundation, structural frame, roof and gutters. The cost of any Operating Expenses that are capital in nature shall be amortized over the useful life of such improvement (as reasonably determined by Landlord), and only the amortized portion shall be included in Operating Expenses.

(e) For purposes of this Lease, “Real Estate Taxes” shall include any form of real estate tax or assessment or service payments in lieu thereof, and any license fee, commercial rental tax, improvement bond or other similar charge or tax (other than inheritance, personal income or estate taxes) imposed upon the Building or the common areas associated therewith (or against Landlord’s business of leasing the Building) by any authority having the power to so charge or tax, together with costs and expenses of contesting the validity or amount of Real Estate Taxes which at Landlord’s option may be calculated as if such contesting work had been performed on a contingent fee basis (whether charged by Landlord’s counsel or representative; provided, however, that said fees are reasonably comparable to the fees charged for similar services by others not affiliated with Landlord, but in no event shall fees exceed thirty-three percent (33%) of the good faith estimated tax savings). Additionally, Tenant shall pay, prior to delinquency, all taxes assessed against and levied upon trade fixtures, furnishings, equipment and all personal property of Tenant contained in the Leased premises.

Section 3.03. Payment of Additional Rent. Landlord shall estimate the total amount of Additional Rent to be paid by Tenant during each calendar year of the Lease Term, pro-rated for any partial years. Commencing on the Commencement Date, Tenant shall pay to Landlord each month, at the same time the Monthly Rental Installments are due, an amount equal to one-twelfth (1/12th) of the estimated Additional Rent for such year. Within one hundred twenty (120) days after the end of each calendar year, Landlord shall submit to Tenant a statement of the actual amount of such Additional Rent and within thirty (30) days after receipt of such statement, Tenant shall pay any deficiency between the actual amount owed and the estimates paid during such calendar year. In the event of overpayment, Landlord shall credit the amount of such overpayment toward the next installments of Minimum Annual Rent. Any Operating Expenses not billed to Tenant within two (2) years of the year such expenses accrued shall be waived by Landlord.

Section 3.04. Late Charges. Tenant acknowledges that Landlord shall incur certain additional unanticipated administrative and legal costs and expenses if Tenant fails to pay timely any payment required hereunder. Therefore, in addition to the other remedies available to Landlord hereunder, if any payment required to be paid by Tenant to Landlord hereunder is not paid (a) within five (5) days following written notice from Landlord on the first occasion in any twelve (12) month period, or (b) as and when due on any subsequent occasion in any twelve (12) month period, Tenant shall pay an administrative fee equal to five percent (5%) of such past due account; provided, however, that such administrative fees shall not accrue on any balance of Additional Rent that has not been paid as a result of a legitimate dispute raised in good faith.

ARTICLE 4 - SECURITY DEPOSIT

INTENTIONALLY OMITTED

ARTICLE 5 - USE

Section 5.01. Use of Leased Premises. The Leased Premises are to be used by Tenant solely for the Permitted Use and for no other purposes without the prior written consent of Landlord.

Section 5.02 Covenants of Tenant Regarding Use. Tenant shall (i) use and maintain the Leased Premises and conduct its business thereon in a safe, careful, reputable and lawful manner, (ii) comply with all laws, rules, regulations, orders, ordinances, directions and requirements of any governmental authority or agency, now in force or which may hereafter be in force, including without limitation those

-4-

which shall impose upon Landlord or Tenant any duty with respect to or triggered by a change in the use or occupation of, or any improvement or alteration to, the Leased Premises, (iii) comply with any protective covenants applicable to the Park which are in effect and as may hereafter be adopted and promulgated and (iv) comply with and obey all reasonable directions of the Landlord, including any rules and regulations that may be adopted by Landlord from time to time and provided to Tenant in writing. Tenant shall not do or permit anything to be done in or about the Leased Premises or common areas which will in any way obstruct or interfere with the rights of other tenants or occupants of the Building or injure or annoy them. Landlord shall not be responsible to Tenant for the nonperformance by any other tenant or occupant of the Building of its lease or of any rules and regulations. Tenant shall not overload the floors of the Leased Premises. All damage to the floor structure or foundation of the Building due to improper positioning or storage of items or materials shall be repaired by Landlord at the sole expense of Tenant, who shall reimburse Landlord immediately therefor upon demand. Tenant shall not use the Leased Premises, or allow the Leased Premises to be used, for any purpose or in any manner which would invalidate any policy of insurance now or hereafter carried on the Building or increase the rate of premiums payable on any such insurance policy unless Tenant reimburses Landlord as Additional Rent for any increase in premiums charged. Landlord represents Tenant’s use of the Leased Premises for the Permitted Use will not increase the Building’s insurance cost.

Section 5.03. Landlord’s Rights Regarding Use. In addition to the rights specified elsewhere in this Lease, Landlord shall have the following rights regarding the use of the Leased Premises or the common areas, each of which may be exercised without notice or liability to Tenant, (a) Landlord may install such signs, advertisements, notices or tenant identification information as it shall deem necessary or proper; (b) Landlord shall have the right at any time to control, change or otherwise alter the common areas as it shall deem necessary or proper, provided such change does not materially and adversely impact Tenant use of the Leased Premises for the Permitted Use; and (c) Landlord or Landlord’s agent shall be permitted to inspect or examine the Leased Premises at any reasonable time upon not less than 24 hours prior notice (except in the event of an emergency, in which case no such prior notice shall be required). With respect to any such entry by Landlord, Landlord shall be accompanied by Tenant’s Facilities Management representative, provided Tenant makes such representative available to Landlord, and Landlord shall have the right to make any repairs to the Leased Premises which are necessary for its preservation; provided, however, that any repairs made by Landlord shall be at Tenant’s expense, except as provided in Section 7.02 hereof. Landlord shall incur no liability to Tenant for such entry, nor shall such entry constitute an eviction of Tenant or a termination of this Lease, or entitle Tenant to any abatement of rent therefor; provided, however, that Landlord agrees to use reasonable efforts to minimize interference with Tenant’s business operations.

ARTICLE 6 - UTILITIES AND SERVICES

Tenant shall obtain in its own name and pay directly to the appropriate supplier the cost of all utilities and services serving the Leased Premises. However, if any services or utilities are jointly metered with other property, Landlord shall make a reasonable determination of Tenant’s proportionate share of the cost of such utilities and services (at rates that would have been payable if such utilities and services had been directly billed by the utilities or services providers) and Tenant shall pay such share to Landlord within thirty (30) days after receipt of Landlord’s written statement. Landlord shall not be liable in damages or otherwise for any failure or interruption of any utility or other Building service and no such failure or interruption shall entitle Tenant to terminate this Lease or withhold sums due hereunder. In the event of utility “deregulation”, Landlord shall choose the service provider. Tenant shall have the exclusive control over the heating, ventilating and air-conditioning (“HVAC”) system serving the Leased Premises on a 24 hour a day/7 day a week basis. Notwithstanding the foregoing, if (a) such interruption of service is caused by the negligence or willful misconduct of Landlord or its employees and (b) such interruption of service renders the Leased Premises or any portion of the Leased Premises untenantable for a period of five (5) consecutive business days after Landlord receives written notice from Tenant of such interruption of service, rent shall abate with respect to the area which is affected for each such consecutive day after said five (5) business day period that such area of the Leased Premises is so rendered until such service is restored. The rent abatement shall equal the Monthly Rental Installment due for the period of the interruption with respect to the square footage affected. The Leased Premises shall be considered untenantable if Tenant does not use the Leased Premises or portion thereof affected in the conduct of its normal business operations as a result of said interruption of service to the Leased Premises. It is agreed and understood that Tenant shall not use nor be entitled to use the Leased Premises or portion thereof affected to conduct its normal business operations during any day for which Landlord is obligated to abate rent hereunder. The abatement herein provided shall be Tenant’s sole and exclusive remedy for interruption of service. Landlord agrees to use its reasonable efforts to restore such utility service as soon as possible.

-5-

ARTICLE 7 - MAINTENANCE AND REPAIRS

Section 7.01. Tenant’s Responsibility. During the Lease Term, Tenant shall, at its own cost and expense, maintain the Leased Premises in good condition, regularly servicing and promptly making all repairs and replacements thereto, including but not limited to the electrical systems, heating and air conditioning systems, plate glass, floors, windows and doors, and sprinkler and plumbing systems, and shall obtain a preventive maintenance contract on the HVAC systems, and provide Landlord with a copy thereof. The preventive maintenance contract shall meet or exceed Landlord’s standard maintenance criteria, and shall provide for the inspection and maintenance of the heating, ventilating and air conditioning system on not less than a semi-annual basis. In the event Tenant fails to maintain the Leased Premises as required herein or fails to commence repairs (requested by Landlord in writing) within thirty (30) days after such request, or fails diligently to proceed thereafter to complete such repairs, Landlord shall have the right in order to preserve the Leased Premises or portion thereof, and/or the appearance thereof, to make such repairs or have a contractor make such repairs and charge Tenant for the cost thereof as additional rent, together with interest at the rate of twelve percent (12%) per annum from the date of making such payments.

Section 7.02. Landlord’s Responsibility. During the Lease Term, Landlord shall maintain in good condition and repair, and replace as necessary, the roof, exterior walls, foundation and structural frame of the Building (including the water tightness of the Building) and the parking and landscaped areas, the costs of which shall be included in Operating Expenses; provided, however, that to the extent any of the foregoing items require repair because of the negligence, misuse, or default of Tenant, its employees, agents, customers or invitees, Landlord shall make such repairs solely at Tenant’s expense.

Section 7.03. Alterations. Tenant shall not permit alterations in or to the Leased Premises unless and until the plans and the contractor have been approved by Landlord in writing. As a condition of Landlord’s approval, Landlord may require Tenant to remove the alterations and restore the Leased Premises upon termination of this Lease provided Landlord notifies Tenant of such removal requirement in writing at the time such alteration is approved; otherwise, all such alterations shall at Landlord’s option become a part of the realty and the property of Landlord, and shall not be removed by Tenant. Tenant shall ensure that all alterations shall be made in accordance with all applicable laws, regulations and building codes, in a good and workmanlike manner and of quality equal to or better than the original construction of the Building, and that its contractors comply with the terms and conditions of Landlord’s Building Contractor Guidelines (which Landlord agrees to furnish to Tenant upon request). Upon completion of the work, Tenant shall provide lien waivers from the subcontractors or a final affidavit of lien waiver from the general contractor, and such lien waiver shall be in a form acceptable to Landlord. No person shall be entitled to any lien derived through or under Tenant for any labor or material furnished to the Leased Premises, and nothing in this Lease shall be construed to constitute a consent by Landlord to the creation of any lien. If any lien is filed against the Leased Premises for work claimed to have been done for or material claimed to have been furnished to Tenant, Tenant shall cause such lien to be discharged of record within thirty (30) days after filing. Tenant shall indemnify Landlord from all costs, losses, expenses and attorneys’ fees in connection with any construction or alteration and any related lien.

ARTICLE 8 - INSURANCE

Section 8.01. Landlord’s Insurance.

(a) During the Lease Term, Landlord shall maintain, with such deductible as Landlord in its sole judgment determines advisable, all risk coverage insurance on the Building (excluding all trade fixtures and property required to be insured by Tenant under this Lease) in an amount equal to the full replacement value of the Building. Such insurance coverage may be maintained by means of a blanket policy of insurance.

(b) Commercial General Liability insurance with respect to the Common Areas with limits at least equal to the amount Tenant is required to maintain pursuant to Section 8.02(a) below. Such liability insurance may be maintained under an umbrella policy.

Section 8.02. Tenant’s Insurance. During the Lease Term, Tenant shall maintain the following types of insurance, in the amounts specified and in the form hereinafter provided for:

(a) Liability insurance in the Commercial General Liability form (including Broad Form Property Damage and Contractual Liabilities or reasonable equivalent thereto) covering the Leased Premises and Tenant’s use thereof against claims for bodily injury or death, property damage and product liability occurring upon, in or about the Leased Premises, such insurance to be written on an occurrence basis (not a claims made basis), to be in combined single limits amounts not less than $3,000,000 and to have general aggregate limits of not less than $5,000,000 for each policy year.

-6-

(b) All Risk Coverage, Vandalism and Malicious Mischief, and Sprinkler Leakage insurance, if applicable, for the full cost of replacement of Tenant’s trade fixtures, merchandise and personal property.

(c) Worker’s Compensation: minimum statutory amount.

All policies of insurance provided for in this Section 8.02 (i) shall be issued in form reasonably acceptable to Landlord, (ii) shall name Landlord, Landlord’s managing agent, any mortgagee and any other party reasonably designated by Landlord as additional insureds, and (iii) shall provide that they may not be materially changed or canceled on less than thirty (30) days’ prior written notice to Landlord. Tenant shall furnish Landlord with Certificates of Insurance evidencing all required coverages on or before the Commencement Date, and thereafter within thirty (30) days prior to the expiration of each such policy. If Tenant fails to carry such insurance, Landlord may obtain such insurance and Tenant shall promptly reimburse Landlord therefor. If Tenant elects not to carry business interruption insurance, Tenant releases Landlord from any and all liability arising during the Lease Term which would have been covered by business interruption insurance had Tenant carried such insurance.

Section 8.03. Waiver of Subrogation. Landlord and Tenant hereby waive any rights each may have against the other on account of any loss or damage occasioned to Landlord or Tenant, as the case may be, or their respective property, the Leased Premises, its contents, or other portions of the Building arising from any risk which is insured against under any all risk coverage insurance carried (or required to be carried) by either Landlord or Tenant. All insurance policies maintained by Landlord or Tenant as provided in this Lease shall contain an agreement by the insurer waiving the insurer’s right of subrogation against the other party to this Lease.

Section 8.04. Tenant’s Responsibility. All of Tenant’s trade fixtures, merchandise and personal property in the Leased Premises shall be and remain at Tenant’s sole risk. Landlord shall not be liable to Tenant or to any other person, and Tenant hereby releases Landlord from (i) any and all liability for theft thereof or any damage thereto occasioned by any act of God or by any acts, omissions or negligence of any persons, and (ii) any and all liability for any injury to the person or property of Tenant or other persons in or about the Leased Premises, the Building or the common areas associated therewith, except to the extent caused by the negligence or willful misconduct of Landlord. Notwithstanding the foregoing, nothing contained in this Section 8.04 shall override (or be deemed to override) the waivers contained in Section 8.03 above. This provision shall survive the expiration or earlier termination of this Lease.

Section 8.05. Tenant’s Indemnity. Tenant shall indemnify, defend and hold harmless Landlord, its agents, employees and contractors from and against any and all claims, demands, penalties, costs, liabilities, losses and expenses (including reasonable attorneys’ fees actually incurred) to the extent arising from or based upon any alleged act, omission or negligence of Tenant or Tenant’s agents, employees contractors or invitees or otherwise arising in connection with the Leased Premises or Tenant’s use of the common areas associated therewith, except to the extent caused by the negligence or willful misconduct of Landlord. Notwithstanding the foregoing, nothing contained in this Section 8.05 shall override (or be deemed to override) the waivers contained in Section 8.03 above. This provision shall survive the expiration or earlier termination of this Lease.

Section 8.06. Landlord’s Indemnity. Landlord shall indemnify, defend and hold harmless Tenant, its agents, employees and contractors from and against any and all claims, demands, penalties, costs, liabilities, losses and expenses (including reasonable attorneys’ fees actually incurred) to the extent arising from or based upon any alleged act, omission or negligence of Landlord or Landlord’s agents, employees, contractors or invitees, except to the extent caused by the negligence or willful misconduct of Tenant. Notwithstanding the foregoing, nothing contained in this Section 8.05 shall override (or be deemed to override) the waivers contained in Section 8.03 above. This provision shall survive the expiration or earlier termination of this Lease.

ARTICLE 9 - CASUALTY

In the event of total or partial destruction of the Building or the Leased Premises by fire or other casualty, Landlord agrees to promptly restore and repair the Leased Premises; provided, however, Landlord’s obligation hereunder shall be limited to the reconstruction of such of the tenant finish improvements as were originally required to be made by Landlord, if any. Rent shall proportionately abate during the time that the Leased Premises or part thereof are unusable because of any such damage. Notwithstanding the foregoing, if the Leased Premises are (i) so destroyed that they cannot be repaired or rebuilt within one hundred fifty (150) days front the casualty date; or (ii) destroyed by a casualty which is

-7-

not covered by the insurance required hereunder or, if covered, such insurance proceeds are not released by any mortgagee entitled thereto or are insufficient to rebuild the Building and the Leased Premises; then, in case of a clause (i) casualty, either Landlord or Tenant may, or, in the case of a clause (ii) casualty, then Landlord may, upon thirty (30) days’ written notice to the other party, terminate this Lease with respect to matters thereafter accruing. Notwithstanding the provisions of this paragraph, if any such damage or destruction occurs within the final year of the term hereof, then either party, in its sole discretion, may, without regard to the aforesaid one hundred fifty (150) day period, terminate this Lease by written notice to the other party.

ARTICLE 10 - EMINENT DOMAIN

If all or any substantial part of the Building or common areas shall be acquired by the exercise of eminent domain, Landlord may terminate this Lease by giving written notice to Tenant on or before the date that actual possession thereof is so taken. If all or any part of the Leased Premises shall be acquired by the exercise of eminent domain so that the Leased Premises shall become impractical for Tenant to use for the Permitted Use, Tenant may terminate this Lease as of the date that actual possession thereof is so taken by giving written notice to Landlord. All damages awarded shall belong to Landlord; provided, however, that Tenant may claim dislocation damages if such amount is not subtracted from Landlord’s award.

ARTICLE 11 - ASSIGNMENT AND SUBLEASE

Section 11.01 Assignment and Sublease. Tenant shall not assign this Lease or sublet the Leased Premises in whole or in part without Landlord’s prior written consent, which consent shall not be unreasonably withheld, delayed or denied. Subject to Section 11.02 below, any change in control of Tenant resulting from a merger, consolidation, stock transfer or asset sale shall be considered an assignment or transfer that requires Landlord’s prior written consent. In the event of any permitted assignment or subletting, Tenant shall remain primarily liable hereunder, and any extension, expansion, rights of first offer, rights of first refusal or other options granted to Tenant under this Lease shall be rendered void and of no further force or effect. The acceptance of rent from any other person shall not be deemed to be a waiver of any of the provisions of this Lease or to be a consent to the assignment of this Lease or the subletting of the Leased Premises. Any assignment or sublease consented to by Landlord shall not relieve Tenant (or its assignee) from obtaining Landlord’s consent to any subsequent assignment or sublease. By way of example and not limitation, Landlord shall be deemed to have reasonably withheld consent to a proposed assignment or sublease if in Landlord’s opinion (i) the Leased Premises are or may be in any way adversely affected; (ii) the business reputation of the proposed assignee or subtenant is unacceptable; or (iii) the financial worth of the proposed assignee or subtenant is insufficient to meet the obligations hereunder. If Landlord refuses to give its consent to any proposed assignment or subletting, Landlord may, at its option, within thirty (30) days after receiving a request to consent, terminate this Lease by giving Tenant thirty (30) days prior written notice of such termination, whereupon each party shall be released from all further obligations and liability hereunder, except those which expressly survive the termination of this Lease. In the event that Tenant assigns or sublets the Leased Premises or any part thereof, and at any time receives rent and/or other consideration which exceeds that which Tenant would at that time be obligated to pay to Landlord, Tenant shall pay to Landlord, as Additional Rent, 50% of such excess rent and/or other consideration. Tenant agrees to pay Landlord $500.00 upon demand by Landlord to reimburse Landlord for reasonable accounting and attorneys’ fees incurred in conjunction with the processing and documentation of any requested assignment, subletting or any other hypothecation of this Lease or Tenant’s interest in and to the Leased Premises.

Section 11.02. Permitted Transfer. Notwithstanding anything to the contrary contained in Section 11.01 above, Tenant shall have the right, without Landlord’s consent, but upon ten (10) days prior notice to Landlord, to (i) sublet all or part of the Leased Premises to any related corporation or other entity which controls Tenant, is controlled by Tenant or is under common control with Tenant; (ii) assign all or any part of this Lease to any related corporation or other entity which controls Tenant, is controlled by Tenant, or is under common control with Tenant, or to a successor entity into which or with which Tenant is merged or consolidated or which acquires substantially all of Tenant’s assets in property; or (iii) effectuate any public offering of Tenant’s stock on the New York Stock exchange or in the NASDAQ over the counter market, provided that in the event of a transfer pursuant to clause (ii), the net worth after any such transaction is not less than the net worth of Tenant as of the date hereof and provided further that such successor entity assumes all of the obligations and liabilities of Tenant (any such entity hereinafter referred to as a “Permitted Transferee”). For the purpose hereof “control” shall mean ownership of not less than fifty percent (50%) of all voting stock or legal and equitable interest in such corporation or entity. Any such transfer shall not relieve Tenant of its obligations under this Lease.

-8-

ARTICLE 12 - TRANSFERS BY LANDLORD

This Lease and all rights of Tenant hereunder are and shall be subject and subordinate to the lien and security title of any Mortgage (as hereinafter defined) presently existing or hereafter encumbering the Building provided that the holder of said Mortgage agrees not to disturb Tenant’s possession of the Leased Premises so long as Tenant is not in default hereunder. For purposes of this Lease, “Mortgage” shall mean any or all mortgages, deeds to secure debt, deeds of trust or other instruments in the nature thereof, and any amendments, modifications, extensions or renewals thereof. Within twenty (20) days following receipt of a written request from Landlord, Tenant shall execute and deliver to Landlord an estoppel certificate in such form as Landlord may reasonably request certifying (i) that this Lease is in full force and effect and unmodified or stating the nature of any modification, (ii) the date to which rent has been paid, (iii) that there are not, to Tenant’s knowledge, any uncured defaults or specifying such defaults if any are claimed, and (iv) any other matters or state of facts reasonably required respecting the Lease, it being intended that any such statement delivered pursuant hereto may be relied upon by Landlord and by any purchaser or mortgagee of the Building. No owner of the Leased Premises, whether or not named herein, shall have liability hereunder after it ceases to hold title to the Leased Premises.

ARTICLE 13 - DEFAULT AND REMEDY

Section 13.01. Default. The occurrence of any of the following shall be a “Default”:

(a) Tenant fails to pay any Monthly Rental Installment or Additional Rent (i) within five (5) days following written notice from Landlord on the first occasion in any twelve (12) month period, and (ii) within five (5) days after the same is due on any subsequent occasion within said twelve (12) month period.

(b) Tenant fails to perform or observe any other term, condition, covenant or obligation required under this Lease for a period of thirty (30) days after notice thereof from Landlord; provided, however, that if the nature of Tenant’s default is such that more than thirty days are reasonably required to cure, then such default shall be deemed to have been cured if Tenant commences such performance within said thirty-day period and thereafter diligently completes the required action within a reasonable time.

(c) Tenant shall assign or sublet all or a portion of the Leased Premises in contravention of the provisions of Article 11 of this Lease.

(d) All or substantially all of Tenant’s assets in the Leased Premises or Tenant’s interest in this Lease are attached or levied under execution (and Tenant does not discharge the same within sixty (60) days thereafter); a petition in bankruptcy, insolvency or for reorganization or arrangement is filed by or against Tenant (and Tenant fails to secure a stay or discharge thereof within sixty (60) days thereafter); Tenant is insolvent and unable to pay its debts as they become due; Tenant makes a general assignment for the benefit of creditors; Tenant takes the benefit of any insolvency action or law; the appointment of a receiver or trustee in bankruptcy for Tenant or its assets if such receivership has not been vacated or set aside within thirty (30) days thereafter; or dissolution or other termination of Tenant’s corporate charter if Tenant is a corporation.

Section 13.02. Remedies. Upon the occurrence of any Default, Landlord shall have the following rights and remedies, in addition to those allowed by law or in equity, any one or more of which may be exercised without further notice to Tenant:

(a) Terminate this Lease by giving Tenant notice of termination, in which event this Lease shall expire and terminate on the date specified in such notice of termination and all rights of Tenant under this Lease and in and to the Leased Premises shall terminate. Tenant shall remain liable for all obligations under this Lease arising up to the date of such termination, and Tenant shall surrender the Leased Premises to Landlord on the date specified in such notice. Furthermore, Tenant shall be liable to Landlord for the unamortized balance of any Tenant improvement allowance and brokerage fees paid in connection with the Lease.

(b) Without terminating this Lease, and with or without notice to Tenant, re-enter the Leased Premises and cure any default of Tenant, and Tenant shall reimburse Landlord as Additional Rent for any costs and expenses which Landlord thereby incurs; and Landlord shall not be liable to Tenant for any loss or damage which Tenant may sustain by reason of Landlord’s action.

(c) Terminate this Lease as provided in subparagraph (a) above and recover from Tenant all damages Landlord may incur by reason of Tenant’s default, including, without limitation, an amount which, at the date of such termination is equal to the sum of the following: (i) the value of the excess, if

-9-

any, discounted at the prime rate of interest (as reported in the Wall Street Journal), of (A) the Minimum Annual Rent, Additional Rent and all other sums that would have been payable hereunder by Tenant for the period for the remainder of the Lease Term had this Lease not been terminated (said period being referred to herein as the “Remaining Term”), less (B) the aggregate reasonable rental value of the Leased Premises for the Remaining Term, as determined by a real estate broker licensed in the State of Georgia who has at least ten (10) years of experience; (ii) the costs of recovering possession of the Leased Premises and all other expenses incurred by Landlord due to Tenant’s Default, including, without limitation, reasonable attorney’s fees and the cost to prepare the Leased Premises for re-letting (all costs and expenses set forth in this clause (ii) being referred to herein, collectively, as the “Default Damages”); and (iii) the unpaid Minimum Annual Rent and Additional Rent that accrued prior to the date of termination, plus any interest and late fees due hereunder and any other sums of money and damages owing on the date of termination by Tenant to Landlord under this Lease or in connection with the Leased Premises (all amounts set forth in this clause (iii) being referred to herein, collectively, as the “Prior Obligations”). Landlord shall provide Tenant with written notice of the amount as calculated above within sixty (60) days from the date of such termination. Tenant shall pay such amount within sixty (60) days from the receipt of Landlord’s notice. Landlord and Tenant acknowledge and agree that the payment of the amount set forth in clause (i) above shall not be deemed a penalty, but shall merely constitute payment of liquidated damages, it being understood that actual damages to Landlord are extremely difficult, if not impossible, to ascertain. Tenant expressly acknowledges and agrees that the liabilities and remedies specified in this subparagraph (c) shall survive the termination of this Lease.

(d) Intentionally Omitted.

(e) Without terminating this Lease, terminate Tenant’s right to possession of the Leased Premises as of the date of Tenant’s Default, and thereafter (i) neither Tenant nor any person claiming under or through Tenant shall be entitled to possession of the Leased Premises, and Tenant shall immediately surrender the Leased Premises to Landlord; and (ii) Landlord may re-enter the Leased Premises and dispossess Tenant and any other occupants of the Leased Premises by any lawful means and may remove their effects, without prejudice to any other remedy which Landlord may have. Thereafter, Landlord may, but shall not be obligated to, re-let all or any part of the Leased Premises as the agent of Tenant for a term different from that which would otherwise have constituted the balance of the Lease Term and for rent and on terms and conditions different from those contained herein, whereupon Tenant shall be obligated to pay to Landlord as liquidated damages the difference between the rent provided for herein and that provided for in any lease covering a subsequent re-letting of the Leased Premises, for the Remaining Term, together with all Default Damages. Neither the filing of a dispossessory proceeding nor an eviction of personalty in the Leased Premises shall be deemed to terminate the Lease.

(f) Allow the Leased Premises to remain unoccupied and collect rent from Tenant as it comes due; provided, however, that to the extent required by applicable law, Landlord will use reasonable efforts to mitigate its damages.

(g) Sue for injunctive relief or to recover damages for any loss resulting from the Default.

Section 13.03. Landlord’s Default and Tenant’s Remedies. Landlord shall be in default if it fails to perform any term, condition, covenant or obligation required under this Lease for a period of thirty (30) days after written notice thereof from Tenant to Landlord; provided, however, that if the term, condition, covenant or obligation to be performed by Landlord is such that it cannot reasonably be performed within thirty (30) days, such default shall be deemed to have been cured if Landlord commences such performance within said thirty-day period and thereafter diligently undertakes to complete the same. Upon the occurrence of any such default. Tenant may sue for injunctive relief or to recover damages for any loss directly resulting from the breach, but Tenant shall not be entitled to terminate this Lease or withhold, offset or abate any sums due hereunder.

Section 13.04. Limitation of Landlord’s Liability. If Landlord shall fail to perform any term, condition, covenant or obligation required to be performed by it under this Lease and if Tenant shall, as a consequence thereof, recover a money judgment against Landlord, Tenant agrees that it shall look solely to Landlord’s right, title and interest in and to the Building for the collection of such judgment; and Tenant further agrees that no other assets of Landlord shall be subject to levy, execution or other process for the satisfaction of Tenant’s judgment.

Section 13.05. Nonwaiver of Defaults. Neither party’s failure or delay in exercising any of its rights or remedies or other provisions of this Lease shall constitute a waiver thereof or affect its right thereafter to exercise or enforce such right or remedy or other provision. No waiver of any default shall be deemed to be a waiver of any other default. Landlord’s receipt of less than the full rent due shall not

-10-

be construed to be other than a payment on account of rent then due, nor shall any statement on Tenant’s check or any letter accompanying Tenant’s check be deemed an accord and satisfaction. No act or omission by Landlord or its employees or agents during the Lease Term shall be deemed an acceptance of a surrender of the Leased Premises, and no agreement to accept such a surrender shall be valid unless in writing and signed by Landlord.

Section 13.06. Attorneys’ Fees. If a Default shall occur, Tenant shall pay to Landlord, on demand, all expenses incurred by Landlord as a result thereof, including reasonable attorneys’ fees, court costs and expenses actually incurred; provided, however, that Landlord and Tenant shall each reimburse the other for the reasonable and actual attorneys’ fees, court costs and expenses incurred by such other party in connection with any litigation initiated by Landlord or Tenant, as the case may be, pursuant to this Lease which results in a final, unappealable judgment as to the merits in the other party’s favor.

ARTICLE 14 - LANDLORD’S RIGHT TO RELOCATE TENANT

INTENTIONALLY OMITTED

ARTICLE 15 - TENANT’S RESPONSIBILITY REGARDING

ENVIRONMENTAL LAWS AND HAZARDOUS SUBSTANCES.

Section 15.01. Definitions.

(a) “Environmental Laws” - All present or future federal, state and municipal laws, ordinances, rules and regulations applicable to the environmental and ecological condition of the Leased Premises, the rules and regulation of the Federal Environmental Protection Agency or any other federal, state or municipal agency or governmental board or entity having jurisdiction over the Leased Premises.

(b) “Hazardous Substances” - Those substances included within the definitions of “hazardous substances,” “hazardous materials,” “toxic substances,’’ “solid waste” or “infectious waste” under Environmental Laws and petroleum products.

Section 15.02. Compliance. Tenant, at its sole cost and expense, shall promptly comply with the Environmental Laws including any notice from any source issued pursuant to the Environmental Laws or issued by any insurance company which shall impose any duty upon Tenant with respect to the use, occupancy, maintenance or alteration of the Leased Premises whether such notice shall be served upon Tenant or served upon Landlord and Landlord advised Tenant of such need to cure.

Section 15.03. Restrictions on Tenant. Tenant shall operate its business and maintain the Leased Premises in compliance with all Environmental Laws. Tenant shall not cause or permit the use, generation, release, manufacture, refining, production, processing, storage or disposal of any Hazardous Substances on, under or about the Leased Premises, or the transportation to or from the Leased Premises of any Hazardous Substances, except as necessary and appropriate for its Permitted Use in which case the use, storage or disposal of such Hazardous Substances shall be performed in compliance with the Environmental Laws.

Section 15.04. Notices, Affidavits, Etc.

(a) Tenant shall immediately notify Landlord of (i) any violation by Tenant, its employees, agents, representatives, customers, invitees or contractors of the Environmental Laws on, under or about the Leased Premises, or (ii) the presence or suspected presence of any Hazardous Substances on, under or about the Leased Premises and shall immediately deliver to Landlord any notice received by Tenant relating to (i) and (ii) above from any source. Tenant shall execute affidavits, representations and the like within five (5) days of Landlord’s request therefor concerning Tenant’s best knowledge and belief regarding the presence of any Hazardous Substances on, under or about the Leased Premises.

(b) Landlord shall immediately notify Tenant of (i) any violation by Landlord, its employees, agents, representatives, customers, invitees or contractors of the Environmental Laws on, under or about the Leased Premises, or (ii) the presence or suspected presence of any Hazardous Substances on, under or about the Leased Premises and shall immediately deliver to Tenant any notice received by Landlord relating to (i) and (ii) above from any source. Landlord shall execute affidavits, representations and the like within ten (10) business days of Tenant’s request therefor concerning Landlord’s best knowledge and belief regarding the presence of any Hazardous Substances on, under or about the Leased Premises.

-11-

Section 15.05. Landlord’s Rights. Landlord and its agents shall have the right, but not the duty, upon advance notice (except in the case of emergency when no notice shall be required) to inspect the Leased Premises and conduct tests thereon to determine whether or the extent to which there has been a violation of Environmental Laws by Tenant or whether there are Hazardous Substances on, under or about the Leased Premises. In exercising its rights herein, Landlord shall use reasonable efforts to minimize interference with Tenant’s business but such entry shall not constitute an eviction of Tenant, in whole or in part, and Landlord shall not be liable for any interference, loss, or damage to Tenant’s property or business caused thereby.

Section 15.06. Tenant’s Indemnification. Tenant shall indemnify Landlord and Landlord’s managing agent from any and all claims, losses, liabilities, costs, expenses and damages, including attorneys’ fees, costs of testing and remediation costs, incurred by Landlord in connection with any breach by Tenant of its obligations under this Article 15; provided, however, that Tenant shall have no obligation to indemnify Landlord to the extent that Landlord is actually reimbursed by insurance proceeds. The covenants and obligations under this Article 15 shall survive the expiration or earlier termination of this Lease.

Section 15.07. Landlord’s Representation. Notwithstanding anything contained in this Article 15 to the contrary, Tenant shall not have any liability to Landlord under this Article 15 resulting from any conditions existing, or events occurring, or any Hazardous Substances existing or generated at, in, on, under or in connection with the Leased Premises prior to the Commencement Date of this Lease except to the extent Tenant exacerbates the same.

ARTICLE 16 - MISCELLANEOUS

Section 16.01. Benefit of Landlord and Tenant. This Lease shall inure to the benefit of and be binding upon Landlord and Tenant and their respective successors and assigns.

Section 16.02. Governing Law. This Lease shall be governed in accordance with the laws of the State where the Building is located.

Section 16.03. Guaranty. Intentionally Omitted.

Section 16.04. Force Majeure. Landlord and Tenant (except with respect to the payment of any monetary obligation) shall be excused for the period of any delay in the performance of any obligation hereunder when such delay is occasioned by causes beyond its control, including but not limited to work stoppages, boycotts, slowdowns or strikes; shortages of materials, equipment, labor or energy; unusual weather conditions; or acts or omissions of governmental or political bodies.

Section 16.05. Examination of Lease. Submission of this instrument for examination or signature to Tenant does not constitute a reservation of or option for Lease, and it is not effective as a Lease or otherwise until execution by and delivery to both Landlord and Tenant.

Section 16.06. Indemnification for Leasing Commissions. Broker shall be entitled to receive a commission in the amounts, and upon the terms and conditions, contained in a separate commission agreement between Landlord and Broker. Tenant warrants and represents to Landlord that, other than Broker, no other party is entitled, as a result of the actions of Tenant, to a commission or other fee resulting from the execution of this Lease; and in the event Tenant extends or renews this Lease, or expands the Leased Premises, and Broker is entitled to a commission under the above-referenced commission agreement, Tenant shall pay all commissions and fees payable to any party (other than Broker) engaged by Tenant to represent Tenant in connection therewith. Landlord warrants and represents to Tenant that, except as set forth above, no other party is entitled, as a result of the actions of Landlord, to a commission or other fee resulting from the execution of this Lease. Landlord and Tenant agree to indemnify and hold each other harmless from any loss, cost, damage or expense (including reasonable attorney’s fees) incurred by the nonindemnifying party as a result of the untruth or incorrectness of the foregoing warranty and representation, or failure to comply with the provisions of this subparagraph. Broker is representing Tenant in connection with this Lease, and is not representing Landlord. Employees of Landlord or its affiliates, are representing Landlord and are not representing Tenant. The parties acknowledge that certain officers, directors, shareholders, or partners of Landlord or its general partner(s), are licensed real estate brokers and/or salesmen under the laws of the State of Georgia. Tenant consents to such parties acting in such dual capacities.

Section 16.07. Notices. Any notice required or permitted to be given under this Lease or by law shall be deemed to have been given if it is written and delivered by overnight courier or mailed by certified mail, postage prepaid, to the party who is to receive such notice at the address specified in

-12-

Article 1. If sent by overnight courier, notice shall be deemed given as of the First business day after sending. If mailed, the notice shall be deemed to have been given on the date which is three business days after mailing. Either party may change its address by giving written notice thereof to the other party.

Section 16.08. Partial Invalidity; Complete Agreement. If any provision of this Lease shall be held to be invalid, void or unenforceable, the remaining provisions shall remain in full force and effect. This Lease represents the entire agreement between Landlord and Tenant covering everything agreed upon or understood in this transaction. There are no oral promises, conditions, representations, understandings, interpretations or terms of any kind as conditions or inducements to the execution hereof or in effect between the parties. No change or addition shall be made to this Lease except by a written agreement executed by Landlord and Tenant.

Section 16.09. Financial Statements. During the Lease Term and any extensions thereof, as long as Tenant’s financial statements are publicly available, Tenant shall provide to Landlord upon request, a copy of Tenant’s most recent annual report. Without limiting the foregoing, in the event that Tenant’s financial statements are no longer publicly available, Tenant shall provide to Landlord on an annual basis, within ninety (90) days following the end of Tenant’s fiscal year, a copy of Tenant’s most recent financial statements (certified and audited if available) prepared as of the end of Tenant’s fiscal year. All such financial statements shall be signed by Tenant (or an officer of Tenant, if applicable) who shall attest to the truth and accuracy of the information set forth in such statements, All financial statements provided by Tenant to Landlord hereunder shall be prepared in conformity with generally accepted accounting principles, consistently applied.

Section 16.10. Signage. Landlord shall have the right to approve the placing of signs and the size and quality of the same. Tenant shall place no exterior signs on the Leased Premises without the prior written consent of Landlord. Any signs not in conformity with the Lease may be intermediately removed by Landlord.

Section 16.11. Consent. Where the consent of a party is required, such consent will not be unreasonably withheld.

Section 1612. Parking. Throughout the term of this Lease and any extensions thereof, Landlord shall make available to Tenant one hundred seventeen (117) automobile parking spaces (on an unassigned, non-exclusive basis) in the parking area of the Park. Such parking shall be at no additional cost to Tenant. Tenant agrees to cooperate reasonably with Landlord and other tenants in the use of parking facilities. Landlord reserves the right in its reasonable discretion to determine whether parking facilities are becoming crowded and, in such event, to allocate parking spaces among Tenant and other tenants. There will be no assigned parking unless Landlord, in its sole discretion, may deem advisable. No vehicle may be repaired or serviced in the parking area and any vehicle deemed abandoned by Landlord will be towed from the project and all costs therein shall be borne by the Tenant. All driveways, ingress and egress, and all parking spaces are for the joint use of all tenants. There shall be no parking permitted on any of the streets or roadways located within the Parking.

Section 16.13. Time. Time is of the essence of each term and provision of this Lease.

Section 16.14. Representations and Warranties. Tenant hereby represents and warrants that (i) Tenant is duly organized, validly existing and in good standing (if applicable) in accordance with the laws of the state under which it was organized; (ii) Tenant is authorized to do business in the State where the Building is located; and (iii) the individual(s) executing and delivering this Lease on behalf of Tenant has been properly authorized to do so, and such execution and delivery shall bind Tenant to is terms.

Section 16.15. Usufruct. Tenant’s interest in the Leased Premises is a usufruct, not subject to levy and sale, and not assignable by Tenant except as expressly set forth herein.

(SIGNATURES CONTAINED ON THE FOLLOWING PAGE)

-13-

IN WITNESS WHEREOF, the parties hereto have executed this Lease as of the day and year first above written.

| Signed, sealed and delivered as to Landlord, in the presence of: |

LANDLORD:

DUKE REALTY LIMITED PARTNERSHIP, an | |||||||||

| Indiana limited partnership | ||||||||||

| /s/ Tara Bell |

||||||||||

| Unofficial Witness | By: | Duke Realty Corporation, | ||||||||

| its General Partner | ||||||||||

| /s/ [Illegible] |

By: | /s/ [Illegible] | ||||||||

| Notary Public | Name: | [Illegible] | ||||||||

| Title: | [Illegible] | |||||||||

| Notary Public, Gwinnett County, Georgia | ||||||||||

| My Commission Expires August 12, 2005 | ||||||||||

| Signed, sealed and delivered as to Tenant, in the presence of: |

TENANT:

PRIMERICA LIFE INSURANCE COMPANY, a Massachusetts corporation | |||||||||

|

|

||||||||||

| Unofficial Witness | By: | /s/ Karen Fine | ||||||||

| Name: | Karen Fine | |||||||||

| Title: | EVP | |||||||||

| /s/ Ansleigh Smith |

||||||||||

| Notary Public | ||||||||||

| Attest: |

| |||||||||

| Name: |

| |||||||||

| ANSLEIGH SMITH | Title: |

| ||||||||

| Notary Public, Gwinnett County, Georgia | ||||||||||

| My Commission Expires Sept 15, 2006. | ||||||||||

-14-

08/21/02

EXHIBIT D

SPECIAL STIPULATIONS

The Special Stipulations set forth herein are hereby incorporated into the body of the lease to which these Special Stipulations are attached (the “Lease”), and to the extent of any conflict between these Special Stipulations and the Lease, these Special Stipulations shall govern and control.

I. Option to Extend.

(a) Grant and Exercise of Option. Provided that (i) the Lease is in full force and effect, (ii) no Default has occurred and is then continuing and no facts or circumstances exist which, with the giving of notice or the passage of time, or both, would constitute a Default, and (iii) Tenant’s tangible net worth is at least Ten Million and No/100 Dollars ($10,000,000.00), as revealed by its most current financial statements, Tenant shall have one (1) option to extend the initial Lease Term (the “Original Term”) for one (1) additional period of five (5) years (the “Extension Term”). For the purpose hereof, “tangible net worth” shall mean the value of tangible assets (i.e., assets excluding those which are intangibles such as goodwill, patents and trademarks) over liabilities. The leasing of the Leased Premises for the Extension Term shall be upon the same terms and conditions contained in the Lease for the Original Term except (i) Tenant shall not have any further option to extend; (ii) any improvement allowances, termination rights or other concessions applicable to the Leased Premises during the Original Term shall not apply to the Extended Term, and (iii) the Minimum Annual Rent shall be adjusted as set forth herein (“Rent Adjustment”). Tenant shall exercise such option by delivering to Landlord, no later than one hundred eighty (180) days prior to the expiration of the Original Term, written notice of Tenant’s desire to extend the Original Term. Tenant’s failure to timely exercise such option shall be deemed a waiver of such option. If Tenant properly exercises its option to extend, Landlord shall notify Tenant of the Minimum Annual Rent for the Extension Term no later than ninety (90) days prior to the commencement of the Extension Term. Tenant shall have twenty (20) business days following its receipt of Landlord’s notice to notify Landlord in writing that Tenant objects to the Rent Adjustment and therefore that Tenant elects to determine the Fair Market Value Rent (as defined and calculated below). Tenant shall be deemed to have accepted the Rent Adjustment if it fails to deliver to Landlord a written objection thereto within said twenty (20) business day period. If Tenant timely exercises its option to extend, Landlord and Tenant shall execute an amendment to the Lease (or, at Landlord’s option, a new lease on the form then in use for the Building) reflecting the terms and conditions of the Extension Term, within thirty (30) days following the determination of the Minimum Annual Rent for the Extension Term.

(b) Fair Market Value Rent. The “Fair Market Value Rent” shall be an amount equal to the minimum annual rent then being quoted by landlord to prospective new tenants of the Building for space of comparable size and quality and with similar or equivalent improvements as are found in the Building, and if none, then in similar buildings owned by Landlord. The Fair Market Value Rent shall be determined as follows:

(i) Selection of Appraisers. If Tenant notifies Landlord that Tenant disagrees with Landlord’s determination of the Minimum Annual Rent for the Extension Term and that Tenant elects to determine the Fair Market Value Rent, then Landlord and Tenant shall, within ten (10) days after Landlord’s receipt of said notice, each select an appraiser to determine the Fair Market Value Rent for the Leased Premises. Each appraiser so selected shall be either an MAI appraiser or a licensed real estate broker, each having at least ten years prior experience in the appraisal or leasing of comparable space in the metropolitan area in which the Leased Premises are located and with a working knowledge of current rental rates and practices.

(ii) Appraisal. Upon selection, Landlord’s and Tenant’s appraisers shall work together in good faith to agree upon the Fair Market Value Rent. The estimate chosen by such appraisers shall be binding on both Landlord and Tenant. If the two appraisers cannot agree upon the Fair Market Value Rent for the Leased Premises within twenty (20) days after their appointment, then, within ten (10) days after the expiration of such twenty (20) day period, the two appraisers shall select a third appraiser meeting the above criteria. Once the third appraiser has been selected as provided for above, then such third appraiser shall within ten (10) days after appointment make its determination of which of the appraisers’ two estimates most closely reflects Fair Market Value Rent and such estimate shall be binding on both Landlord and Tenant as the Fair Market Value Rent for the applicable Extension Term. The parties shall share equally in the costs of the third arbitrator, and each party shall pay the cost of its own arbitrator.

D-1

(c) Personal. This Option to Extend is personal to Primerica Life Insurance Company and its Permitted Transferee and shall become null and void upon the occurrence of an assignment of the Lease or a sublet of all or a part of the Leased Premises.

2. Right of First Offer.

(a) Provided that (i) the Lease is in full force and effect, (ii) no Default has occurred and is then continuing and no facts or circumstances exist which, with the giving of notice or the passage of time, or both, would constitute a Default, and (iii) the creditworthiness of Tenant, as revealed by its most current financial statements, is materially the same as or better than on the date of the Lease, Landlord shall notify Tenant in writing (“Landlord’s Notice”) of the availability of any space within the Building, as shown on Exhibit E attached hereto and made a part hereof (the “Offer Space”) before entering into a lease with a third party for such Offer Space. Tenant shall have ten (10) business days from its receipt of Landlord’s Notice to deliver to Landlord a written acceptance agreeing to lease the Offer Space on the terms and conditions contained in Landlord’s Notice which shall be the same terms and conditions as Landlord is willing to provide to such third party. In the event Tenant fails to notify Landlord of its acceptance within said ten (10) business day period, such failure shall be conclusively deemed a waiver of Tenant’s Right of First Offer and a rejection of the Offer Space, whereupon Tenant shall have no further rights with respect to the Offer Space and Landlord shall be free to lease the Offer Space to a third party. In the event Tenant accepts the Offer Space on the terms and conditions specified in the Landlord’s Notice, the term for the Offer Space shall be coterminous with the term for the original Leased Premises; provided, however, that the term for the Offer Space shall be not less than thirty-six (36) months. If the term of the Offer Space would then exceed the Lease Term for the original Leased Premises, the Lease Term for the original Leased Premises shall be extended automatically to the extent necessary, to be coterminous with the term for the Offer Space. The Minimum Annual Rent for the Offer Space shall be equal to the rate which is then being quoted by Landlord to prospective new tenants for the Offer Space, excluding free rent and other concessions, but adjusted to reflect any term that is less than the term contained in Landlord’s Notice, provided, however, that in no event shall Tenant’s Minimum Annual Rent per square foot for the Offer Space be less than the highest Minimum Annual Rent per square foot payable during the original Lease Term for the original Leased Premises. If, as a result of Tenant’s exercise of this right of first offer, the Lease Term for the original Leased Premises is extended, the Minimum Annual Rent for the original Leased Premises during the first twelve (12) months of any such extended term shall be an amount equal to 103% of the Minimum Annual Rent in effect at the end of the preceding term, and shall increase at the rate of 3% per annum thereafter.

(b) If, within such 10 business day period, Tenant accepts the Offer Space, then Landlord and Tenant shall amend the Lease to include the Offer Space subject to the same terms and conditions of the Lease, as modified by the terms and conditions of the Landlord’s Notice; provided, however, that except as otherwise expressly set forth in the Landlord’s Notice, no Tenant Improvement allowances or other such financial concessions contained in the Lease, if any, shall apply to the Offer Space.

(c) Notwithstanding anything to the contrary contained herein, if, at any time, (i) Landlord delivers a Landlord’s Notice with respect to any Offer Space that adjoins the Leased Premises, (ii) Tenant waives its right of first offer to lease said Offer Space pursuant to the terms of subsection (a) above, and (iii) Landlord leases said Offer Space to a third party, this Special Stipulation 2 shall be thereafter null and void and of no further force or effect and Tenant shall no longer have a right of first offer to lease any Offer Space.

(d) This Right of First Offer is personal to Primerica Life Insurance Company and its Permitted Transferee and shall become null and void upon the occurrence of an assignment of the Lease or a sublet of all or a part of the Leased Premises.

3. Mezzanine. Tenant shall have the exclusive right to occupy and use the mezzanine area located directly above Suite 100 of the Building as shown on Exhibit F attached hereto and made a part hereof (the “Mezzanine Space”). The Mezzanine Space shall be deemed part of the Leased Premises for all purposes under the Lease; provided, however, that Tenant shall not be required to pay base rent or any Operating Expenses or increases in insurance premiums or Real Estate Taxes with respect to the Mezzanine Space and the Mezzanine Space shall not be included in the calculation of Tenant’s Proportionate Share, or rentable area.

4. Tenant Alterations Allowance. Landlord and Tenant acknowledge that Tenant intends to make certain alterations to the Leased Premises following the date hereof, and that Tenant shall be required to comply with the provisions of Section 7.03 of the Lease in connection therewith. Without limiting the foregoing, Landlord agrees to pay an allowance to Tenant for the construction and installation of said alterations (the “Tenant Alterations”) up to Forty-Two Thousand and Eight Hundred Seventy-Eight and

-2-

00/100 Dollars ($42,878.00) (the “Allowance”), provided that (i) Tenant delivers to Landlord, on or before May 1, 2003, a written request for such reimbursement, and (ii) such request is accompanied by copies of invoices or receipts for the cost of the Tenant Alterations marked “paid in full.” If the Allowance exceeds the cost to construct and install the Tenant Alterations, such savings shall be the property of Landlord. If Tenant fails to deliver a written request for reimbursement as aforesaid on or before May 1, 2003, Tenant shall be deemed to have waived its right to such reimbursement.

5. Building Generator. Tenant shall have the exclusive right to use the back-up generator that currently services the Building (the “Building Generator”) as a back-up power source for the Leased Premises, provided that (a) the Building Generator (and the use thereof) is in compliance with all of the terms and conditions of this Lease, (b) the Building Generator (and the use thereof) is in compliance with any and all applicable laws, statutes, ordinances, regulations and protective covenants, and (c) Tenant maintains the Building Generator in good condition and repair. Landlord shall have no obligation, whatsoever, to replace the Building Generator or perform any repairs to the Building Generator and any use of the Building Generator by Tenant shall be at Tenant’s sole risk and expense. Tenant shall have the right to periodically test the Building Generator during the Lease Term.

6. Operating Expense Exclusions. Notwithstanding the provisions of Section 3.02 of the Lease, Operating Expenses shall not include the following:

(a) legal fees, brokerage commissions, adverting costs and other costs incurred in connection with the leasing of the Building;

(b) costs and expenses arising by reason of any fire or other casualty (excluding and commercially reasonable deductible) or any condemnation to the extent that Landlord is reimbursed by insurance proceeds or condemnation awards;

(c) costs incurred by Landlord as a result of Landlord’s gross negligence or willful misconduct;

(d) wages, salaries, medical, surgical and general welfare benefits, pension payments, payroll taxes, workers’ compensation costs or other compensation paid to or for any executive employees above the grade of building manager;

(e) Landlord’s general overhead expenses not related to the Building;

(f) payments of principals or interest on any mortgage or other encumbrance including ground lease payments and points, commission and legal fees associated with financing;

(g) depreciation;

(h) legal fees, accountants’ fees and other expenses incurred in litigation with Tenant or other tenants or occupants of the Building or associated with the enforcement of any lease or defense of the Landlord’s title or interest in the Building or any part thereof;

(i) costs including permit, license and inspection fees incurred in renovating or otherwise improving, decorating, painting or altering another tenant’s space in the Building;

(j) costs incurred due to the violation by Landlord or any other tenant in the Building of the terms and conditions of any lease;

(k) the cost of any services provided to Tenant or other occupants of the Building for which Landlord is directly reimbursed in a manner separate from a pass-through of general operating expenses;

(l) charitable or political contributions;

(m) interest, penalties or other costs arising out of Landlord’s failure to make timely payments of its obligations; and

(n) costs incurred in advertising and promotional activities for the Building.

7. Compliance With Law.

(a) Existing Governmental Regulations. If any federal, state or local laws, ordinances, orders, rules, regulations or requirements (collectively, “Governmental Requirements”) in existence as of

-3-

the date of the Lease require an alteration or modification of the Leased Premises (a “Code Modification”) and such Code Modification (i) is not made necessary as a result of the specific use being made by Tenant of the Leased Premises (as distinguished from an alteration or improvement which would be required to be made by the owner of any warehouse-office building comparable to the Building irrespective of the use thereof by any particular occupant), and (ii) is not made necessary as a result of any alteration of the Leased Premises by Tenant, such Code Modification shall be performed by Landlord, at Landlord’s sole cost and expense.