0001475922falseDEF 14A0001475922ecd:EqtyAwrdsAdjsMemberecd:PeoMember2022-01-012022-12-310001475922ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-01-012024-12-310001475922ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310001475922ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001475922ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2021-01-012021-12-310001475922pri:GlennWilliamsMember2024-01-012024-12-310001475922ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-01-012021-12-310001475922ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-31000147592222024-01-012024-12-310001475922ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-01-012022-12-31000147592262024-01-012024-12-3100014759222022-01-012022-12-310001475922ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-01-012022-12-310001475922ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-3100014759222023-01-012023-12-310001475922ecd:EqtyAwrdsAdjsMemberecd:PeoMember2023-01-012023-12-310001475922ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310001475922pri:PeterSchneiderMember2024-01-012024-12-310001475922ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310001475922ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2020-01-012020-12-310001475922ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2020-01-012020-12-310001475922ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-310001475922ecd:EqtyAwrdsAdjsMemberecd:PeoMember2024-01-012024-12-310001475922ecd:EqtyAwrdsAdjsMemberecd:PeoMember2020-01-012020-12-310001475922ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2020-01-012020-12-310001475922ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310001475922ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2024-01-012024-12-310001475922ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2020-01-012020-12-310001475922ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310001475922ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310001475922ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2022-01-012022-12-310001475922ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2021-01-012021-12-310001475922ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310001475922ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-3100014759222021-01-012021-12-310001475922ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001475922ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310001475922ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310001475922ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-31000147592232024-01-012024-12-310001475922ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001475922ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-01-012022-12-310001475922ecd:NonPeoNeoMemberecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMember2020-01-012020-12-310001475922ecd:EqtyAwrdsAdjsMemberecd:PeoMember2021-01-012021-12-3100014759222020-01-012020-12-31000147592242024-01-012024-12-310001475922ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2024-01-012024-12-3100014759222024-01-012024-12-31000147592252024-01-012024-12-310001475922ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-31000147592212024-01-012024-12-310001475922ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2024-01-012024-12-310001475922ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310001475922ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2024-01-012024-12-310001475922ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310001475922ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310001475922ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310001475922ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001475922ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2023-01-012023-12-310001475922ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsMember2024-01-012024-12-310001475922ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2022-01-012022-12-310001475922ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2020-01-012020-12-310001475922ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2021-01-012021-12-310001475922ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310001475922ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-01-012021-12-31iso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

PRIMERICA, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

April 1, 2025

To Our Fellow Stockholders:

Our purpose is to create financially independent families. We remain committed to serving middle-income households throughout the United States and Canada and have created a culture that aligns the needs of our stockholders, clients, the independent sales force and our employees. During 2024, our Board of Directors continued to guide and oversee management in the creation of long-term stockholder value through effective and sustainable business strategies, performance-aligned compensation programs, a commitment to corporate ethics, valuing human capital and strong governance practices. We strongly encourage you to review the entire accompanying Proxy Statement, which provides an overview of the priorities of our Board and senior management.

Continued Alignment of Compensation and Performance

Our compensation philosophy includes a strong commitment to provide incentive programs that link executive pay to Company performance. The Compensation Committee of our Board reviews our executive compensation program with independent experts as part of its ongoing effort to appropriately align compensation with performance. As part of this effort, the Compensation Committee is focused on ensuring that our key executives are incentivized to execute on the strategic priorities of our Company. Please read a message from the Compensation Committee beginning on page 45 of the accompanying Proxy Statement.

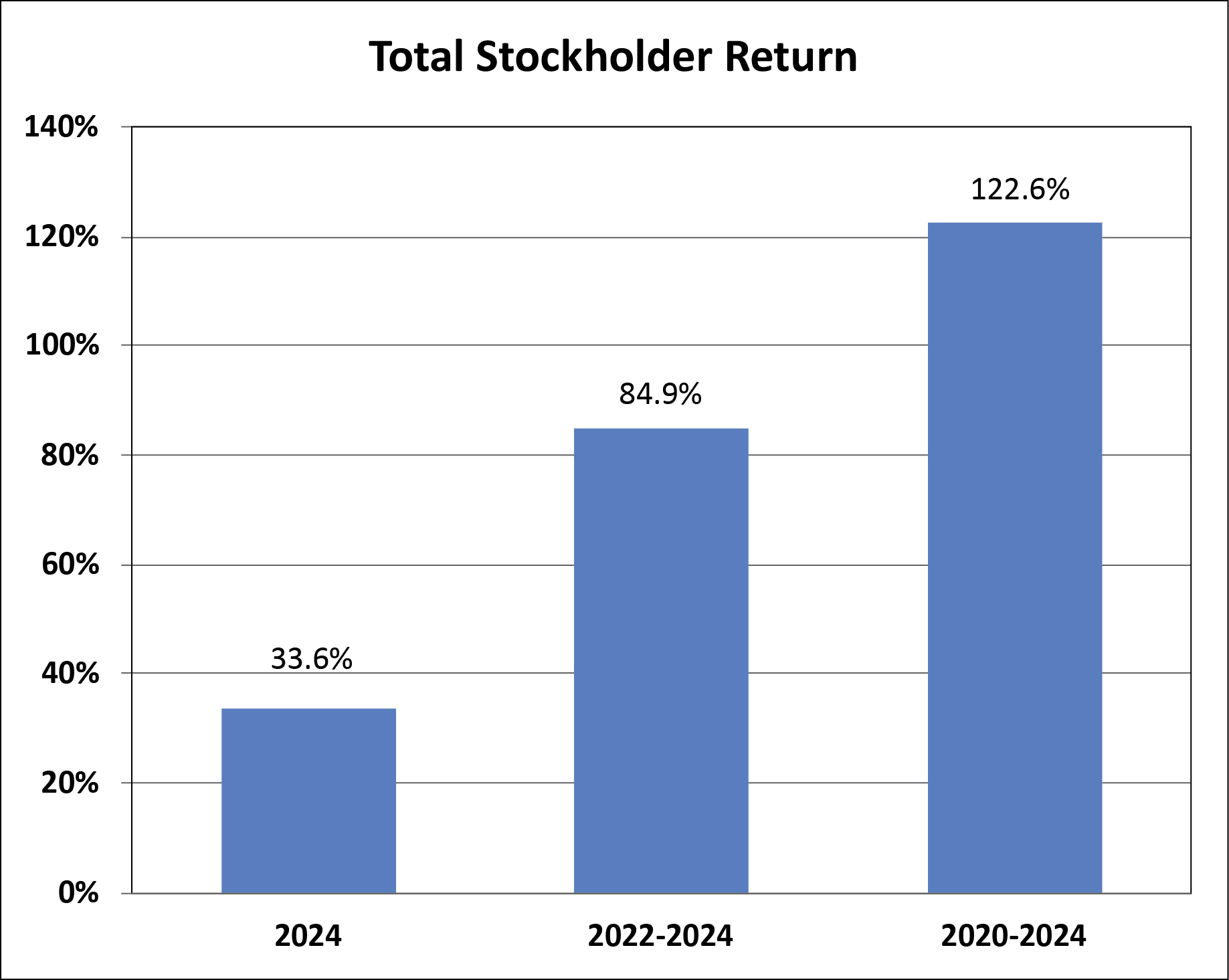

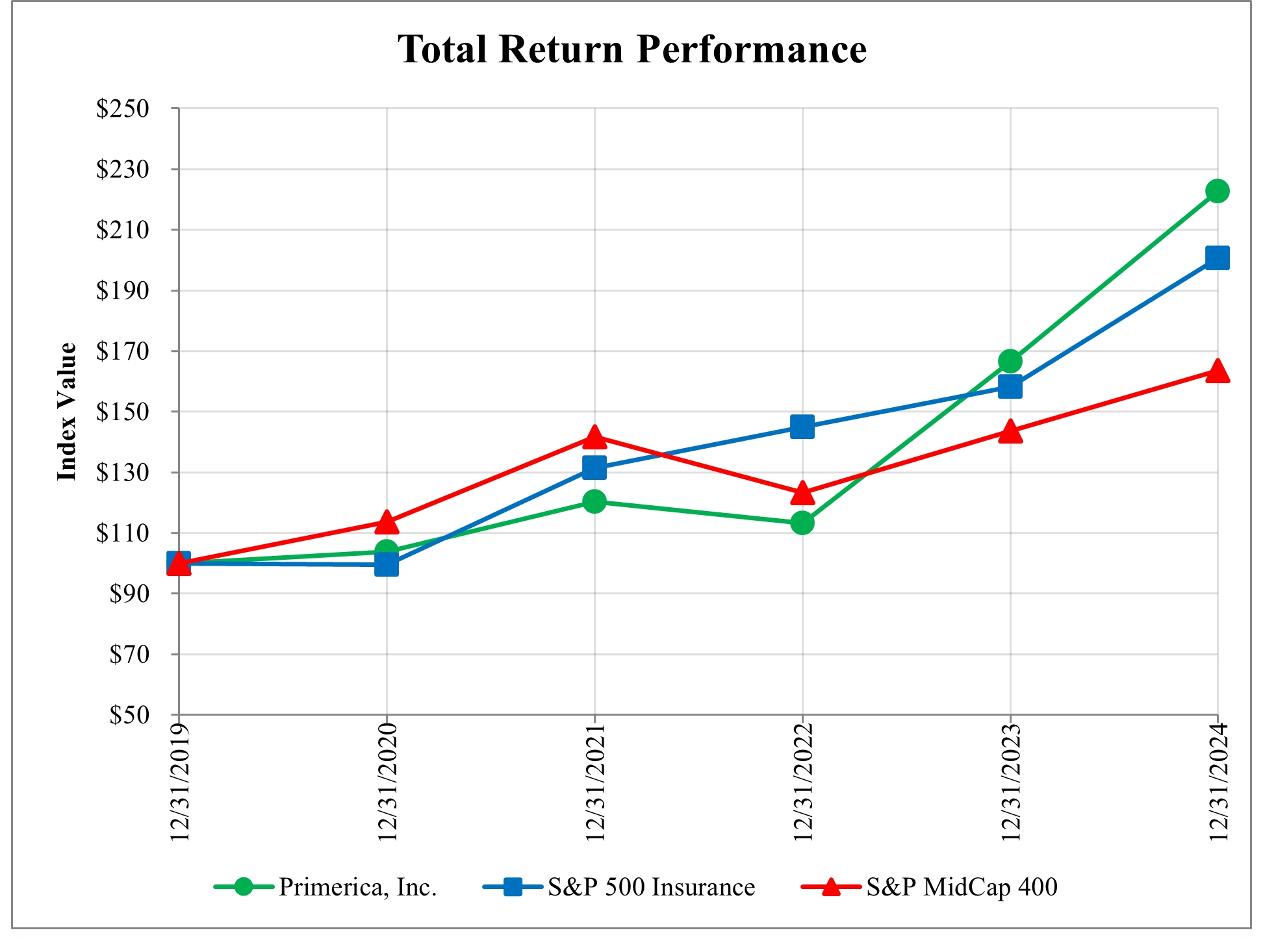

Despite a continued high cost of living that impacted our middle-income clients, the Company performed well in fiscal 2024. Further, our total stockholder return (which includes the payment and reinvestment of dividends) for fiscal 2024 and the five-year period from fiscal 2020 through fiscal 2024 was 33.6% and 122.6%, respectively. Please read a message from Glenn J. Williams, our Chief Executive Officer, in our 2024 Annual Report to Stockholders that accompanies the Proxy Statement.

Social Impact

For nearly 50 years, our core business has been enabling access to financial information, products and services for traditionally underserved markets throughout the United States and Canada. By leveraging the independent sales force and our employees, we help middle-income families make informed financial decisions and provide them with a

strategy and means to gain financial independence. The diversity of the independent sales force reflects the communities in which they live and work, and their recruitment of new sales representatives creates a cycle that enhances our impact on underrepresented markets. The products we provide – primarily term life insurance and a range of investment and savings products – help meet critical needs and put families on the path toward financial security. When families are empowered to make informed financial decisions, their households and the communities around them are positively impacted. For more information on the social impact of our business, see our 2024 Corporate Sustainability Report, which can be found in the Sustainability section of our investor relations website at https://investors.primerica.com.

Cultivating a Strong Corporate Culture

Integrity and accountability are at the foundation of our culture, which contributes to Primerica’s long-term success. Senior management defines and shapes Primerica’s corporate culture and sets the expectations and tone for a work environment founded on integrity and a commitment to doing the right thing. As such, the Company is dedicated to promoting a workplace that features open lines of communication and attracts and develops talented employees, with a focus on ensuring that our employee workforce reflects the diversity of the independent sales representatives and our clients. Our Board shares this commitment and provides valuable oversight for the Company’s overall culture. Further, our Board collaborates with management to establish and communicate an ethical tone at the top, which guides employee and sales force conduct and helps protect Primerica’s reputation.

Valuing Human Capital

Our people are essential to our ability to deliver value to our stockholders. Employees remain highly satisfied with Primerica. In 2025, we were again recognized by USA Today as a Top Workplaces USA and Forbes named us as one of America's Best Midsize Employers. In 2024, we were named a regional Top Workplaces by the Atlanta-Journal Constitution for the eleventh consecutive year and Newsweek named us, for the second time, as one of America's Greatest Workplaces.

The variety of experiences, backgrounds and ideas of our employees enables us to develop solutions that address the financial needs of our customers. We strive to build an inclusive culture where people feel accepted, their ideas are welcomed, and they can make a positive impact on our business and the communities we serve. In 2025, Newsweek named us for the second time as one of America's Greatest Workplaces for Diversity. You can learn more about the Company’s human capital management efforts beginning on page 17 of the accompanying Proxy Statement.

Leading Corporate Governance Practices

We are committed to strong governance practices, which we believe are important to our stockholders and protect the long-term vitality of Primerica. Our accountability to you is illustrated in many of the governance practices that are described in the accompanying Proxy Statement.

We strongly encourage all of our stockholders to vote promptly.

On behalf of our Board of Directors and management, we want to thank you for your continued support of, and confidence in, our Company.

Sincerely,

|

|

|

|

D. Richard Williams |

Gary L. Crittenden |

Non-Executive Chairman of the Board |

Lead Director |

Notice of 2025 Annual Meeting of Stockholders

|

|

Date and Time |

May 14, 2025, at 8:30 a.m., local time (the “Annual Meeting”) |

Place |

The Primerica Home Office located at 1 Primerica Parkway, Duluth, Georgia 30099 |

Items of Business |

•To elect the eleven directors nominated by our Board of Directors and named in the accompanying Proxy Statement (Proposal 1); •To consider an advisory vote on executive compensation (Say-on-Pay) (Proposal 2); •To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2025 (Proposal 3); and •To transact such other business as may properly come before the Annual Meeting and any adjournments thereof. |

Record Date |

March 17, 2025. Only stockholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting. |

Proxy Voting |

Please vote your shares at your earliest convenience. This will ensure the presence of a quorum at the Annual Meeting. Promptly voting your shares will save the expense and burden of additional solicitation. |

E-Proxy Process |

We are taking advantage of Securities and Exchange Commission rules allowing companies to furnish proxy materials to stockholders over the Internet. We believe that this “e-proxy” process expedites your receipt of proxy materials, while also lowering the costs and reducing the environmental impact of the Annual Meeting. On or about April 1, 2025, we will mail a Notice of Internet Availability of Proxy Materials to holders of our common stock as of March 17, 2025, other than those holders who previously requested electronic or paper delivery of communications from us. Please refer to the Notice of Internet Availability of Proxy Materials, proxy materials e-mail or proxy card you received for information on how to vote your shares and to ensure that your shares will be represented and voted at the Annual Meeting even if you cannot attend. |

Live Meeting Webcast |

We expect to make available a live webcast of the Annual Meeting at our investor relations website at https://investors.primerica.com. |

Possible Meeting by Remote Communication |

In the event it is not possible or advisable to hold our Annual Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. Please monitor our investor relations website at https://investors.primerica.com for updated information. |

|

Important Notice Regarding the Availability of Proxy Materials for the 2025 Annual Meeting of Stockholders to be Held on May 14, 2025. The Proxy Statement and the 2024 Annual Report to Stockholders are available free of charge at www.proxyvote.com. |

By Order of Our Board of Directors,

Stacey k. Geer

Executive Vice President, Chief Governance

and Risk Officer and Corporate Secretary

Duluth, Georgia

April 1, 2025

This summary highlights selected information about Primerica, Inc. (the “Company”, “Primerica” or “we”) but it does not contain all of the information you should consider. We urge you to read the entire Proxy Statement before you vote. You may also wish to review Primerica’s Annual Report on Form 10-K (the “2024 Annual Report”) for the fiscal year ended December 31, 2024 (“fiscal 2024”), which is available on our investor relations website at https://investors.primerica.com.

This Proxy Statement will be made available to stockholders on or about April 1, 2025.

Meeting Agenda and Voting Recommendations

See “Matters To Be Voted On” beginning on page 8 for more information.

|

|

Proposal |

Vote Recommendation |

|

“FOR” each director nominee |

2.Advisory vote on executive compensation (Say-on-Pay) |

“FOR” |

3.Ratification of the appointment of our independent registered public accounting firm |

“FOR” |

2025 Annual Meeting of Stockholders

You are entitled to vote at the Company’s Annual Meeting of Stockholders to be held on May 14, 2025 and any adjournment or postponement thereof (the “Annual Meeting”) if you were a holder of record of our common stock at the close of business on March 17, 2025. Please see page 99 for instructions on how to vote your shares and other important information.

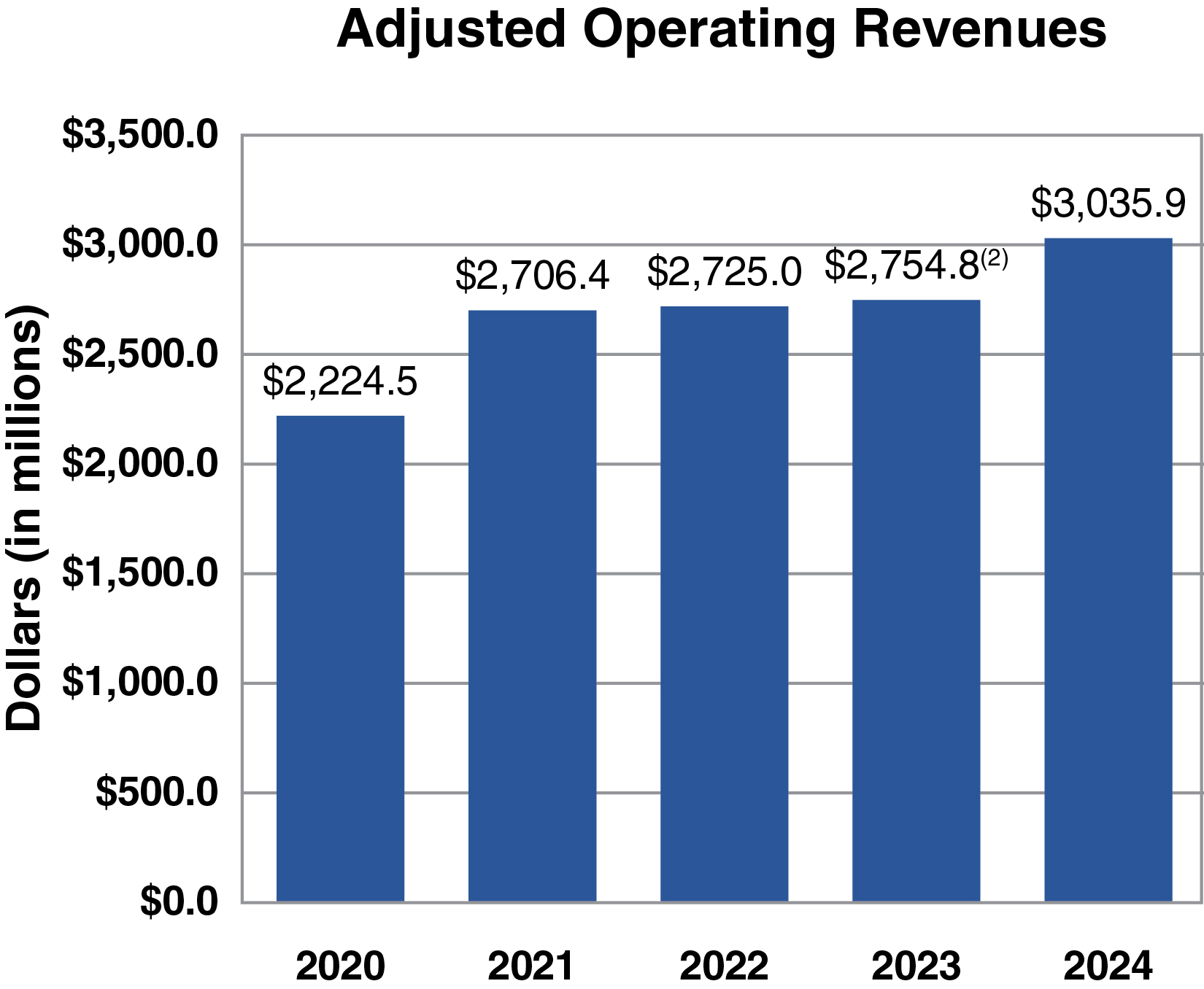

Financial Accomplishments

We were extremely pleased with the results we delivered in fiscal 2024. Highlights included:

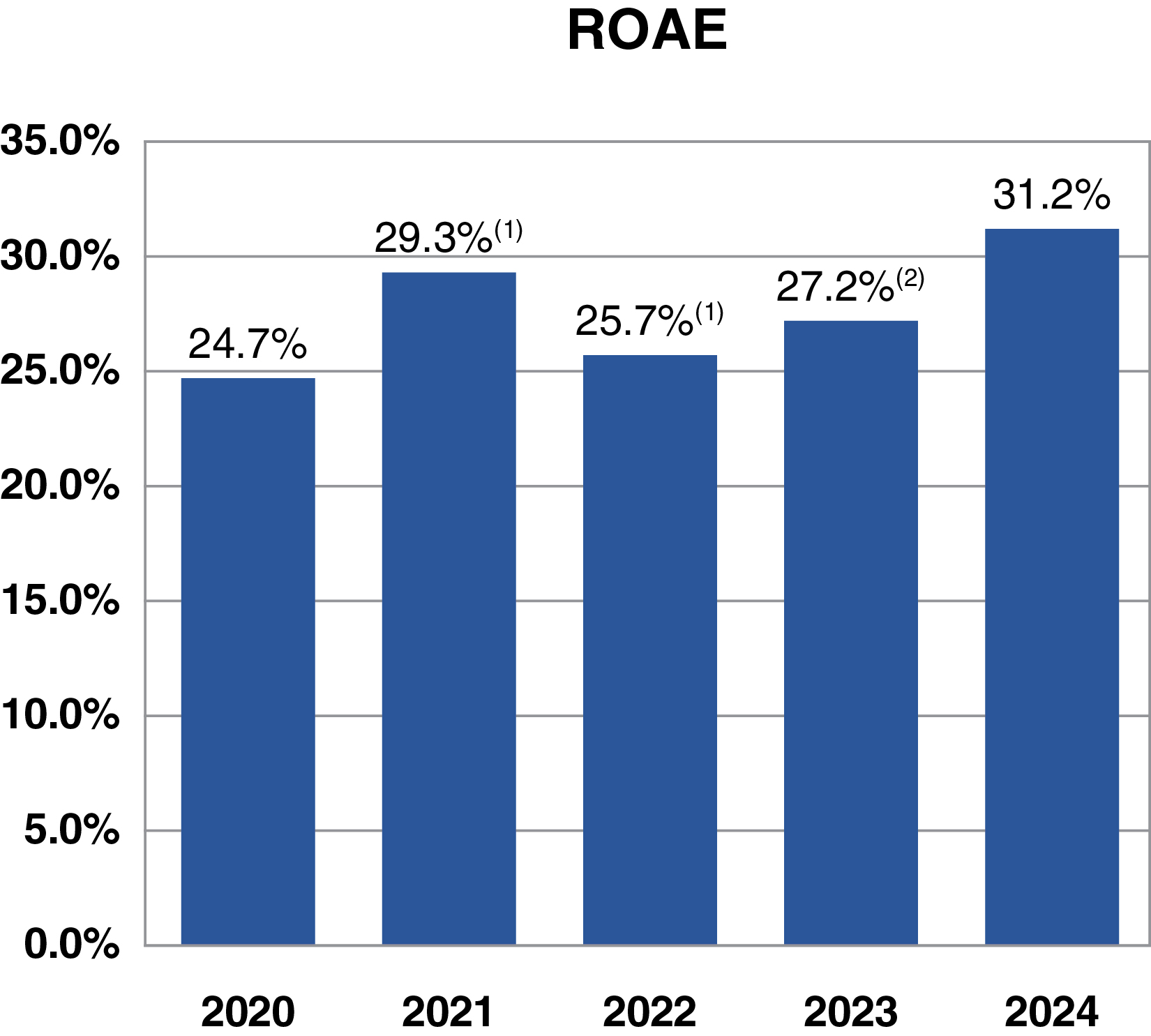

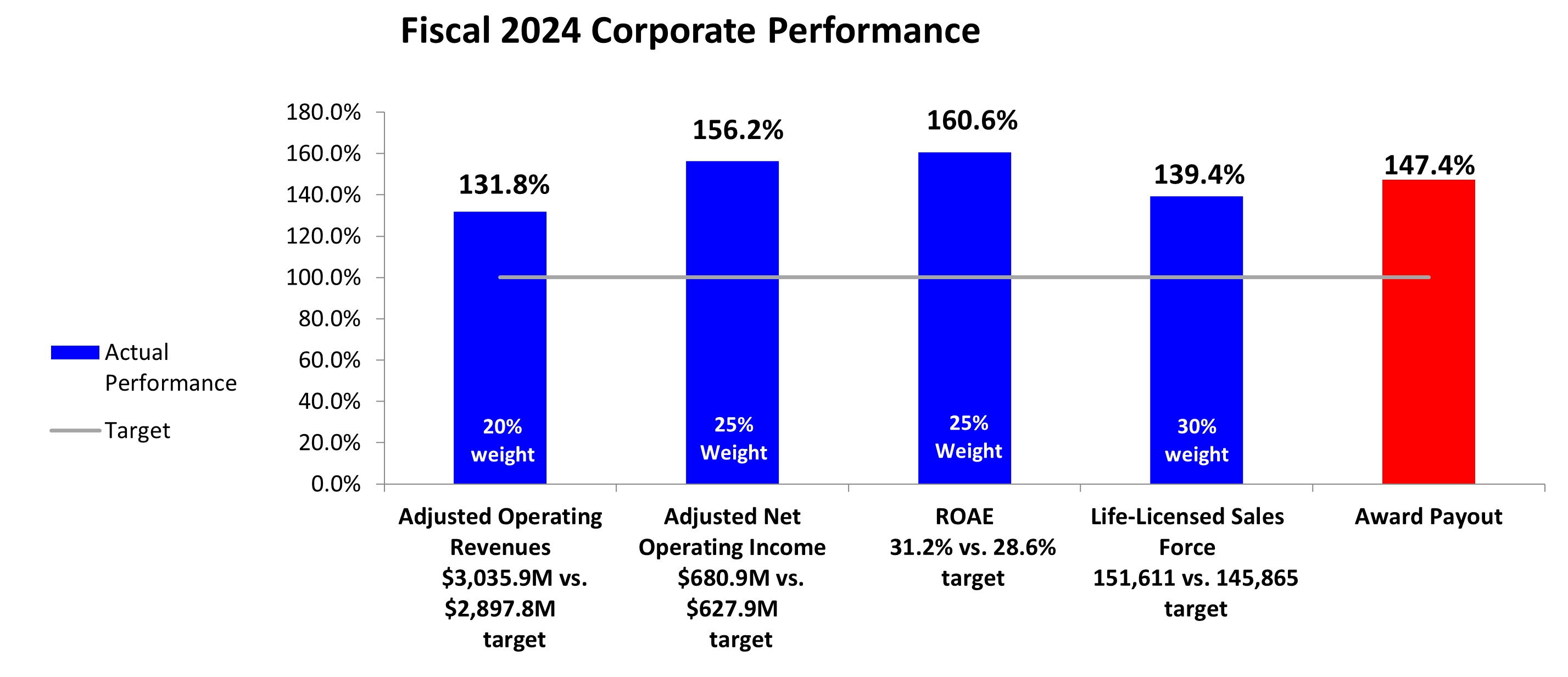

•Adjusted net operating income return on adjusted stockholders’ equity (“ROAE”) of 31.2% (see “Reconciliation of GAAP and Non-GAAP Financial Measures” in Exhibit A to this Proxy Statement);

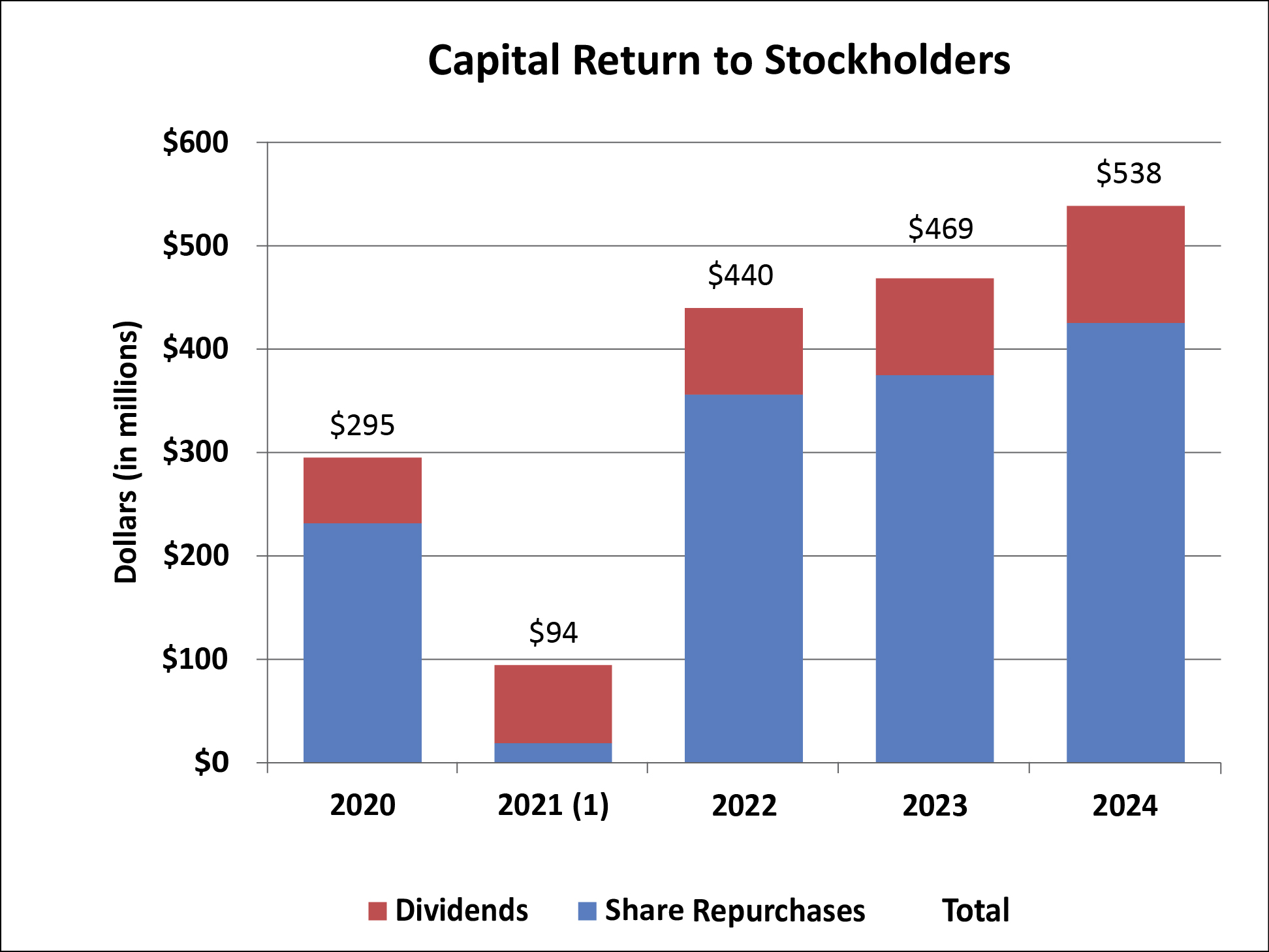

•Return to stockholders in the form of approximately $425.0 million in share repurchases; and

•Increase of 26.9% in annual stockholder dividends to $3.30 per share.

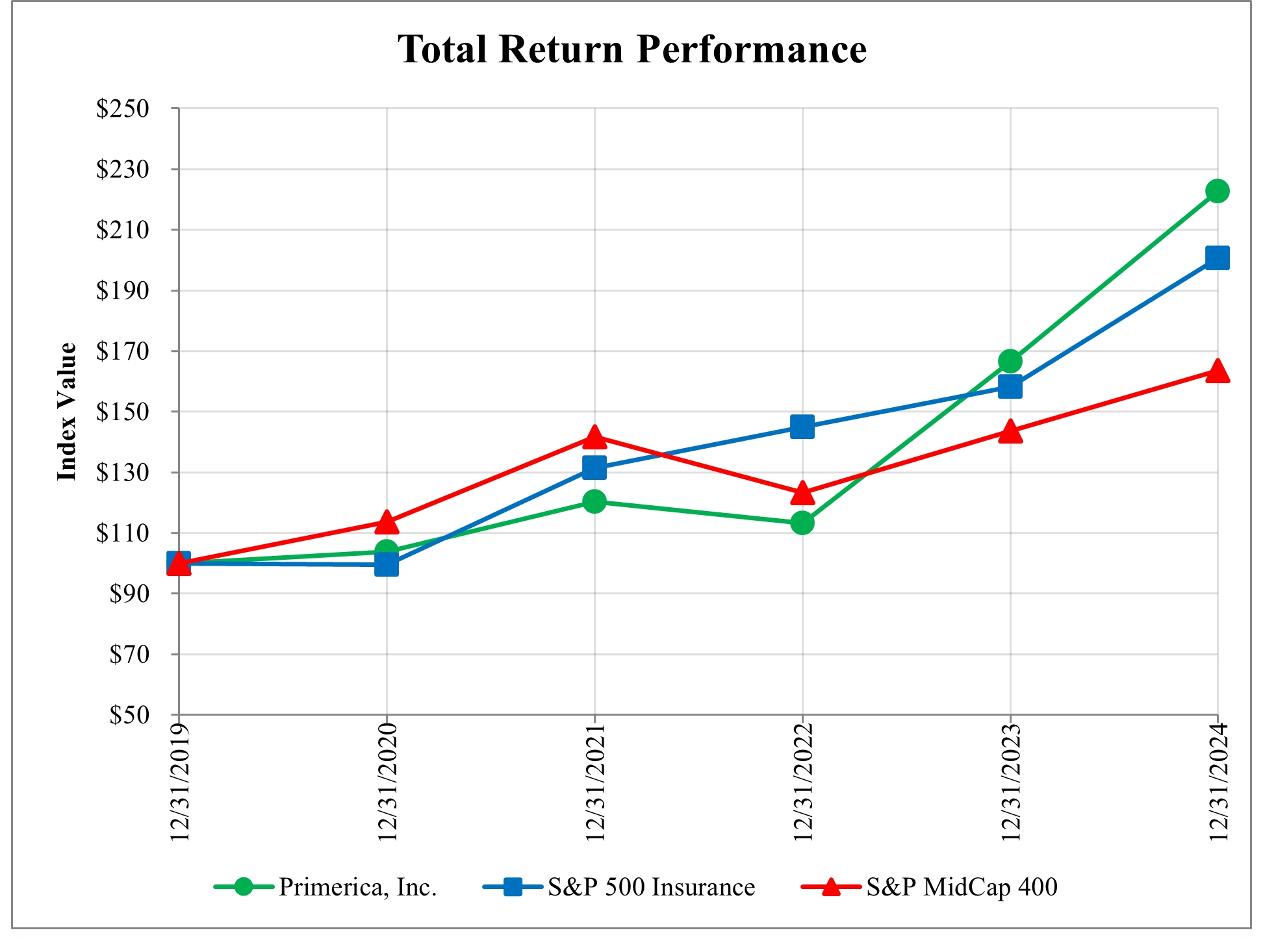

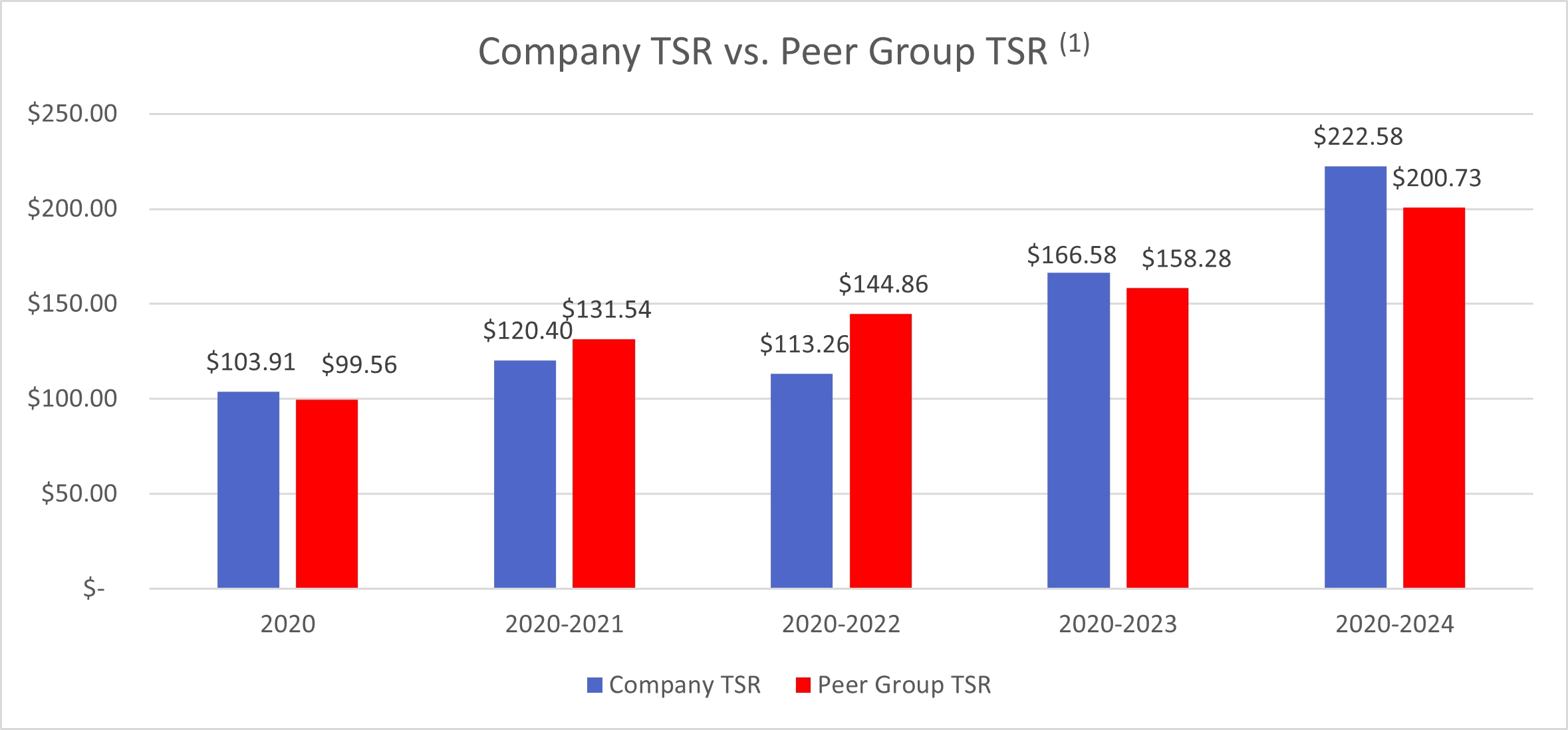

Our total stockholder return (“TSR”) (which includes the payment and reinvestment of dividends) for fiscal 2024 and the five-year period from January 1, 2020 through December 31, 2024 was 33.6% and 122.6%, respectively. TSR for fiscal 2024 was far higher than the S&P MidCap 400 Index return for 2024 of 13.9% and the S&P 500 Insurance Index return of 26.8%.

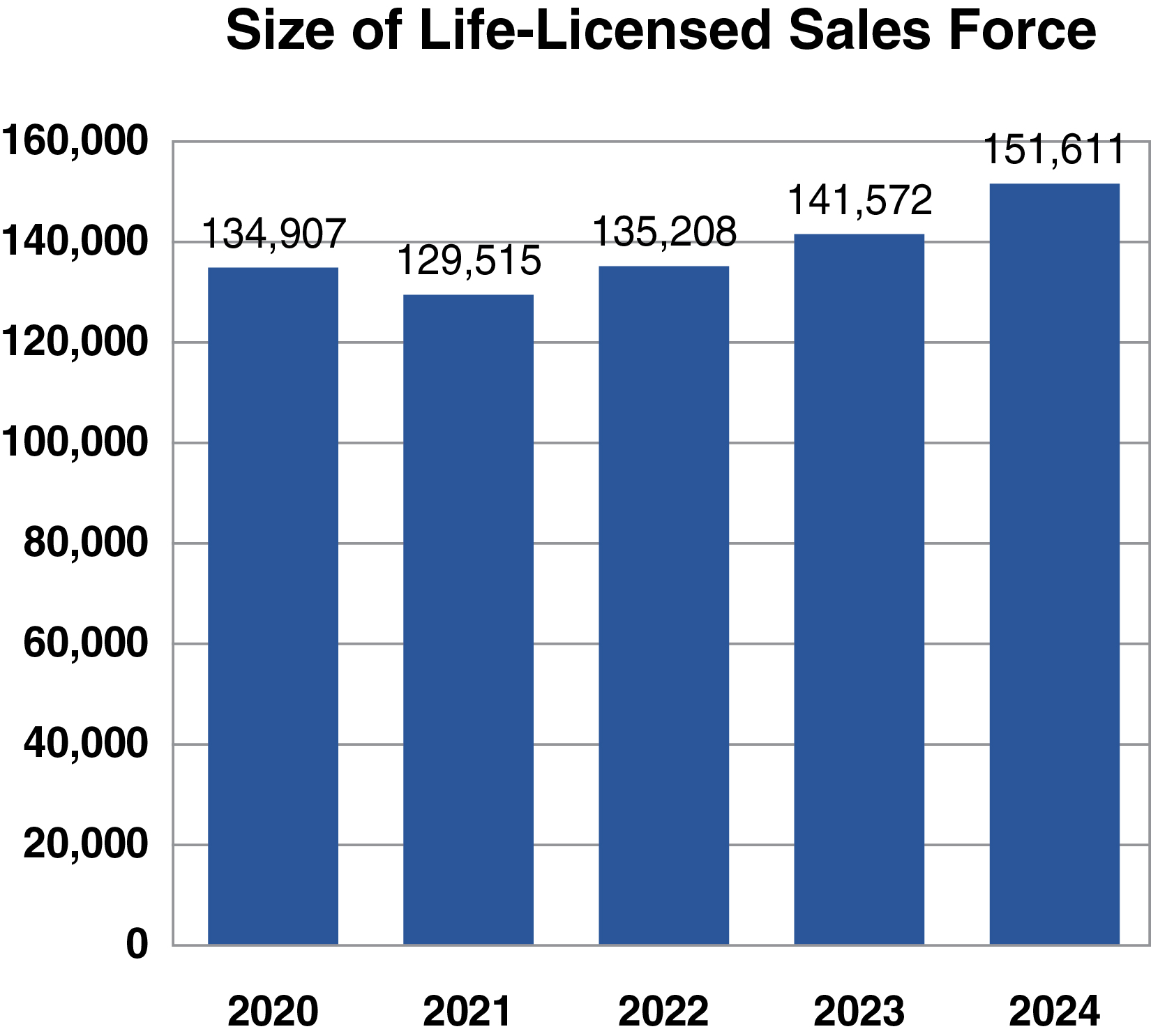

Distribution Results

Our business showed strong results in fiscal 2024. In particular:

•The number of life-licensed independent sales representatives was 151,611 at December 31, 2024 compared with 141,572 at December 31, 2023;

•New life insurance licenses increased 14.7% to 56,320 compared with 49,096 in the fiscal year ended December 31, 2023 (“fiscal 2023”);

•Recruiting of new independent representatives increased to 445,425 compared with 361,925 in fiscal 2023;

•Issued term life insurance policies increased 3.2% to 370,396 compared with 358,860 in fiscal 2023. Issued face amount was $122.2 billion in fiscal 2024 compared with $119.1 billion in fiscal 2023;

•Term life insurance claims paid to policy beneficiaries was $1.8 billion in both fiscal 2024 and fiscal 2023;

•Value of client assets at December 31, 2024 was $112.1 billion compared with $96.7 billion at December 31, 2023;

•Investment and Savings Products (“ISP”) sales increased 31.1% to $12.1 billion compared with $9.2 billion in fiscal 2023; and

•The number of mutual fund-licensed sales representatives increased slightly to approximately 25,500 at December 31, 2024 from 25,272 at December 31, 2023.

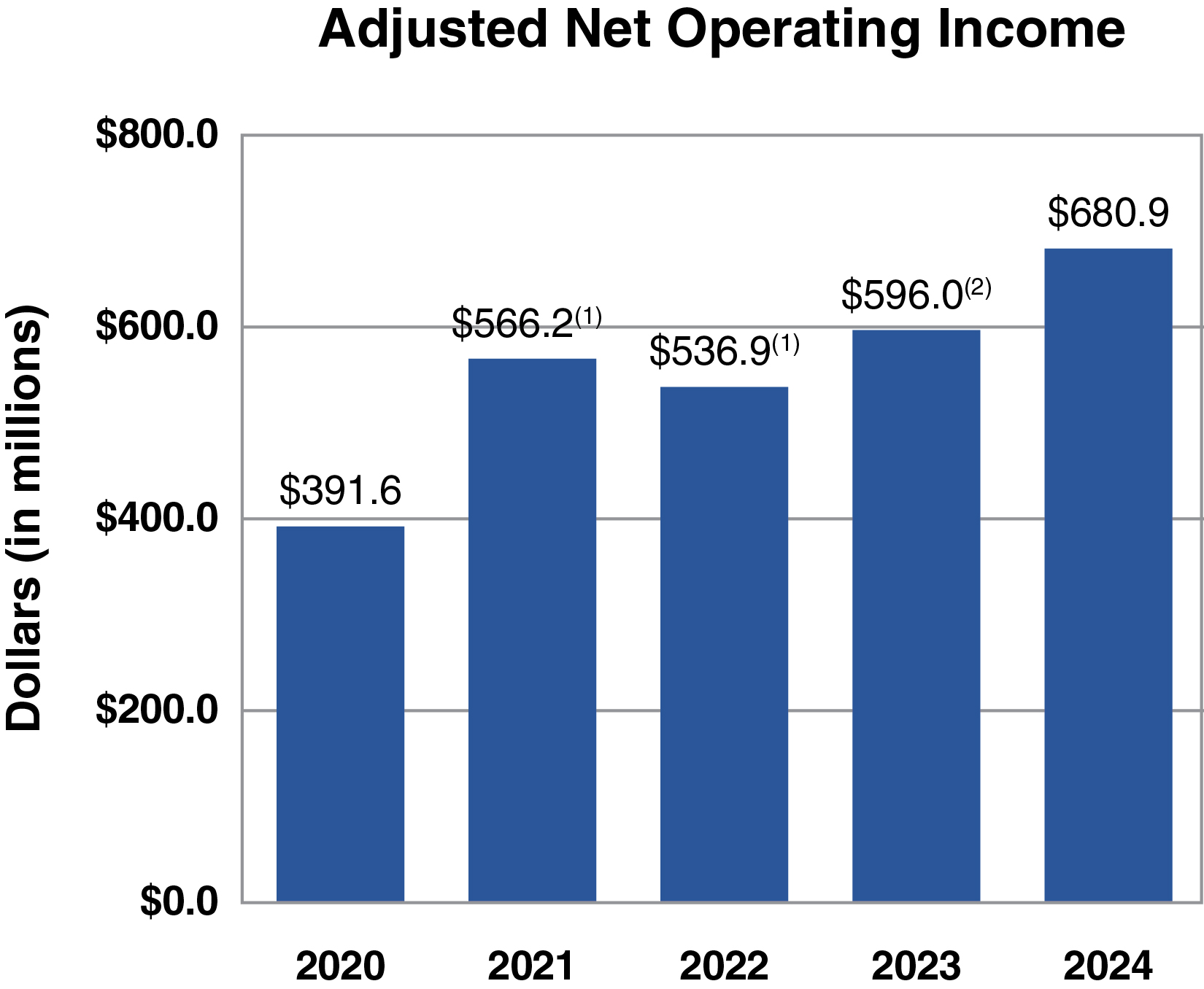

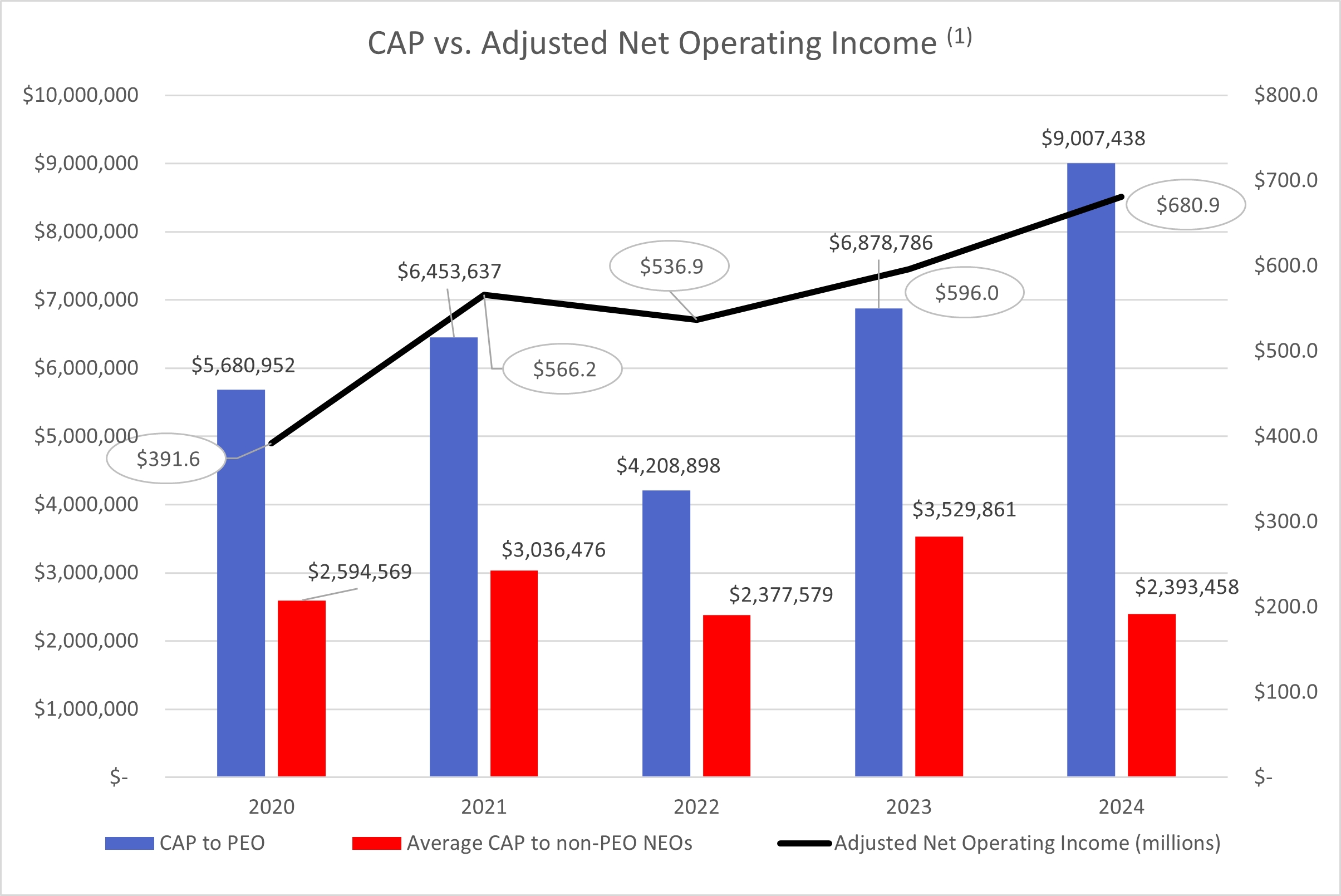

Corporate Performance

The bar graphs below depict our performance over the past five fiscal years for the four metrics that we use to measure annual corporate performance under our incentive compensation program. These metrics do not reflect financial results prepared in accordance with United States generally accepted accounting principles (“GAAP”). See “Reconciliation of GAAP and Non-GAAP Financial Measures” in Exhibit A to this Proxy Statement for a reconciliation to 2024 GAAP results. Reconciliations for earlier years are available through the Financial Info section of our investor relations website at https://investors.primerica.com.

|

|

Primerica 2025 Proxy Statement |

3 |

(1)Amounts for the fiscal year ended December 31, 2022 ("fiscal 2022") and the fiscal year ended December 31, 2021 ("fiscal 2021") reflect adjustments from originally published amounts due to the adoption of Accounting Standards Update No. 2018-12, Financial Services—Insurance (Topic 944) — Targeted Improvements to the Accounting for Long-Duration Contracts (“ASU 2018-12”) or (“LDTI”).

(2)Financial results for fiscal 2023 have been restated from the Proxy Statement for the Company's Annual Meeting of Stockholders held on May 8, 2024 (the "2024 Proxy Statement") to exclude the results of the Senior Health business, which has been reported as a discontinued operation. Refer to the 2024 Annual Report for a definition of the Senior Health business. Financial results for fiscal 2022 and fiscal 2021 have not been restated from the 2024 Proxy Statement so they still include the results of the Senior Health business, which was acquired on July 1, 2021 and disposed of on September 30, 2024.

Strategic Initiatives

Primerica is a leading provider of financial products to middle-income households in the United States and Canada with 151,611 licensed independent sales representatives as of December 31, 2024. These licensed independent sales representatives assist our clients in meeting their needs for term life insurance, which we underwrite, and mutual funds, annuities, managed investments and other financial products, which we distribute primarily on behalf of third parties. We insured over 5.5 million lives and had approximately 3.0 million client investment accounts as of December 31, 2024. Our business model uniquely positions us to reach underserved middle-income consumers in a cost-effective manner and has proven itself in both favorable and challenging economic environments.

Our purpose is to create financially independent families. Our strategic vision, in support of this purpose, is to build unparalleled financial services distribution capabilities that enable our clients, independent sales force, home office associates and stockholders to achieve their financial goals. We believe there is significant opportunity to meet the increasing array of financial services needs of our clients. We intend to leverage the independent sales force to meet these client needs, which will drive long-term value for all of our stakeholders. Our Board of Directors (our or the “Board” or “Board of Directors”) oversees strategy, which has been organized across the following four primary areas:

•Maximizing sales force growth, leadership and productivity;

•Broadening and strengthening our protection product portfolio;

•Becoming the middle-income market’s provider of choice for retirement and investment products; and

•Developing powerful digital capabilities that deepen our relationships with clients and extend our reach in the market.

Looking forward to 2025 and beyond, we updated our corporate strategic plan to include the following growth pillars:

•Understand and solve the financial challenges faced by current and prospective clients;

•Enable leaders in the independent sales force to grow their teams and build new leaders, expanding our distribution capabilities across business lines;

•Expand representative and client digital experiences to create connected conversations;

•Deepen our talent pool to ensure our success, now and in the future; and

•Proactively ensure the Company's image accurately reflects who we are.

Corporate Governance Highlights

See “Governance” beginning on page 12 for more information.

Our Board of Directors currently consists of eleven members. We are pleased that our Board reflects the diversity of the independent sales representatives and the communities that we serve. Our Board members bring an array of backgrounds and expertise that benefit the middle-income market.

The highlights of our corporate governance program are set forth below:

|

|

|

|

|

Board Structure •73% of the Board Members are Independent •Independent Lead Director of the Board •Separate Non-Executive Chairman of the Board and Chief Executive Officer Roles •Independent Audit, Compensation and Corporate Governance Committees of the Board •Regular Executive Sessions of Independent Directors •Annual Board and Committee Self-Assessments •Significant Number of Directors that Demonstrate Gender, Racial and Ethnic Diversity •Limit on the Number of Boards on Which our Directors are Allowed to Serve •Mandatory Retirement Age for Directors (unless waived by the Board) |

|

Stockholder Rights •Annual Election of Directors •Regular Director Refreshment •Majority Voting for Directors in Uncontested Elections •No Poison Pill in Effect •Annual Stockholder Engagement to Discuss Corporate Governance, Executive Compensation and Environmental, Social and Governance Matters •Multiple Avenues for Stockholders to Communicate with the Board |

|

Other Highlights •Stock Ownership Guidelines for Directors and Executive Officers •Pay-for-Performance Philosophy •Stand-alone Compensation Recovery Policy and Broad Clawback Provisions in the Company’s 2020 Omnibus Incentive Plan •Policies Prohibiting Hedging, Pledging and Short Sales by Employees, Officers and Directors •Publication of an Annual Corporate Sustainability Report •Board Oversight of the Enterprise Risk Management Process |

|

|

Primerica 2025 Proxy Statement |

5 |

Sustainability Highlights

See “Sustainability Matters” beginning on page 17 for more information.

The Corporate Governance Committee of our Board of Directors (the “Corporate Governance Committee”), to which the Board has delegated oversight responsibility for the Company’s social, environmental and sustainability initiatives, receives regular updates from members of management on sustainability-related topics, such as employee engagement and wellness, talent management, and climate. In addition, the Company publishes an annual Corporate Sustainability Report, which is available in the Sustainability section of our investor relations website at https://investors.primerica.com.

We are proud of our sustainability-related awards and recognition, which include:

▪Top Workplaces USA – 2021 - 2025

▪Newsweek America's Greatest Workplaces for Diversity – 2024 and 2025

▪The Canadian Foundation for Physically Disabled Persons Corporate Award to Primerica Life Insurance Company of Canada – 2025

▪Newsweek America's Greatest Workplaces – 2023 and 2024

▪Newsweek America's Greatest Workplaces for Women – 2024

▪Forbes America's Best Midsize Employers – 2024 and 2025

▪USA Today America's Climate Leaders – 2024

▪Forbes America’s Best Employers for Women – 2019 - 2024

▪Forbes America's Best Employer for Diversity – 2021 and 2022

▪Bloomberg Gender Equality Index – 2020 - 2023

Our Corporate Sustainability Report and the information available in the Sustainability section of our investor relations website are not deemed part of this Proxy Statement and are not incorporated herein by reference.

Executive Compensation Highlights

See “Executive Compensation” beginning on page 45 for more information.

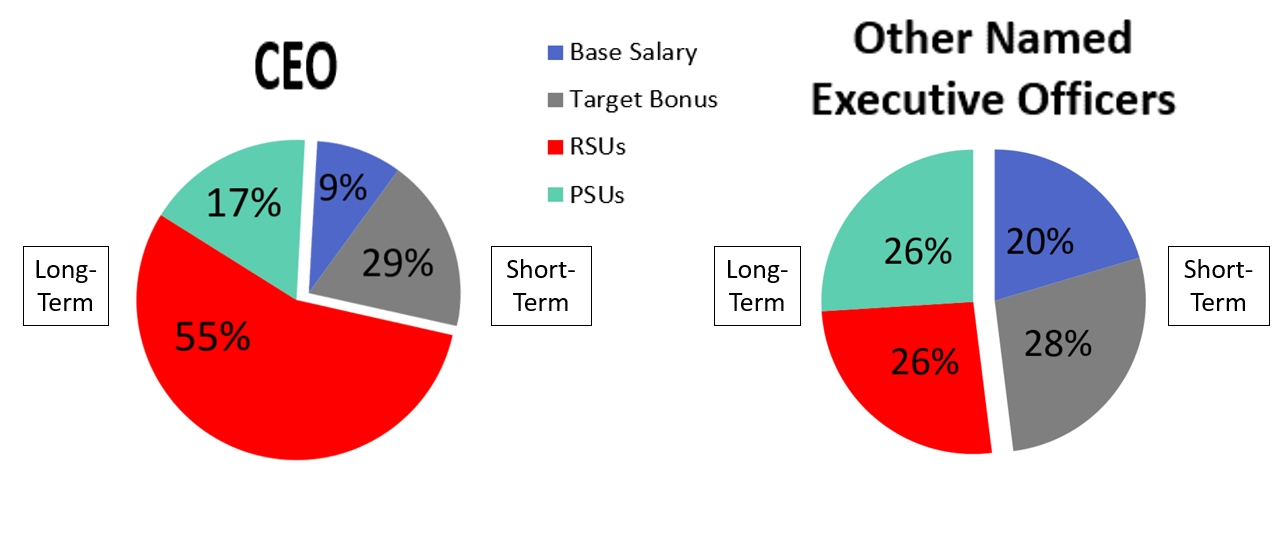

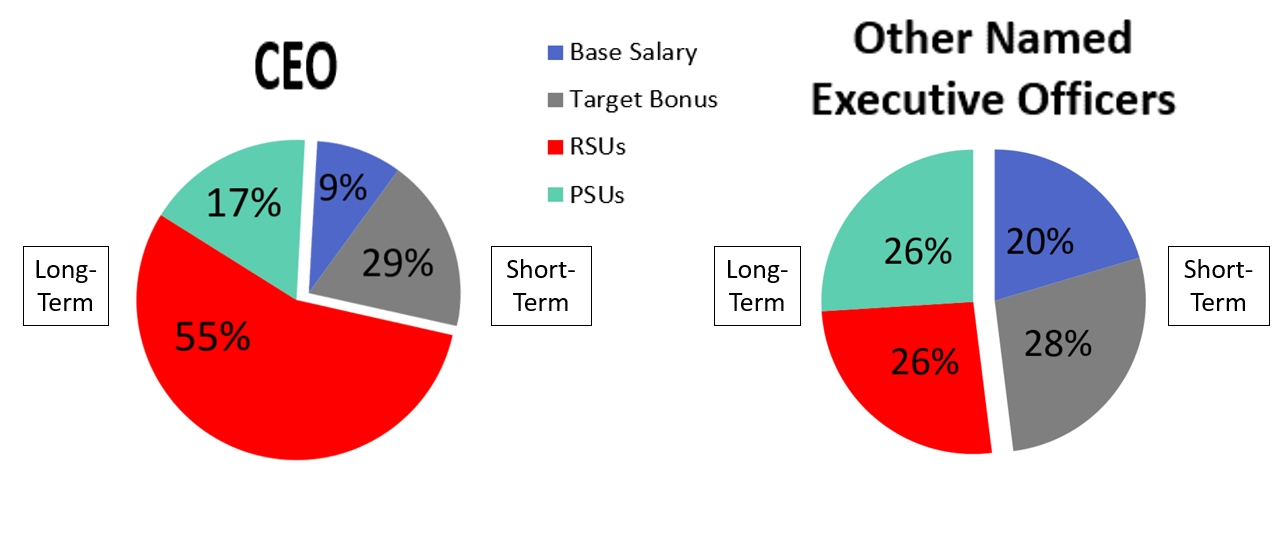

The Compensation Committee of our Board of Directors (the “Compensation Committee”) has structured our executive compensation program to pay for performance and, over the long term, to provide compensation to our executive officers that is market competitive. Further, a meaningful percentage of compensation is tied to the achievement of challenging corporate performance objectives. Set forth below is a brief description of our executive compensation program for fiscal 2024.

•Compensation components include base salary, long-term equity awards, annual cash incentive awards and other compensation.

•The Compensation Committee set cash incentive award targets for each of our executive officers at the beginning of fiscal 2024.

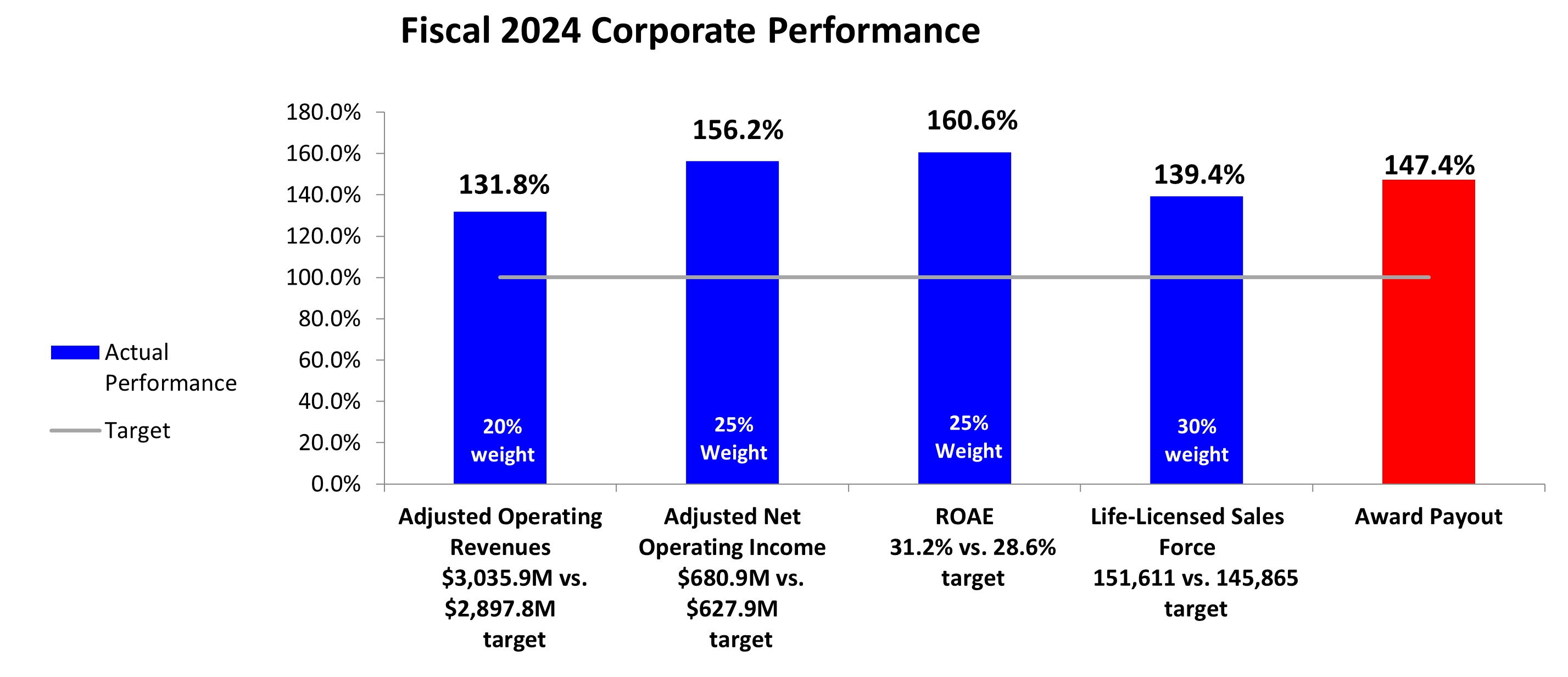

oCash incentive awards are based on the Company’s achievement of pre-determined performance goals related to adjusted operating revenues, adjusted net operating income, ROAE and size of life-licensed sales force at year end. Award amounts can be increased or decreased by the Compensation Committee by up to 20% for personal performance, including the impact of unanticipated events.

oThe 2024 corporate performance award was equal to 147.4% of the target.

oThe Compensation Committee made a personal performance adjustment for Mr. Pitts, as discussed in "Executive Compensation -- Compensation Committee Message."

•The Compensation Committee made an annual grant of long-term equity awards to each of our executive officers in February 2024 based on fixed values determined by the Compensation Committee.

oEquity award value is split equally between time-based restricted stock units (“RSUs”) and performance stock units (“PSUs”).

oThe RSUs vest in equal installments over three years.

oThe PSUs will be earned based equally on the Company’s average ROAE and average annual adjusted operating earnings per share (“EPS”) growth over a three-year performance period of 2024 through 2026, and our executive officers will receive between 0% and 150% of the awarded shares in March 2027.

•The Compensation Committee made a special equity grant valued at $2.5 million to our Chief Executive Officer in December 2024. The special equity grant is scheduled to cliff vest in December 2027.

•Each of our executive officers has an employment agreement that provides for severance payments upon a termination of employment without cause or a resignation for good reason.

The Company provides only limited perquisites, and the Compensation Committee has adopted an Executive and Director Perquisites Policy. This policy provides that all perquisites paid to directors and senior executives must be approved by the Compensation Committee and it lists certain categories of perquisites that have been pre-approved.

The table below highlights the fiscal 2024 compensation for our named executive officers as disclosed in the “Summary Compensation Table” on page 71.

|

|

|

|

|

|

|

|

|

|

Summary Compensation Table Elements* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salary |

|

Equity

Awards |

|

Short-Term

Cash Bonus |

|

Other

Compensation |

|

Total |

Chief Executive Officer |

|

|

|

|

|

|

|

|

|

Compensation |

$600,000 |

(1) |

$4,699,536 |

(1) |

$1,768,800 |

(1) |

$121,973 |

|

$7,190,309 |

% of Total |

8% |

|

65% |

|

25% |

|

3% |

|

100% |

|

|

|

|

|

|

|

|

|

|

President |

|

|

|

|

|

|

|

|

|

Compensation |

$550,000 |

|

$1,749,984 |

|

$1,474,000 |

|

$100,166 |

|

$3,874,150 |

% of Total |

14% |

|

45% |

|

38% |

|

3% |

|

100% |

|

|

|

|

|

|

|

|

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|

Compensation |

$500,000 |

|

$999,641 |

|

$737,000 |

|

$31,487 |

|

$2,268,128 |

% of Total |

22% |

|

44% |

|

32% |

|

1% |

|

100% |

|

|

|

|

|

|

|

|

|

|

Former Chief Operating Officer |

|

|

|

|

|

|

|

|

|

Compensation |

$500,000 |

|

$1,199,961 |

|

$1,061,280 |

|

$82,709 |

|

$2,843,950 |

% of Total |

18% |

|

42% |

|

37% |

|

3% |

|

100% |

*Percentages may not add to 100% due to rounding.

(1)At our Chief Executive Officer's request, the Compensation Committee reduced his compensation by 20% from September 1, 2022 through December 31, 2024. If not for this reduction, his base salary in 2024 would have been $750,000, his 2024 equity award value would have totaled $5,250,000, his short-term cash bonus for 2024 would have been $2,211,000 and his total compensation for 2024 would have been $7,632,509.

|

|

Primerica 2025 Proxy Statement |

7 |

Proposal 1:

Election of Directors

•What am I Voting on? The Board is asking our stockholders to elect each of the eleven director nominees named in this Proxy Statement to hold office until the Company’s Annual Meeting of Stockholders in 2026 (the “2026 Annual Meeting”) and until his or her successor is elected and qualified.

•Voting Recommendation: “FOR” the election of the eleven director nominees.

•Vote Required: A director will be elected if the number of shares voted “FOR” that director nominee exceeds the number of votes “AGAINST” that director nominee.

See “Board of Directors” beginning on page 27 for more information.

We ask that our stockholders elect the eleven director nominees named below to our Board of Directors to serve until the 2026 Annual Meeting. Stockholders have the option to vote “FOR”, vote “AGAINST” or “ABSTAIN” from voting with respect to each director nominee.

Our Third Amended and Restated By-Laws (“By-Laws”) provide for majority voting for directors in uncontested elections. As a result, each director will be elected by a majority of the votes cast, meaning that each director nominee must receive a greater number of shares voted “FOR” such director nominee than the shares voted “AGAINST” such director nominee.

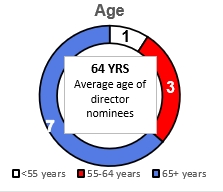

Primerica is a Delaware corporation and, under Delaware law, if an incumbent director is not elected, then that director remains in office until the director’s successor is duly elected and qualified or until the director’s earlier resignation or removal. To address this potential outcome, our By-Laws provide that, if an incumbent director does not receive a greater number of shares voted “FOR” such director than shares voted “AGAINST” such director, then such director must tender his or her resignation to the Board. In that situation, the Corporate Governance Committee would make a recommendation to the Board about whether to accept or reject the resignation or whether to take other action. Within 90 days from the date the election results are certified, the Board will act on the Corporate Governance Committee’s recommendation and will publicly disclose its decision and the rationale behind its decision. In a contested election – a circumstance we do not anticipate at the Annual Meeting – director nominees are elected by a plurality vote. Any shares that are not voted (whether by abstention or otherwise) will have no effect on the outcome of the vote. The following table provides summary information about each director nominee, each of whom currently serves on our Board.

|

|

|

|

|

|

|

|

|

Name |

|

Age |

|

Occupation |

|

Independent |

|

Month Joined Our Board |

John A. Addison, Jr. |

|

67 |

|

Chief Executive Officer, Addison Leadership Group and Former Co-Chief Executive Officer, Primerica |

|

No |

|

October 2009 |

Joel M. Babbit |

|

71 |

|

Co-Founder and Chief Executive Officer, Narrative Content Group, LLC |

|

Yes |

|

August 2011 |

Amber L. Cottle |

|

54 |

|

Vice President of Global Public Policy, Social Impact, Compliance and Safety, Dropbox |

|

Yes |

|

May 2022 |

Gary L. Crittenden |

|

71 |

|

Private Investor |

|

Yes |

|

July 2013 |

Cynthia N. Day |

|

59 |

|

President and Chief Executive Officer, Citizens Bancshares Corporation and Citizens Trust Bank |

|

Yes |

|

January 2014 |

Sanjeev Dheer |

|

65 |

|

Founder and Chief Executive Officer, CENTRL Inc. |

|

Yes |

|

October 2019 |

Beatriz R. Perez |

|

55 |

|

EVP and Chief Communications, Sustainability and Strategic Partnerships Officer, The Coca-Cola Company |

|

Yes |

|

May 2014 |

D. Richard Williams |

|

68 |

|

Non-Executive Chairman of the Board and Former Co-Chief Executive Officer, Primerica |

|

No |

|

October 2009 |

Glenn J. Williams |

|

65 |

|

Chief Executive Officer, Primerica |

|

No |

|

April 2015 |

Darryl L. Wilson |

|

61 |

|

Founder, Chairman and President, The Wilson Collective |

|

Yes |

|

February 2024 |

Barbara A. Yastine |

|

66 |

|

Former Chairman, President and Chief Executive Officer, Ally Bank |

|

Yes |

|

December 2010 |

Each director nominee attended 90% or more, collectively, of the aggregate of all meetings of our Board of Directors and its committees on which he or she served during fiscal 2024.

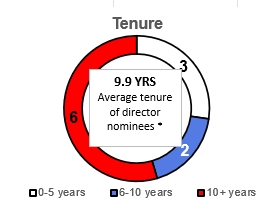

Mr. Wilson, Ms. Cottle and Mr. Dheer were elected to our Board of Directors effective February 2024, May 2022 and October 2019, respectively. The average tenure of all of our director nominees is 9.9 years. Unless otherwise instructed, the members of the Proxy Committee (as defined in “Information About Voting and the Annual Meeting”) will vote the proxies held by them “FOR” the election to our Board of Directors of the nominees named above.

|

|

Primerica 2025 Proxy Statement |

9 |

Proposal 2:

Advisory Vote on Executive Compensation (Say-on-Pay)

•What am I Voting on? The Board is asking our stockholders to approve, on an advisory basis, the compensation of the named executive officers as disclosed in this Proxy Statement.

•Voting Recommendation: “FOR” the proposal.

•Vote Required: Approval requires a “FOR” vote by at least a majority of the shares represented at the Annual Meeting, by valid proxy or otherwise, and entitled to vote.

See “Executive Compensation” beginning on page 45 for more information.

We most recently sought stockholder approval of the compensation of our named executive officers at the Company's Annual Meeting of Stockholders held on May 8, 2024 (the “2024 Annual Meeting”), at which time approximately 95.1% of votes cast were in favor thereof. At the Company's Annual Meeting of Stockholders held on May 17, 2023, our stockholders supported the Board’s recommendation to hold an annual Say-on-Pay vote. The Say-on-Pay vote is not binding on the Company, our Board of Directors or the Compensation Committee. Our Board and the Compensation Committee value the opinions of our stockholders and, to the extent there is any significant vote against the compensation of our named executive officers as disclosed in this Proxy Statement, we will consider our stockholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

As described in detail under “Executive Compensation — Compensation Discussion and Analysis (CD&A)”, our executive compensation program is designed to attract, motivate and retain our named executive officers, each of whom is critical to our success. Under this program, our named executive officers are rewarded for the achievement of specific annual, long-term, strategic and corporate goals as well as the realization of increased stockholder value. The Compensation Committee continually reviews and modifies our executive compensation program to ensure that it achieves the desired goals of aligning executive compensation with our stockholders’ interests and current market practices. Please read the Compensation Discussion and Analysis ("CD&A") section of this Proxy Statement for additional details about our executive compensation program, including information about the compensation of our named executive officers for fiscal 2024.

The advisory vote in this resolution is not intended to address any specific element of compensation; rather, it relates to the overall compensation of our named executive officers, as well as the philosophy, policies and practices described in this Proxy Statement. Stockholders have the option to vote “FOR”, vote “AGAINST” or “ABSTAIN” from voting on, the following resolution:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Company’s Proxy Statement for the 2025 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and any related material disclosed in such proxy statement.”

Proposal 3:

Ratification of the Appointment of KPMG LLP as Our Independent Registered Public Accounting Firm

•What am I Voting on? The Board is asking our stockholders to ratify the appointment by the Audit Committee of our Board (the “Audit Committee”) of KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2025 (“fiscal 2025”).

•Voting Recommendation: “FOR” the proposal.

•Vote Required: Approval requires a “FOR” vote by at least a majority of the shares represented at the Annual Meeting, by valid proxy or otherwise, and entitled to vote.

See “Audit Matters” beginning on page 90 for more information.

We ask that our stockholders ratify the appointment of KPMG as our independent registered public accounting firm for fiscal 2025.

The Audit Committee has authority to retain and terminate the Company’s independent registered public accounting firm. The Audit Committee has appointed KPMG as our independent registered public accounting firm to audit the consolidated financial statements of the Company and its subsidiaries for fiscal 2025, as well as the Company’s internal control over financial reporting. Although stockholder ratification of the appointment of KPMG is not required, our Board of Directors believes that submitting the appointment to our stockholders for ratification is a matter of good corporate governance. If our stockholders do not ratify the appointment of KPMG, then the Audit Committee will reconsider the appointment. Aggregate fees for professional services rendered by KPMG were $4.6 million and $5.4 million for fiscal 2024 and fiscal 2023, respectively. The decrease in fees for fiscal 2024 was largely due to higher audit fees in 2023 related to the new GAAP accounting standard for insurance contracts (referred to as LDTI) and the adoption of IFRS 17 (Insurance Contracts) statutory accounting standard in Canada.

Stockholders have the option to vote “FOR”, vote “AGAINST” or “ABSTAIN” from voting with respect to this proposal.

One or more representatives of KPMG are expected to be present at the Annual Meeting. The representatives will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate stockholder questions.

|

|

Primerica 2025 Proxy Statement |

11 |

em

Our Board oversees the business and affairs of the Company, aligns management and stockholder interests and is driven by the directors’ belief that good corporate governance is a critical factor in our continued success. Through the Governance section of our investor relations website at https://investors.primerica.com, our stockholders have access to key governing documents such as our Code of Conduct, Corporate Governance Guidelines and the charters of each committee of the Board.

Board Structure

Our Board currently consists of eleven directors. The Company’s governance documents provide our Board with flexibility to select the appropriate leadership structure for the Company. The Company has a non-executive Chairman of the Board and an independent Lead Director. Our Board believes that this structure is the most appropriate leadership structure for the Company at this time and is in the best interests of our stockholders because it provides decisive and effective leadership and, when combined with the Company’s other governance policies and procedures, provides appropriate opportunities for oversight, discussion and evaluation of decisions and direction by our Board. In the event of a potential change to the Board’s leadership structure, we expect to seek prior input from our largest stockholders.

Mr. R. Williams has served as non-executive Chairman of the Board since April 2015. He previously served as Chairman of the Board and Co-Chief Executive Officer. Mr. G. Williams has served as Chief Executive Officer since April 2015. He previously served as President from 2005 through March 2015. Mr. Crittenden, one of our independent directors and Chairman of the Audit Committee, has served as the Lead Director of our Board since May 2023, and he joined our Board in July 2013. As the primary interface between management and our independent directors, the Lead Director provides a valuable supplement to the non-executive Chairman and the Chief Executive Officer roles and serves as a key contact for the non-employee directors, thereby enhancing our Board’s independence from management. The duties and responsibilities of our Chairman of the Board and our Lead Director are set forth below.

|

|

|

Duties and Responsibilities of Chairman of the Board |

|

Duties and Responsibilities of Lead Director |

•Preside over Board meetings and meetings of non-employee directors •Call special meetings of our Board •Solicit feedback from the Lead Director and approve agendas for Board meetings •Review advance copies of Board meeting materials •Preside over stockholder meetings •Facilitate and participate in formal and informal communications with and among directors |

|

•Preside over all Board meetings at which the Chairman of the Board is not present •Call meetings of independent directors and set the agenda for such meetings •Preside over all meetings of independent directors and at all executive sessions of independent directors •Review Board meeting agendas and provide input to the Chairman of the Board |

|

|

|

Duties and Responsibilities of Chairman of the Board |

|

Duties and Responsibilities of Lead Director |

•Review interested party communications directed to our Board and take appropriate action •Represent the Board in communications with stockholders, as needed |

|

•Communicate with management on behalf of the independent directors when appropriate •Act as liaison among the Chairman of the Board, the Chief Executive Officer and the members of the Board •Work with the Chair of the Corporate Governance Committee to lead the annual Board self-assessment, including providing input on the structure of the Board •Lead the annual Chief Executive Officer evaluation •Lead the Chief Executive Officer succession process •Represent the Board in communications with stockholders, as needed |

All directors play an active role in overseeing the Company’s business and risk functions both at our Board and committee levels. See “— Board’s and Management’s Roles in Risk Oversight” for additional information on the Board’s and management’s respective roles in risk oversight. In addition, directors have full and free access to members of management, and our Board and each committee has authority to retain independent financial, legal or other advisors as they deem necessary without consulting, or obtaining the approval of, any member of management. Our Board holds separate executive sessions of its non-employee directors and of its independent directors at least annually.

Board Diversity

We strive to offer an inclusive business environment that benefits from diversity of thought, experience and people. This also holds true for our Board, which is comprised of individuals who bring an array of backgrounds and expertise that benefit our business and the middle-income market we serve. See “Board of Directors – Director Qualifications” for additional information on the skills, experience and background of our Board members.

Pursuant to our Corporate Governance Guidelines, our Board annually reviews the appropriate skills and characteristics of its members in light of the current composition of our Board, and diversity is one of the many factors used in this review. Our Board Diversity Policy requires the Board to consider Board candidates based on merit against objective criteria tied to the skills and/or expertise needed by the Board and the Company while giving due regard to all aspects of diversity. This is intended to create a Board that reflects the diversity of the independent sales force and the market we serve. The Corporate Governance Committee annually reviews our Board Diversity Policy and assesses its effectiveness and recommends any changes to the Board, if needed.

|

|

Primerica 2025 Proxy Statement |

13 |

Board Evaluation Process

Our Corporate Governance Guidelines require that the Corporate Governance Committee conduct an annual review of Board performance and further requires that each standing committee conduct an annual evaluation of its own performance. To facilitate those evaluations, each independent committee prepares a written self-assessment questionnaire that is completed by the members of the committee. In addition, the Corporate Governance Committee prepares a written Board assessment questionnaire that is completed by all members of the Board. The questions are designed to gather suggestions to improve Board and committee effectiveness and solicit additional feedback and include topics such as: (i) Board/committee skills and composition; (ii) Board/committee structure and responsibilities; and (iii) Board/committee culture, dynamics and operations. The Board self-assessment is conducted at a different time during the year than the committee self-assessments, so that the directors have adequate time to reflect on the functioning of the Board as a whole. The Company’s Corporate Secretary compiles the results of each self-assessment and shares those results with all directors. The committee chairs lead discussions during their committee meetings of the results of the self-assessments, highlighting areas that require additional attention. The Corporate Governance Committee discusses the Board self-assessment and the Lead Director leads a discussion of the self-assessment among the full Board. Management then discusses with the Lead Director any specific items that require additional attention and a plan is developed to address such action items.

In fiscal 2024, the Corporate Governance Committee led a Board self-assessment, compiled the results and led a discussion with the Board of Directors about potential changes to Board practices that could be made in response to the self-assessment. In fiscal 2023, the Corporate Governance Committee retained a third party to facilitate an in-depth Board self-assessment, consistent with the process it followed during fiscal 2021. The third party met with each director individually and solicited feedback on Board function and meetings, composition, leadership, as well as other matters. The third party then compiled the results from the interviews and provided an oral report to the Board of Directors with recommendations for improvements. The Corporate Governance Committee expects to continue to use a third-party facilitator to conduct the Board self-assessment on a bi-annual basis.

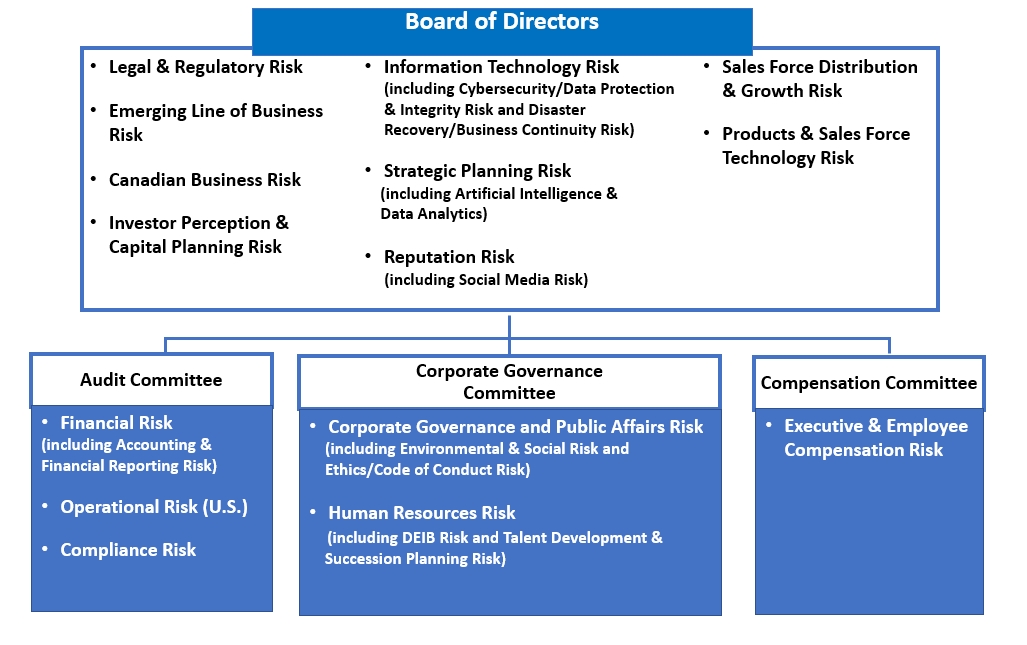

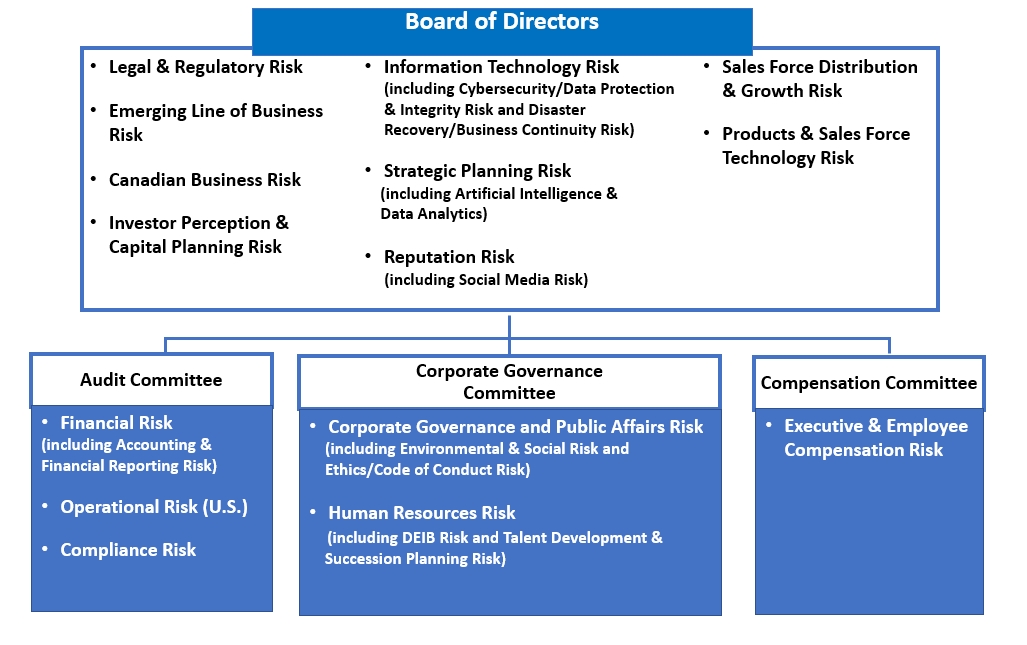

Board’s and Management’s Roles in Risk Oversight

Our Board is ultimately responsible for overseeing the Company’s management of the various risks facing the Company as well as the Company’s compliance culture and overall risk tolerance. The Board and management actively collaborate on the topic of risk management and work together to resolve any potential disagreements relating to risk management. The Board has delegated to the Audit Committee responsibility for regularly monitoring the oversight of our enterprise risk management (“ERM”) program, including: (i) ensuring that all risk areas are monitored by senior management; (ii) confirming that all risk management matters are reported to the Board or the appropriate Board committee and addressed as needed; and (iii) approving our Enterprise Risk Management Policy, which describes our ERM program and delineates the major functions and roles and responsibilities within the program, at least annually. The Audit Committee does a quarterly review of our ERM dashboard, which includes a current rating of the risk level of each enterprise and intermediate level risk. The Board and each Board committee actively

oversee and monitor the management of risks that could impact the Company’s operations in connection with their respective subject matter areas as illustrated in the following graphic.

Management is responsible for implementing the Board-approved risk management strategy and developing policies, controls, processes and procedures to identify and manage risk. Senior management is responsible for ensuring that appropriate risk management is carried out in the business lines, promoting a strong culture of risk management within each business unit or department, identifying all known and emerging risks, recommending appropriate risk limits for identified risk exposures, and developing programs that monitor, test, and report control deficiencies. Each quarter, senior management reviews the enterprise and intermediate risks for highlights, trends, and emerging issues. Matters requiring attention are added to a watch list or heat map for monitoring and reporting to the Board of Directors.

Annually, management identifies and evaluates the Company’s material risk areas, defines mitigating controls (which are documented by our Risk Management and Internal Controls Department), assigns each enterprise risk area to a member of senior management (with the underlying intermediate risks assigned to a senior business leader) and reviews the results of the foregoing with the Audit Committee and the Board of Directors. Management has developed and implemented a Governance, Risk and Compliance tool to monitor ongoing risk, record findings from our testing programs and track mitigating controls across all business areas.

We have established a Business Risk and Control Committee (the “BRCC”) led by our Chief Governance and Risk Officer. The BRCC is our governing body for enterprise risk management and testing programs and is comprised of senior management, including our Chief Executive Officer, and all enterprise and intermediate risk owners. The BRCC meets quarterly to monitor all ERM categories and assess the risk heatmap and watch list. Risk updates are provided by each enterprise risk owner. During BRCC meetings, emerging risks outside of the currently defined risk areas are monitored for additional exposure. Our Chief

|

|

Primerica 2025 Proxy Statement |

15 |

Internal Auditor monitors our ERM program by attending each BRCC meeting to observe and provide feedback and all quarterly meetings of the Audit Committee during which the ERM program and related developments are reviewed and discussed.

In fiscal 2024, our Chief Governance and Risk Officer presented a risk profile and provided quarterly status updates to the Board and each Board committee that has oversight responsibility for one or more key risks. She also provided the Board a quarterly heatmap that highlights the status of significant risks. Further, management provides a detailed quarterly update on significant risk areas, including cybersecurity and privacy risks presented by our Chief Information Officer and legal and regulatory matters presented by our General Counsel. At least annually, the cybersecurity presentation includes additional information on system readiness and protection, our incident response plan, internal training exercises and recovery plans.

Our Chief Internal Auditor reports directly to the Audit Committee. She presents quarterly to the Audit Committee with respect to internal audit findings and recommendations and meets in executive session with the Audit Committee at least quarterly. The Audit Committee uses the results of its discussions with our Chief Internal Auditor to monitor the Company’s internal audit plan.

Stockholder Engagement

In late fiscal 2024, we invited the Company’s largest stockholders, whose holdings together represented over 75% of our outstanding shares, to speak with management and, if requested, the Lead Director about topics important to them. Specific topics covered during these conversations included Board diversity, executive compensation, and sustainability-related matters (including human capital management; data privacy, and climate-related risks). We were pleased with the stockholder feedback, which indicated that our stockholders are generally satisfied with the Company’s corporate governance and executive compensation practices as well as the format and content of the Company’s proxy statement and Corporate Sustainability Report. To enable the Board and its committees to consider direct stockholder feedback, information about these investor conversations is shared with the Board and its committees. The table below describes requests received during these conversations and our responses to those requests.

|

|

|

What We Heard |

|

What We Are Doing |

Continue to expand the discussion of Social-related components of your Sustainability story (e.g., thought leadership, including: how you invest resources in order to understand how middle-income households are doing financially; responsible life insurance product offerings; responsible investment policies and practices; Diversity, Equality and Inclusion; attracting and cultivating talent; training and personal development), as these are the most meaningful sustainability components to Primerica. |

|

We intend to continue to expand disclosure of relevant Social-related areas in our 2025 Corporate Sustainability Report, which will be posted in the Sustainability section of our investor relations website in August 2025. |

Add a right for stockholders to call a special meeting. |

|

The Board will consider this provision in 2025 during its annual review of the Company's Charter and By-Laws. |

Reduce the supermajority thresholds currently required to amend the Company's Charter and/or By-Laws. |

|

The Board will consider this provision in 2025 during its annual review of the Company's Charter and By-Laws. |

Sustainability Matters

Oversight of Sustainability Matters

The Board of Directors has delegated to the Corporate Governance Committee responsibility for oversight of the Company’s corporate governance risk (including environmental and social risk), public affairs risk, and human capital management risk (including talent development, and succession planning). As a result, the Corporate Governance Committee meets regularly with those members of management who have responsibility for such initiatives.

In August 2024, we published our annual Corporate Sustainability Report, which has been posted in the Sustainability section of our investor relations website at https://investors.primerica.com. This report contains the Sustainability Accounting Standards Board (“SASB”) disclosure metrics that we believe are most relevant to our industry and business model. We elected to use the SASB metrics over other available frameworks because of its focus on certain areas that we believe are material to our business. Our Corporate Sustainability Report also contains information in line with the Task Force on Climate-related Financial Disclosures, including our Scope 1 and Scope 2 greenhouse gas emissions.

Human Capital Management

We are proud of our focus on middle-market households that are not adequately served by other financial services companies. The diversity of the independent sales force is a reflection of the middle-income communities in which the independent sales representatives live and work. As such, we believe it is fundamental to the success of our business to ensure that our employee workforce reflects the diversity of the independent sales force and our clients.

The independent sales force utilizes specialized groups, which we refer to as Strategic Markets, to encourage professional and personal growth and development, including Women in Primerica, the African American Leadership Council, the Hispanic American Leadership Council, and the Asian Pacific Islander Leadership Council. These groups provide opportunities for networking and mentorship, sales and business management training and deep learning opportunities. Additional information about the diversity of the independent sales force is available in our 2024 Corporate Sustainability Report in the Sustainability section of our investor relations website at https://investors.primerica.com.

We strive to create a workplace that offers a wide range of opportunities for employees and is open, collaborative and inclusive. In 2024 and 2025, we were recognized by Newsweek as one of America's Greatest Workplaces for Diversity and in 2024, as one of America's Greatest Workplaces for Women. Primerica Life Insurance Company of Canada (PLICC), our Canadian insurance subsidiary, received the 2025 Corporate Award by The Canadian Foundation for Physically Disabled Persons. We were recognized by Forbes as a Best Employer for Women each year from 2019 to 2024, and in 2021 and 2022, Forbes recognized us as a Best Employer for Diversity. Additionally, we were named to the Bloomberg Gender Equality Index each year from 2020 to 2023.

The Corporate Governance Committee has responsibility for oversight of our human capital management commitments and initiatives. Our Chief People Officer serves in the role of chief diversity officer, is responsible for the development and implementation of our human capital management strategy and provides regular updates to the Corporate Governance Committee. At the center of these efforts is ensuring that all employees have access to learning and developmental opportunities that allow them to

|

|

Primerica 2025 Proxy Statement |

17 |

learn, grow and thrive at Primerica. We work to empower and incentivize our senior leaders to embrace this strategy. Our human capital strategy has netted positive results since its adoption.

•To drive accountability at key senior management levels, we implemented an annual performance goal, beginning in 2023, for senior professionals and above that evolves each year based on the Company human capital management priorities. For 2025, the performance goal will focus on leaders developing leaders as the Company prepares to build a deeper pipeline of talent while we plan for continued Company growth and future leadership.

•Leadership development and succession planning that identifies, develops, and mentors all talent as we build our talent pipelines and leadership of the future is critical for the sustainability of our Company. We enhanced the curriculum of our two employee leadership cohorts for emerging talent with a heightened focus on investing in their personal growth, leadership skills refinement and business acumen strength. As the Company manages through retirement transitions, additional investments will be made in 2025 with recently promoted leaders that joined the Chief Executive Office’s Leadership Team. Our goal is to ensure that they too are demonstrating the strong leadership competencies required to successfully lead the organization into the future.

•Employee Resource Groups (ERGs) are open to everyone and are supported by executive leaders who serve as sponsors. They are also supported by employee volunteers who work with the executive sponsors to plan and participate in ERG programs and events. ERG leaders and sponsors meet regularly to collaborate on the various events and programs of each ERG, coordinate combined events with one or more other ERGs and ensure consistent communications among the various ERGs. The initial cohorts are thriving and building interest across our organization: Primerica Black Professional Network (PBPN); Primerica Uniting Latinos and Serving Others (PULSO); Asian Pacific Islander (API); and PRI–Bold (Balancing Our Lives Daily). ERGs promote engagement among employees and allow them to remain connected in our hybrid work environment. As of December 31, 2024, over 300 employees were members of at least one ERG. We are evaluating the interest in additional ERGs.

•Our Human Resources Learning Team introduced a Management Fundamentals curriculum aimed at equipping new and seasoned leaders with leadership development opportunities for personal growth and enhancing overall communication and leadership effectiveness with their teammates.

•In response to employee feedback, we added a floating holiday in 2021 for employees to observe any personal milestone/celebration of significance to them. In addition, we increased our focus on cultural education by highlighting numerous culturally focused holidays throughout the year with educational videos and communications as well as on-site and virtual engagement activities.

For information about our U.S. employees, see “Item 1. Business — Human Capital Management — Employees” in the 2024 Annual Report. Additionally, employees are trained at least annually on our Equal Employment Opportunity and Anti-Harassment Policy. The Corporate Governance Committee is responsible for overseeing management’s implementation and monitoring of the policy and reviews and approves this policy at least annually.

Supporting Employee Engagement

In 2025, we were again recognized by USA Today as a Top Workplaces USA and by Forbes as one of America's Best Midsize Employers. In 2024, we were named a regional Top Workplaces by the Atlanta-Journal Constitution for the eleventh consecutive year and Newsweek named us, for the second time, as one of America's Greatest Workplaces.

In order to monitor employee satisfaction, we conduct annual employee engagement surveys and provide detailed results to management and our Board. In 2024, the Company realized the highest participation in twelve years with a 75% participation rate and a strong employee satisfaction score. Changes to policies, programs, compensation and benefits packages are made based on this feedback. Annually, the Company holds a town hall meeting that is also broadcast virtually to all of our workplace locations. Our Chief Executive Officer, President and Chief People Officer jointly lead this meeting and provide updates on the Company's performance and strategic direction, as well as information on benefits enhancements, policy changes, and other workplace topics. The meeting always ends with a question and answer segment, and employees are encouraged to raise issues of concern and offer suggestions for improvement. Employees are also provided the opportunity to submit questions and suggestions in advance.

Work-Life Balance

We understand and value the importance of an effective work-life balance for employees. We offer many flexible work options and schedules to meet the needs of our employees. The vast majority of our employees work on either a hybrid schedule where they are able to work both at home and in the office or are fully remote. Offering flexible workplace options has become an expectation of employees across many industries and may be necessary to remain competitive and attract top talent.

In addition to flexible workplace options, our full-time and part-time employees receive several benefits that are aligned with achieving a better work-life balance such as paid planned and unplanned time off, 11 paid holidays, and paid time off for volunteering. We also have a dedicated work-life balance employee resource group called PRI-Bold that offers employees an opportunity to share ways to maintain an active and healthy work-life balance, hear from speakers, and gather to share information and participate in outdoor social activities.

Talent Development and Succession Planning

Employees are highly satisfied at Primerica, as evidenced by our employee retention rate in 2024 of 91%. Many employees have been with Primerica for over 20 years, a result of a continued high employee retention rate. The tenure of our named executive officers ranges from 1.5 years to 44 years, with an average tenure of 27 years.

The result of this longevity and loyalty is that many employees will reach retirement age over the coming years. Management is committed to a strong culture that reflects the diversity of the independent sales representatives and our clients while ensuring that our succession planning and internal and external talent pipeline identification processes incorporate these values. Among the many benefits of our planning and talent identification process is increased diversity at the management level. Additional information about our talent development initiatives can be found in our 2024 Corporate Sustainability Report in the Sustainability section of our investor relations website at https://investors.primerica.com.

Our Board of Directors maintains a succession plan for the Chief Executive Officer and other key members of management, which includes a contingency plan if the Chief Executive Officer were to depart

|

|

Primerica 2025 Proxy Statement |

19 |

unexpectedly. At least annually, the Corporate Governance Committee reviews the succession plan and leadership pipeline for these key roles, taking into account the Company’s long-term corporate strategy. In addition, the Corporate Governance Committee oversees the Company’s talent development initiatives. Board members also engage and spend time with our high potential leaders at Board meetings and other events.

Our Corporate Culture

We recognize the importance of doing business the right way. Further, we believe corporate culture influences employee actions and decision-making. This is why we dedicate resources to:

•Promote a vibrant, inclusive workforce;

•Attract, develop and retain talented, employees from an array of backgrounds who bring a mix of relevant experiences;

•Promote a culture of compliance and integrity; and

•Reward and recognize employees for growing people and teams and delivering winning results.

The Company has a Code of Conduct that applies to all employees, directors, and officers of the Company and its subsidiaries. Employees receive required annual training on our Code of Conduct, which is posted on the Governance section of our investor relations website at https://investors.primerica.com and is available in print, free of charge, to our stockholders who request a copy. Employees are required to acknowledge compliance with our Code of Conduct on an annual basis. As independent contractors, members of the independent sales force are not subject to our Code of Conduct but they must comply with a number of policies and procedures that are similar to principles and standards, including those related to anti-corruption and business ethics, set forth in our Code of Conduct. The Company also has made available to all of our employees and the independent sales force an Ethics Hotline, which can be accessed by phone or email and permits employees to anonymously report a violation of our Code of Conduct. Any changes to our Code of Conduct will be posted in our investor relations website at https://investors.primerica.com.

Documenting and bolstering certain aspects of our Code of Conduct is our Equal Employment Opportunity and Anti-Harassment Policy, which includes information about complaint and investigation procedures relating to alleged discrimination incidents. The policy also defines the role of the Board of Directors with respect to alleged violations of such policy.

Our employees consistently give the Company high scores in our annual employee survey for “operating by strong values.” We are proud of our corporate culture and we work hard to instill in our employees and the independent sales representatives the importance of doing the right thing – for our clients as well as our other stakeholders.

In early 2025, we launched a comprehensive company-wide project to develop a corporate values statement that reflects both who we are now and who we want to be in the future. The values statement will be a benchmark for preserving and strengthening Primerica’s culture.

Environmental Responsibility and Impact on Our Business

Our business as a term life insurance and financial services company, by its nature, does not have a significant impact on the environment. Nevertheless, we recognize the significant challenges presented by climate change and the growing importance of this issue to investors and the communities we serve. We

continue our efforts, such as electronic document delivery to our clients, energy efficiency at our corporate headquarters, robust recycling initiatives and promotion of transportation alternatives and flexible working options, to reduce our impact on the Earth’s resources.

Environmental issues, particularly those related to climate change, have the potential to present risks and opportunities to our business. We address those risks and opportunities in the following ways:

•Analyzing the potential impact of climate change on the products we sell, including consideration of environmental factors that might impact health and therefore our pricing assumptions and underwriting practices;

•Ensuring that our product mix offers clients the opportunity to invest in products and services that specifically address environmental risk and responsibility; and

•Incorporating relevant environmental information and analysis into our governance and risk management practices. In early 2022, we completed a climate risk materiality assessment facilitated by a third-party consultant. The assessment found that Primerica’s unique business model is largely resilient to significant climate risk impacts and, therefore, that climate issues do not currently present material risks to the Company. Further, the assessment identified climate areas that could create opportunities for Primerica, which we monitor as part of our overall ERM program. We expect to conduct another third-party climate risk materiality assessment in 2025. See “— Board's and Management’s Roles in Risk Oversight” for additional information on the Board's and management’s respective roles in risk oversight.

In 2024, we were named by USA Today for the first time as one of America's Climate Leaders for our low emission intensity (the amount of greenhouse gas a company produces relative to its revenues).

Upholding Strong Governance

The Company complies with the Corporate Governance Principles published by the Investor Stewardship Group (“ISG”), as described below. ISG is an investor-led effort of more than 70 organizations that includes some of the largest U.S.-based institutional investors and global asset managers, along with several of their international counterparts.

|

|

|

ISG Principle |

|

Primerica Practice |

Principle 1:

Boards are accountable to shareholders |

|

- All directors stand for election annually

- Mandatory retirement age for directors (unless waived by the Board)

- Proxy access with market terms

- Independent Lead Director available to speak with investors if

requested |

Principle 2:

Shareholders should be entitled to

voting rights in proportion to their

economic interest |

|

- Majority voting (with each share of common stock receiving one vote)

in uncontested director elections, and directors not receiving majority

support must tender their resignation for consideration by the Board |

Principle 3:

Boards should be responsive to

shareholders and be proactive in order

to understand their perspectives |

|

- Management offered to meet with investors whose holdings together

represented in excess of 75% shares outstanding

- Engagement topics included Board composition, executive

compensation program, strategy, human capital management and other

sustainability-related matters |

Principle 4:

Boards should have a strong,

independent leadership structure |

|

- Strong independent Lead Director with clearly defined duties that are

disclosed to stockholders

- Strong independent committee chairs

- Proxy Statement discloses why Board believes current leadership

structure is appropriate |

|

|

Primerica 2025 Proxy Statement |

21 |

|

|

|

Principle 5:

Boards should adopt structures and

practices that enhance their effectiveness |

|

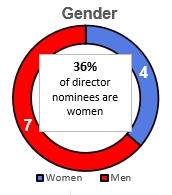

- 73% of Board nominees are independent

- 36% of Board nominees are racially or ethnically diverse; 36% of Board

nominees are women

- Annual Board evaluation, facilitated bi-annually by a third party, and

annual committee evaluations

- Active Board refreshment with 27% refreshment in last five years

- Each director attended more than 90% of the Board and applicable

committee meetings in fiscal 2024, and all directors attended the 2024

Annual Meeting |

Principle 6:

Boards should develop management

incentive structures that are aligned

with the long-term strategy of the

company |

|

- Executive compensation program received over 95% support at the

2024 Annual Meeting

- Compensation Committee annually reviews and approves incentive

program design, goals and objectives for alignment with compensation

and business strategies

- Annual and long-term incentive programs are designed to reward

financial and operational performance that furthers short- and long-

term strategic objectives |

Director Independence

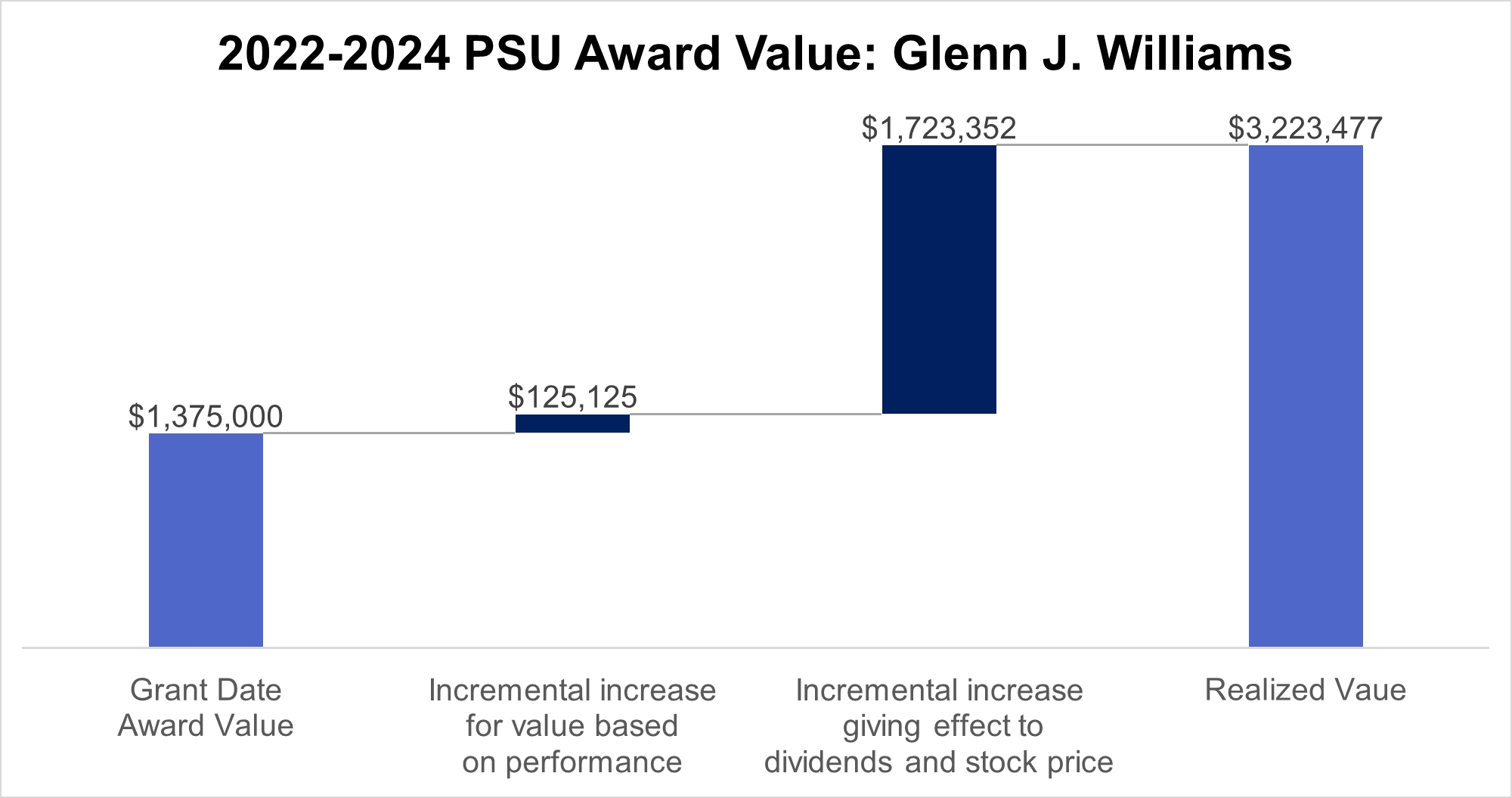

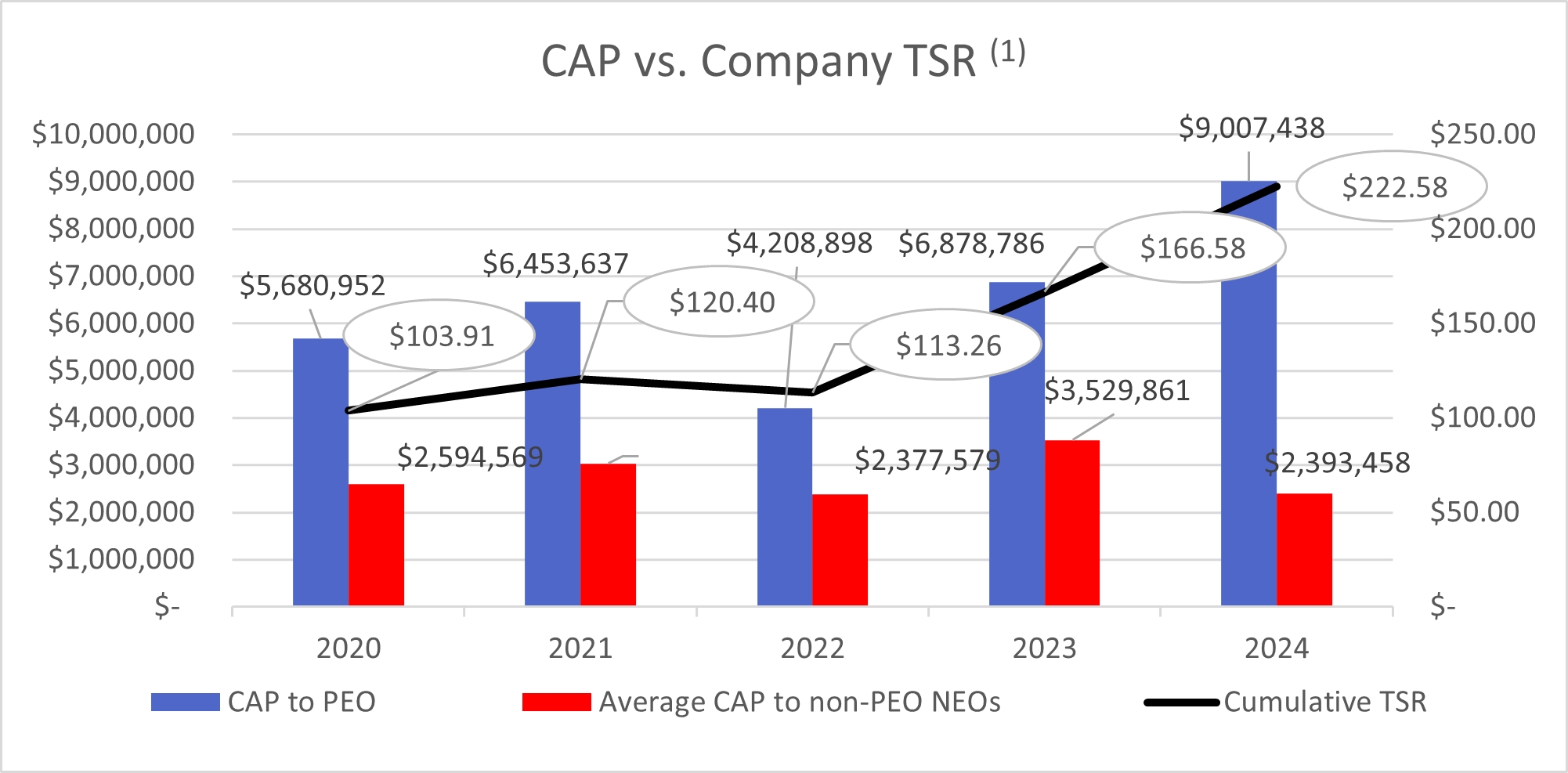

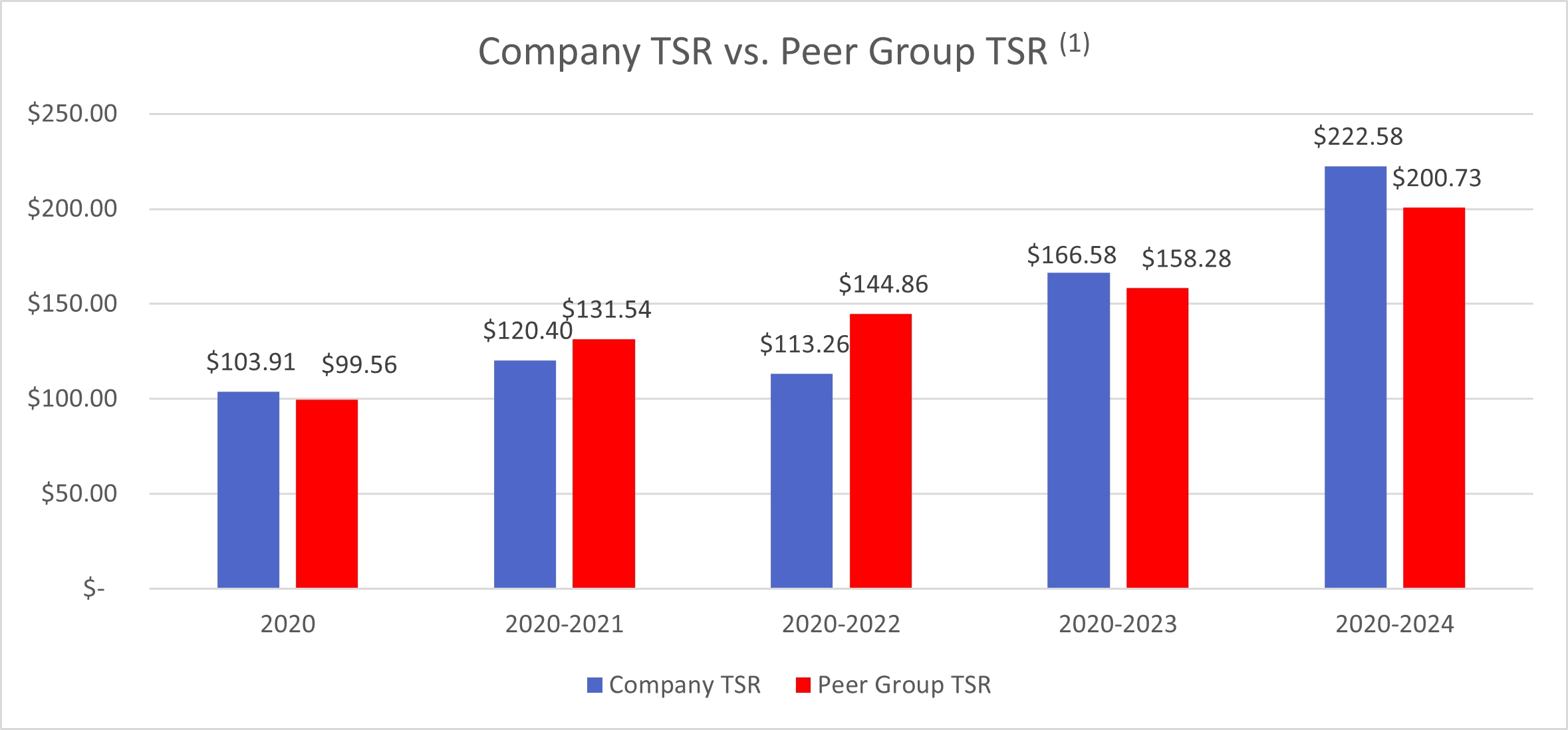

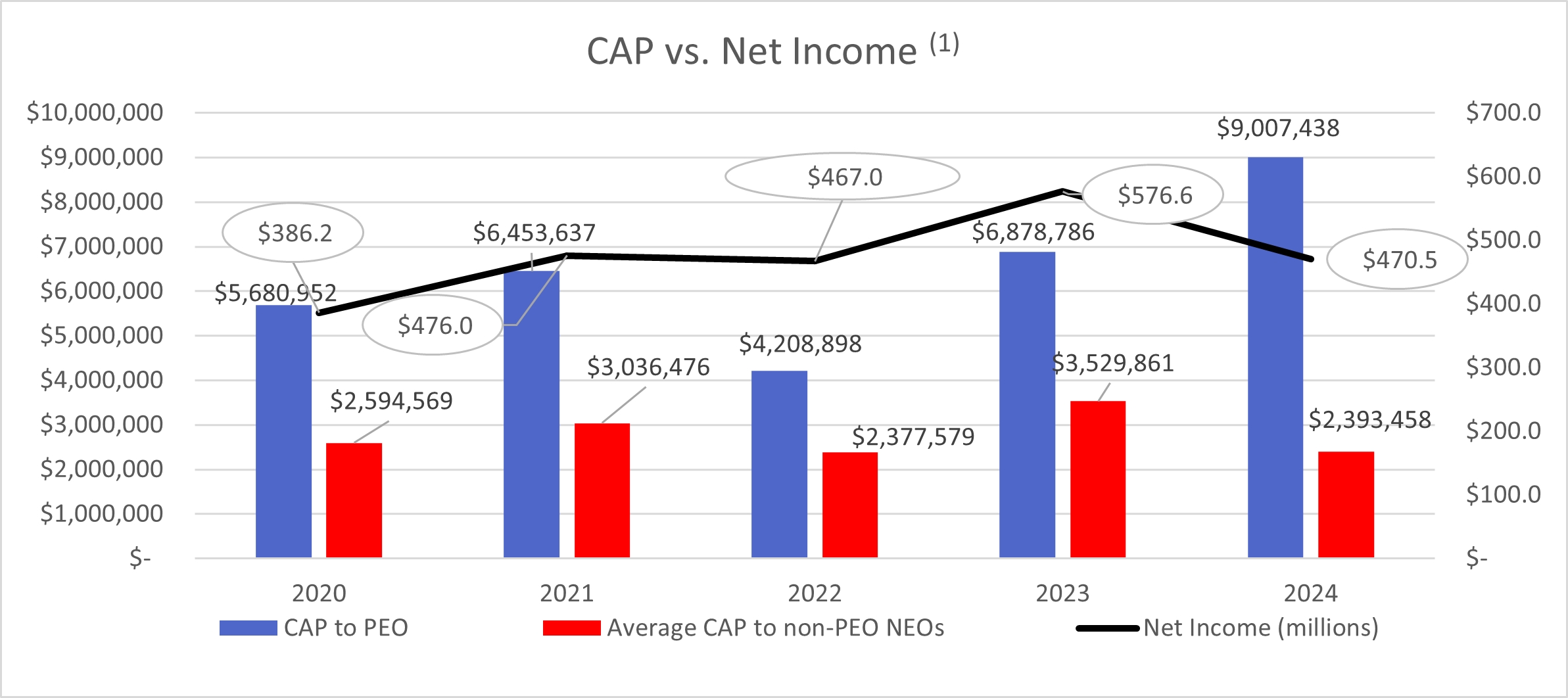

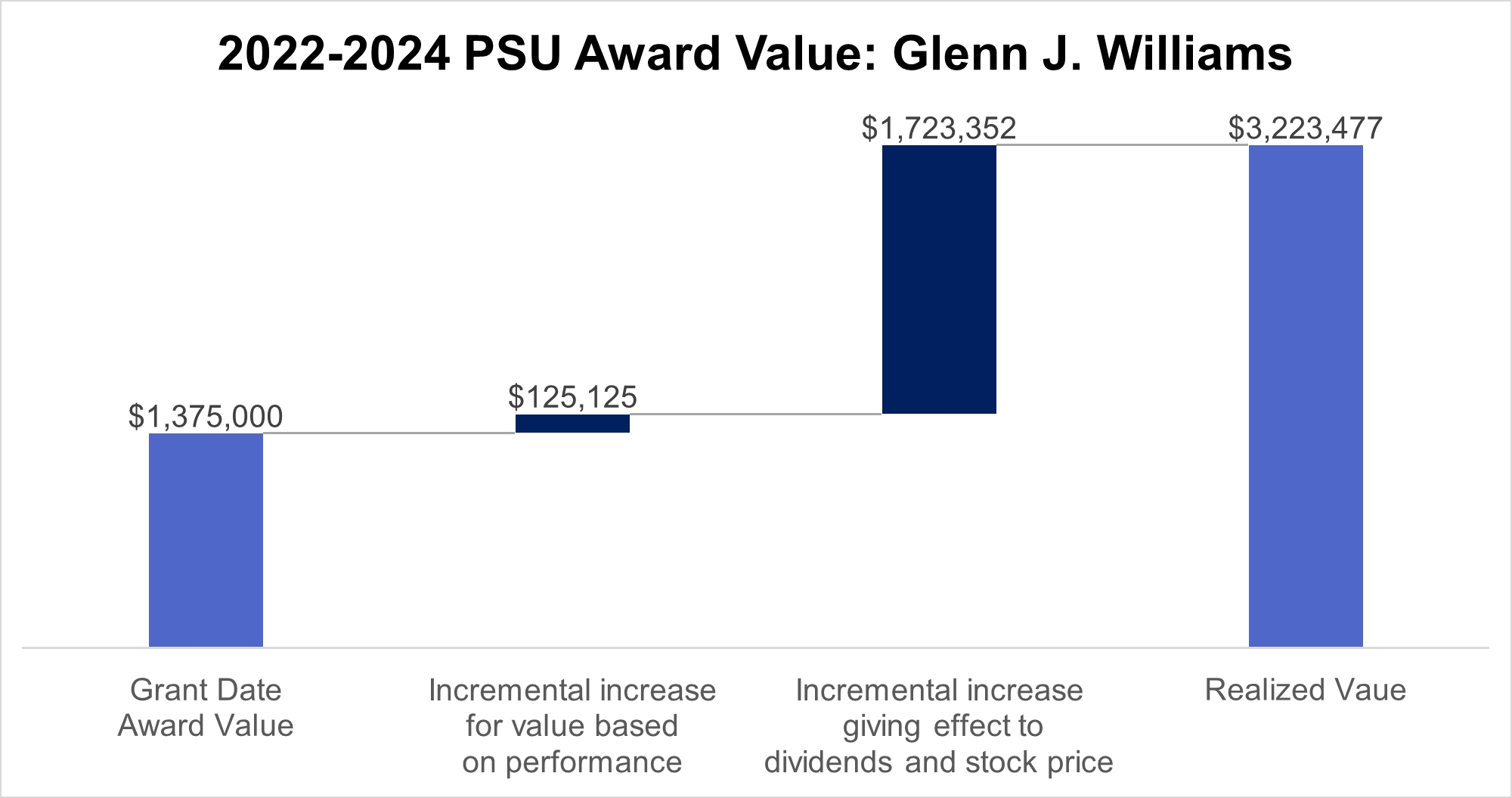

Independence Determinations